Key Points:

- Market taking a “risk-on” approach in the wake of the US Presidential Election.

- US equities and the USD are experiencing a boost in sentiment.

- VIX in steady decline in the aftermath of the Trump victory.

Looking at the markets, one might not at first realise that we have just experienced one of the most divisive and gruelling US Presidential Elections in memory or that the “wild card” candidate emerged victorious. In fact, by most measures, the market is almost disturbingly content and capital is now fleeing safe havens into traditionally riskier fare.

First and foremost, the long touted safest of safe haven investments, gold, has been in free fall in the wake of the election. Implicitly, pulling back to the 1200.00 – 1300.00 range signals that traders are moving into a state of calm not seen since prior to the Brexit referendum. Moreover, it doesn’t appear that the metal is planning on slowing as the week opens, with ADX readings still intimating the downtrend remains in place.

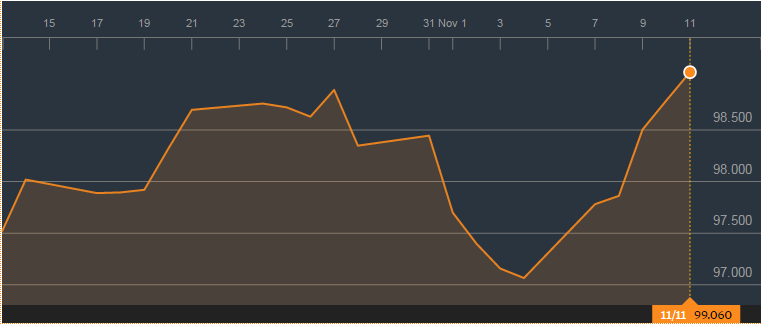

On the currency front, two of the classic pair’s to which the market retreats to in times of uncertainty are weakening against the Greenback. Specifically, the USD/CHF has been trending strongly higher as market fears abate all whilst the USD/JPY is at its highest point since June this year. What’s more, in reaction to the Trump victory, the US Dollar Index is fast approaching a yearly high which seems almost comical given the relentless torrent of analysis predicting the contrary.

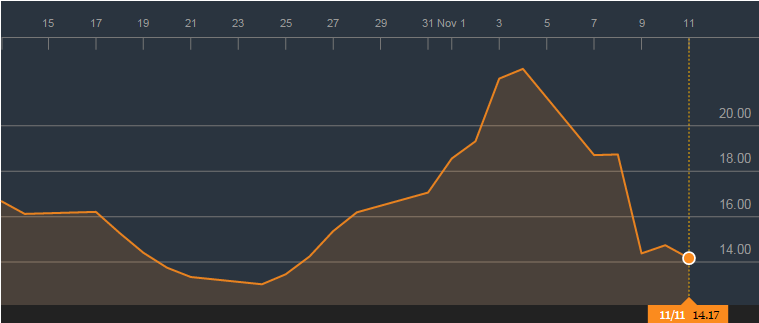

Looking to some widely followed measures used in the gauging of market fears, the general sense of calm seems to be corroborated despite ongoing political unrest in the US. Currently, the CBOE Volatility Index is sub 15.0 and trending lower whilst the Fear Gauge is almost bang on neutral at around 48. It comes as little wonder then, the apparent appetite for risk has been on the rise throughout the remainder of last week with the S&P 500 moving up to around the 2169.75 mark.

Ultimately, whilst this is by no means an exhaustive list of measures to gauge the market’s long-term view of trump, in the immediate aftermath, there seems to be an air of quiet confidence that Trump can be reined in. Whether this view remains in place, only time and further Trump policy details will reveal. However, given the way that US equities and the USD have been hungrily eating up the capital freeing itself up from gold and other safe havens, there seems to be a sizable swell in optimism that one certainly hopes proves to be well founded.