This week’s newsletter will be somewhat condensed as the bulk of our current positioning is based upon the information contained in the two reports referenced herein. The goal of this week’s letter is simply to outline the market ranges which fall within the context of our current Macroview.

With that said, let’s get to work.

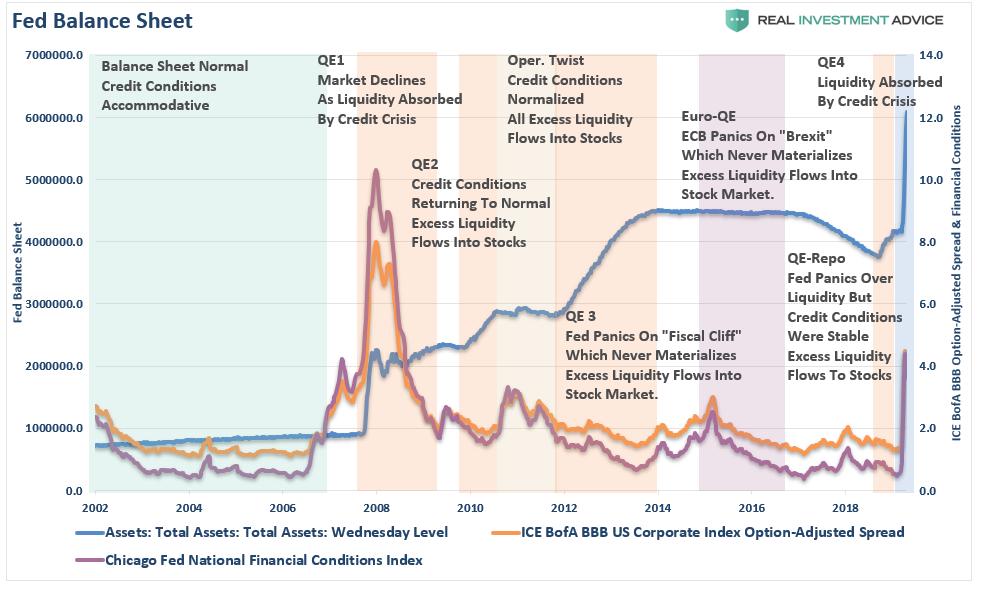

In this week’s #MacroView, I reviewed the history of monetary programs and the training of investors to respond to the “ringing of the bell.”

“As each round of ‘Quantitative Easing’ was the ‘neutral stimulus,’ which was followed by the ‘potent stimulus’ of higher stock prices, Not surprisingly, after a decade of ‘ringing the bell,’ investors have been conditioned to respond accordingly.

It is worth a trip back through history to evaluate the relationship between the Fed’s monetary interventions, and the impact on asset prices.”

While the report details the history of repeated rounds of monetary stimulus to offset potential “credit events” that never occurred, the most relevant period to review is 2008, which is most akin to the situation we are currently experiencing. A credit-event coupled with a major economic recession.

“2008: March – Bear Stearns fails, mortgage defaults start to rise, credit conditions worsen, and yield spreads rise. September – Lehman fails and freezes credit markets. Asset prices decline sharply, triggering margin calls, and the Fed floods the system with liquidity. As discussed last week:”

