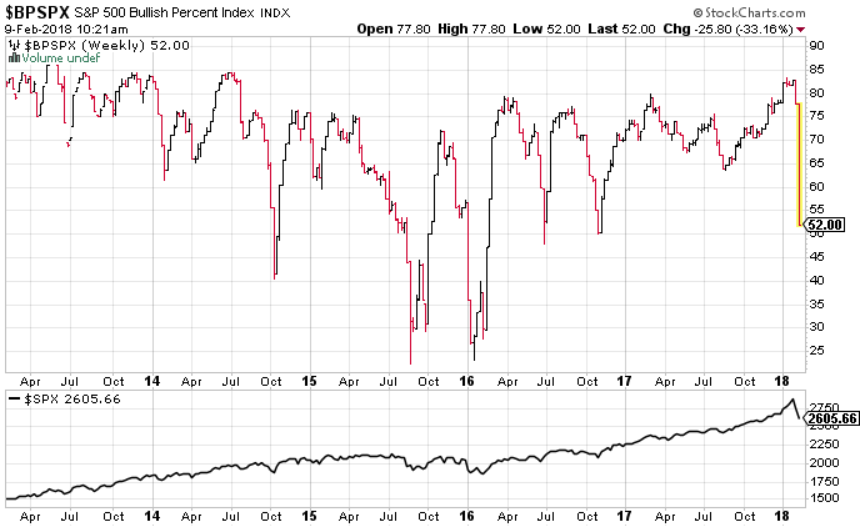

I mentioned on Monday that my market risk indicator was warning. It still hasn’t cleared and it doesn’t look like it has a chance to clear by the end of the day. As a result, I’m calling a warning signal. Market risk warnings come in two varieties. Ones that last for only a week or two (a false signal) and ones that last for several months (a significant correction or bear market). This signal has the odds tilted to more downside because the Bullish Percent Index (BPSPX) is below 60. When it is below 60 and my market risk indicator is warns the odds increase substantially (3 times more likely) that we’ve still got at least another 10% drop from here before we make an ultimate low. This isn’t a prediction, merely stating the odds based on history.

This signal changes the portfolio allocations as follows:

Long / Cash portfolio: 100% cash

Long / Short portfolio: 50% long high beta stocks and 50% long midterm volatility (an ETF/ETN like iPath S&P 500 VIX Mid Term Futures Exp 30 Jan 2019 (NYSE:VXZ) or ProShares VIX Mid Term Futures (NYSE:VIXM))

Volatility Hedged portfolio: 50% long and 50% long midterm volatility (an ETF/ETN like iPath S&P 500 VIX Mid Term Futures Exp 30 Jan 2019 (NYSE:VXZ) or ProShares VIX Mid Term Futures (NYSE:VIXM))

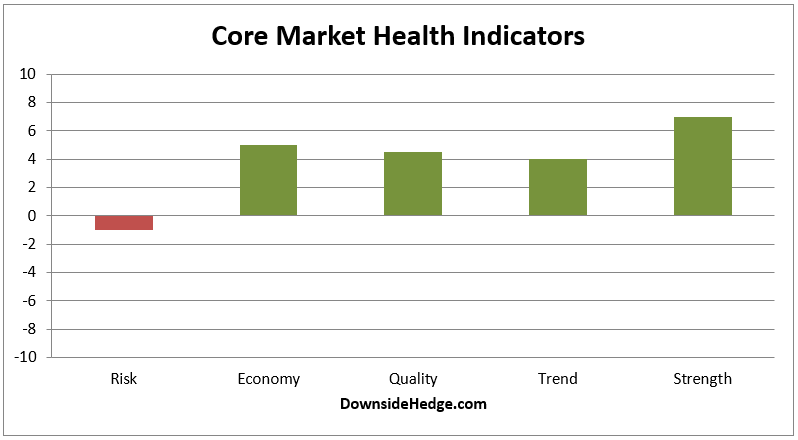

My core market health indicators are all still very healthy (with the exception of core risk of course). This indicates that the current drop is due to technical or sentiment factors and not concern about a longer term drop. As a result, at the moment it looks like this is merely some froth being taken out of the market. Of course, to much froth taken in the short term can lead to longer term concerns so we’ll need to stay vigilant. If my core health indicators start to deteriorate substantially, we’ll have signs that this downturn is likely to be of the intermediate to long term variety.

Conclusion

We’ve got a market risk warning coupled with BPSPX below 60. This indicates we’ve got more downside ahead. However, my core market health indicators are sitting comfortably in bullish territory. This indicates (at this moment) a short term dip rather than an intermediate or long term top.