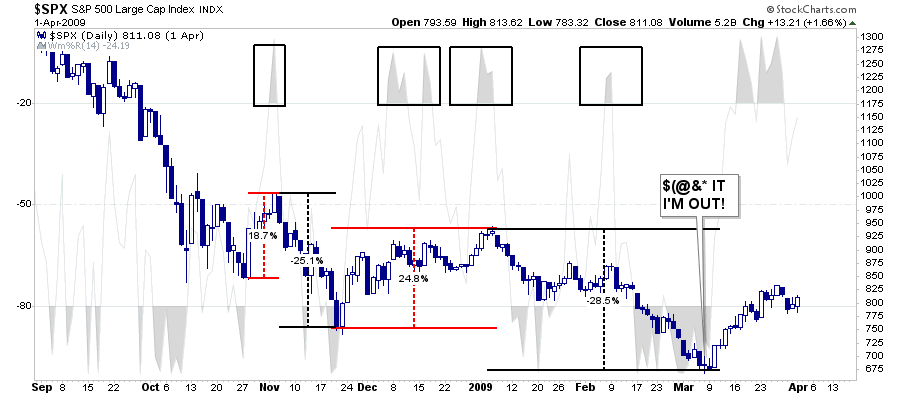

The reality of the economic devastation begins to set in as unemployment skyrockets, consumption and investment contract, and earnings fall nearly 100% from their previous peak, as the market declines 26% into late November. It was then the Federal Reserve launched the first round of Quantitative Easing.

Stocks staged an impressive rally of almost 25% from the lows. Yes, the bull market was back! Except that it wasn’t. Over the next few months, the Fed’s liquidity was absorbed by the “gaping economic wound,” and the market fell another 28.5% to its ultimate low.”

There are currently LOT’S of excuses to rationalize and justify the rally:

- The markets are looking past 2020 earnings.

- The market is looking at the eventual recovery.

- The market is rallying because of the Fed.

Rationalizing fundamentally unsupported advances typically have a “payback” consequence when you least expect it. This is particularly the case when you view the recent rally from a lens of:

- Never before seen levels of jobless claims

- Depression level unemployment rates

- An earnings and profit collapse

- The largest single GDP decline in history

- A loss of 1/3 of small businesses, which comprise nearly 45% of GDP.

- A loss of the biggest driver of asset prices over the last decade – stock buybacks.

As I discussed on Friday:

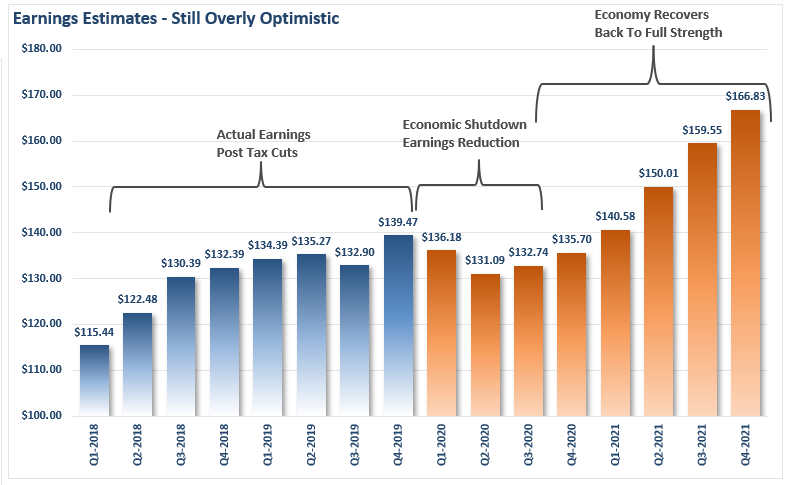

"The chart below shows the most current estimates as of April 2020. As you can see, earnings are expected to decline from Q4-2019 levels of $139.47 to $136.18 and $131.09, respectively in Q1 and Q2 of 2020. That is a decline of -2.3% in Q1 and a total decline of -6% in Q2.”

“So, with the entire U.S. economy effectively shut down, 15-20% unemployment, and -20% GDP, earnings are only expected to take a 6% hit?

-

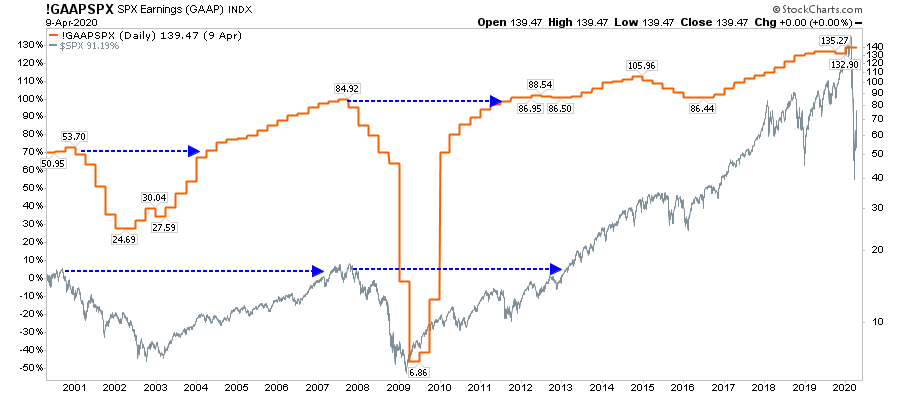

In 2008, without an economic shutdown, S&P 500 earnings fell from $84.92 to $6.86. That is a decline of 92% from the peak, and earnings did not fully recover until 3-years later in Q3-2011.

-

Or in 2000, during the “dot.com crash,” earnings fell from $53.70 to $24.69, or a decline of 54%. Earnings did not fully recover until 4-years later in Q2-2004.”

Do you really believe that stocks have priced in a real earnings collapse?

If you honestly think they have, then why is the market trading at 19x forward operating earnings, which is higher than both 2002, and the February 2020 peak?

As I stated in last week’s missive:

“While 2008 was bad, the impact from the ‘economic shutdown’ due to the virus will be substantially worse for several reasons:

- In 2008, the economy was already slowing down, unemployment was already on the rise, and businesses were adjusting for the related impact to earnings. Also, despite the ‘crisis’ caused in the mortgage market, businesses and consumer activity remained ‘open.’ Outside of the real estate and finance industries, many other sectors were only marginally affected.

- In 2020, the shuttering of the economy caught many businesses ‘flat-footed’ and ill-prepared for an involuntary ‘shuttering’ of business.

- In 2020, the surge in unemployment, combined with a shuttering of business, will have a substantially deeper impact on gross consumption in the economy than in 2008.

- As opposed to 2008, there are many businesses which will never reopen, many more will be very slow to recover, with the rest slow to rehire until demand returns.

The markets are currently rallying on a flush of liquidity, and a massive short-covering rally, which is likely reaching its “exhaustion” stage. Over the next few months, stocks will begin to price in the severity of the economic damage, a substantial decline in earnings, and the realization that hopes for a ‘V-Shaped’ recovery are not likely.”

Whatever rally is left currently in the market is still very likely a “gift” to sell into.

The Ranges

Yes, the economic and fundamental data is pretty discouraging. However, despite the “bearish” backdrop, the market has rallied hard on optimism of getting the country “re-opened,” but, in actually as stated above, more so from the “Pavlov’s response” to the ringing of the Fed’s “liquidity bell.”

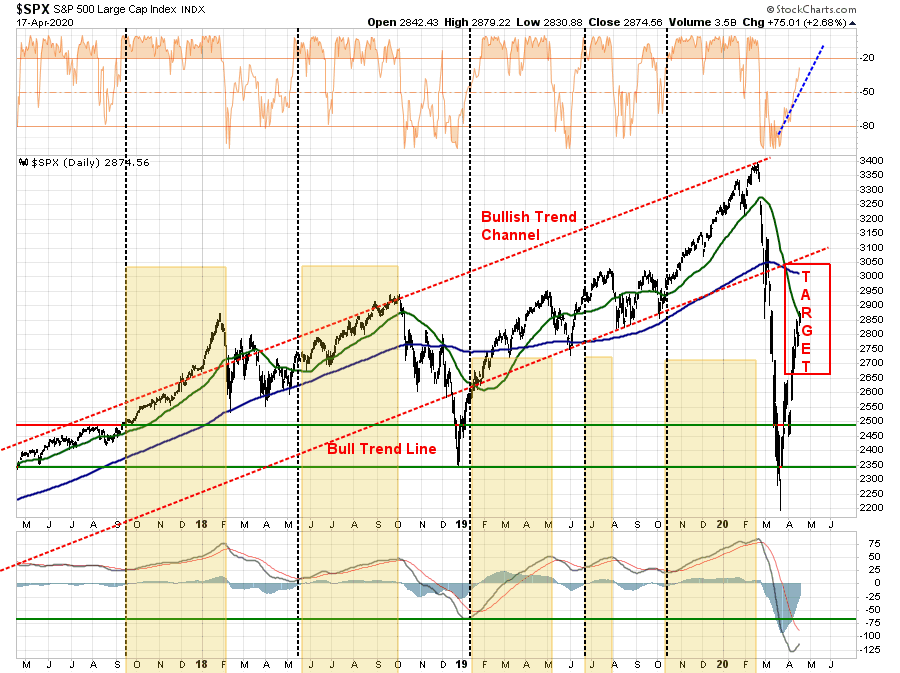

Currently, the market has rallied back to the “target zone” we laid out in mid-March.

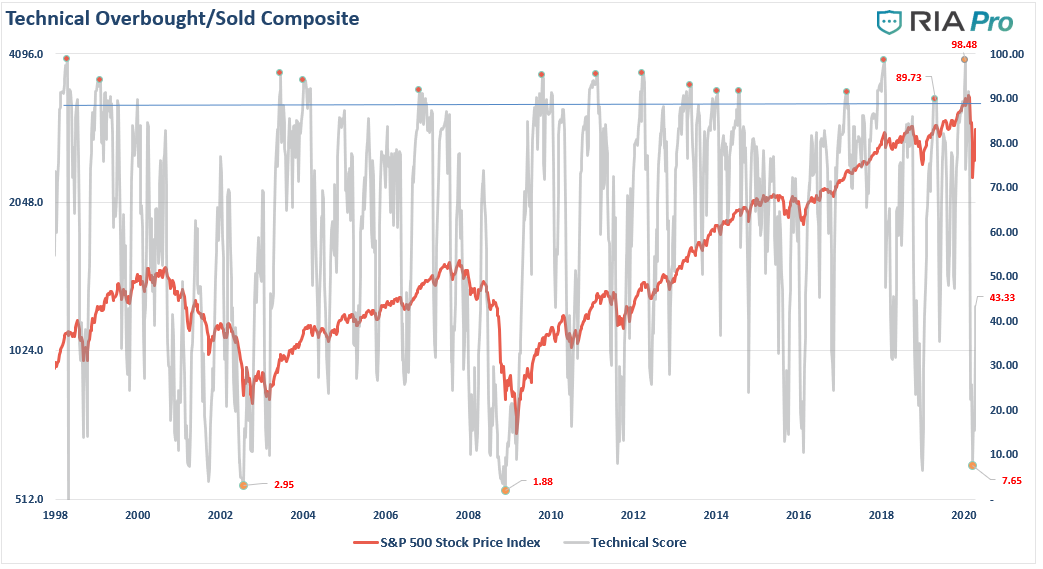

On a very short-term basis, the previous “deep oversold” condition that provided the “fuel” for the rally has been reversed. On Friday, all primary “overbought/sold” indicators are now fully stretched back into overbought territory.

One of our ongoing concerns with the rally has been the lack of participation and the “low volume” rally.

“In eight bear markets across the three indexes since the 90s, the bottom was usually marked with a bang, not a whimper. Trading volume in the first 10 days of the turnaround on all but one occasion (the Stoxx 600 in March 2009) was at least 10% higher than the volume in the bear market as a whole.

This year, all three indexes failed the test. The first 10 sessions after the local low saw average trading volume of ~98% the bear-market average for the S&P 500, ~94% for the Dow Jones and ~104% for the STOXX 600.

Yet conviction was stronger on the way down than on the way up, and that’s a worrying sign. More study is needed, but on volume alone, this bear market doesn’t appear to be over.” – Eddie van der Walt via Bloomberg,

With the market overbought, this leaves more “sellers” who were trapped during the previous decline with a better opportunity to exit. This will particularly be the case as the data worsens over the weeks ahead.

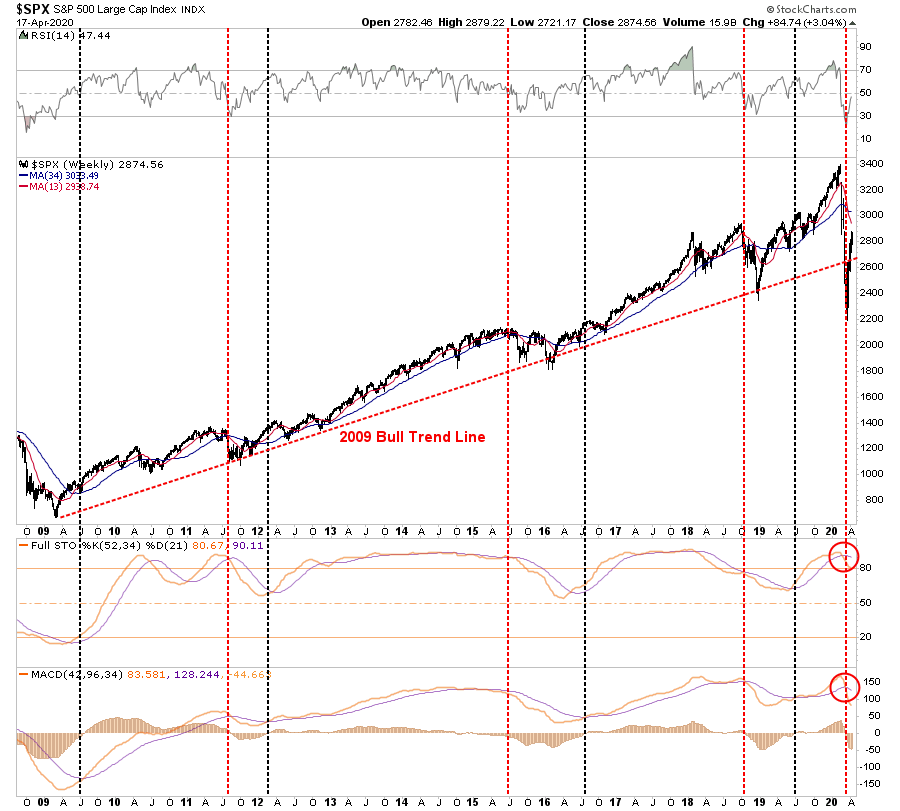

If we look at our weekly indicators, the recent rally is much less “inspiring.”Both of the primary weekly “sell signals” remain intact suggesting the recent rally will fail. A failure from current levels would suggest a retest of the bullish trend line. (A failure of that trendline will set up a retest of the March 23rd lows.)

I know…I know. I’m being all “bearish and ***” by paying attention to “risk.”

So, here is your short-term “bullish” view.

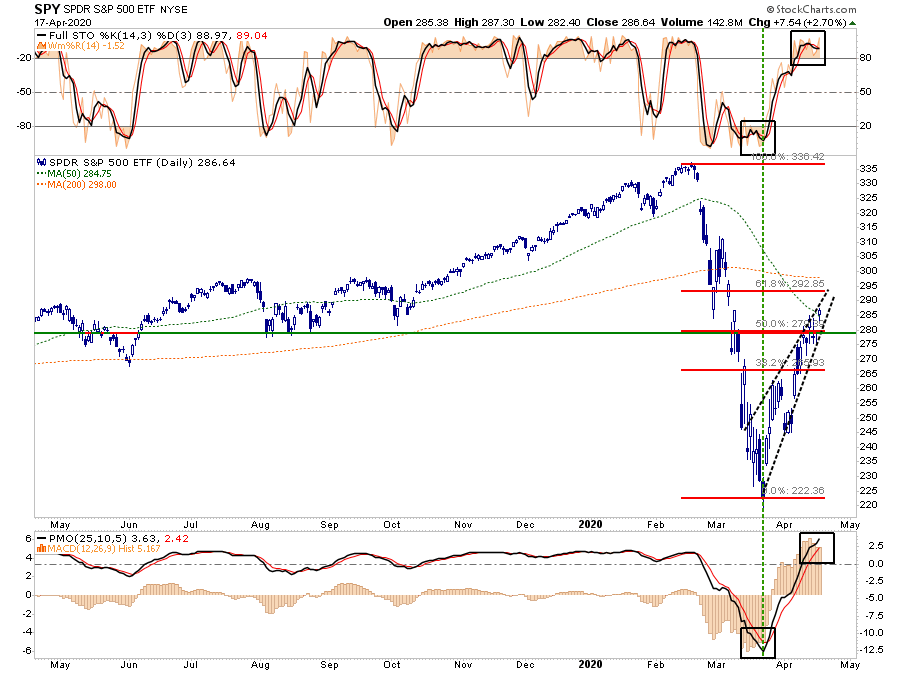

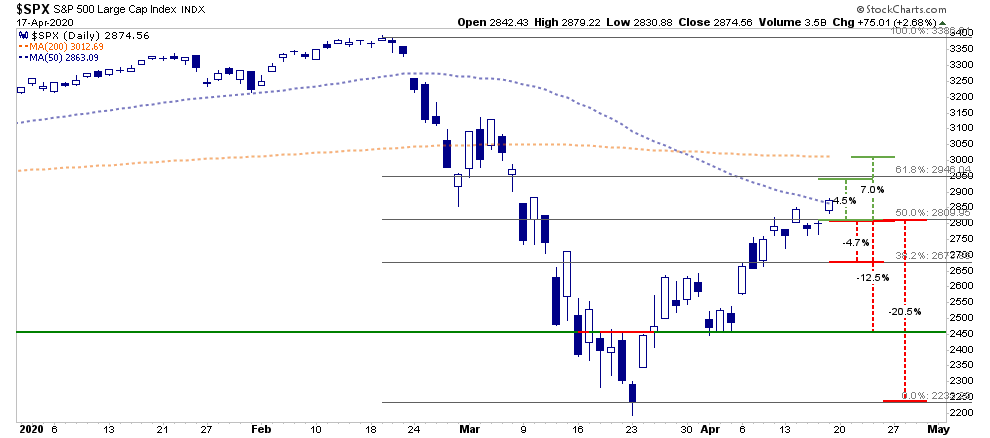

If we set aside the fundamental and economic data for the moment, the short-term technical backdrop is indeed bullishly biased. The 50% retracement level was taken out on Friday, along with the 50-dma. (This is not a confirmed break unless it holds above those levels through next Friday.)

Friday’s close brings the 61.8% retracement level AND the 200-dma into focus as the next resistance levels. This suggests upside in the market of 4.5% to 7% currently. (Certainly nothing to sneeze at, considering such would normally be considered a decent year’s worth of returns. That just shows how skewed things are currently.)

The downside risk ranges are a bit more disappointing.

- -4.7% to the previous 50% retracement level: risk/reward equally balanced.

- -12.5% to the previous higher low: risk/reward is mildly out of favor.

- -20.5% to the March 23rd low: risk/reward extremely out of favor.

From an optimistic view, a reopening of the economy, a virus vaccine, and an immediate return to low single-digit unemployment rates would greatly expand the bullish ranges for the market.

However, even a cursory review of the data suggests a more “realistic” view. The economic damage is going to be with us for a while, and until earnings estimates are revised substantially lower to reflect the “actual economy,” I have to presume the relevant risks outweigh the current reward.

This doesn’t mean we aren’t long-equities. We are, but we are also carrying a much heavier exposure to cash, and have reduced exposure to fixed income. We continue to be selective buyers of quality companies opportunistically and will continue to prudently build our portfolios.

This is just our approach and certainly isn’t for everyone. However, after surviving two previous bear markets, experience has taught us much about “managing risk,” which was summed up nicely in a quote on Friday.

“I would say basically we’re like the captain of a ship when the worst typhoon that’s ever happened comes. We just want to get through the typhoon, and we’d rather come out of it with a whole lot of liquidity. We’re not playing, ‘Oh goody, goody, everything’s going to hell, let’s plunge 100% of the reserves [into buying businesses].’

Nobody in America’s ever seen anything else like this. This thing is different. Everybody talks as if they know what’s going to happen, and nobody knows what’s going to happen.” – Charlie Munger.

We agree with Charlie and Warren on this, and it is our philosophy for protecting our clients. We will continue to follow our process until there is actual visibility into corporate earnings and fundamentals.

While it may seem silly, we believe the process of investing is not about “guessing,” but rather “knowing,” what you are buying.

Market & Sector Analysis

Data Analysis Of The Market & Sectors For Traders

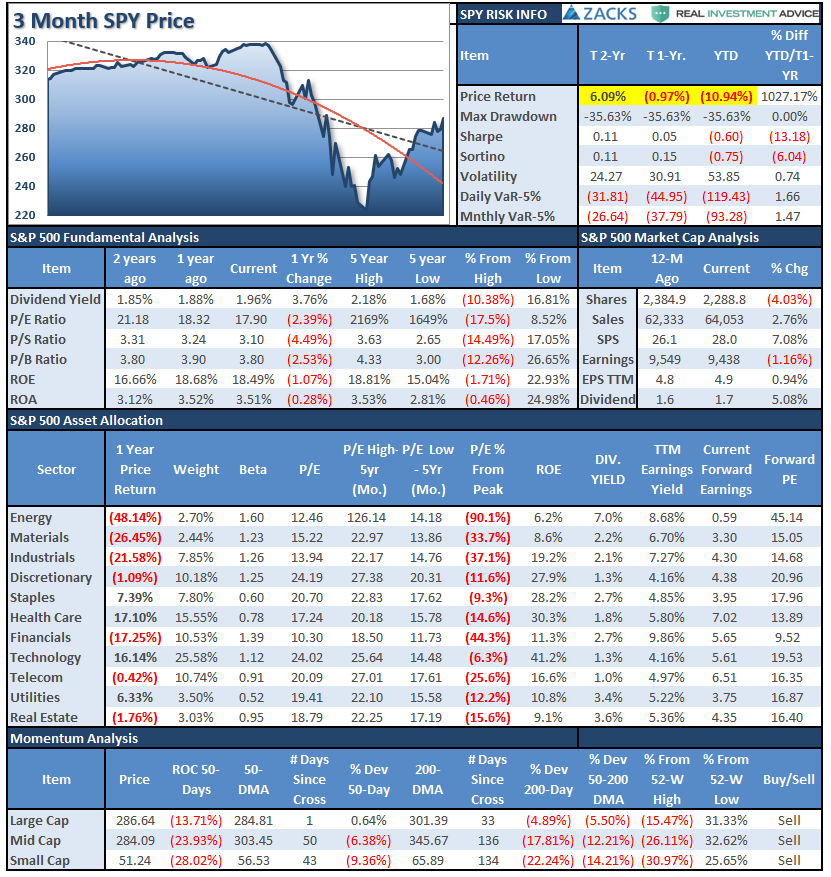

S&P 500 Tear Sheet

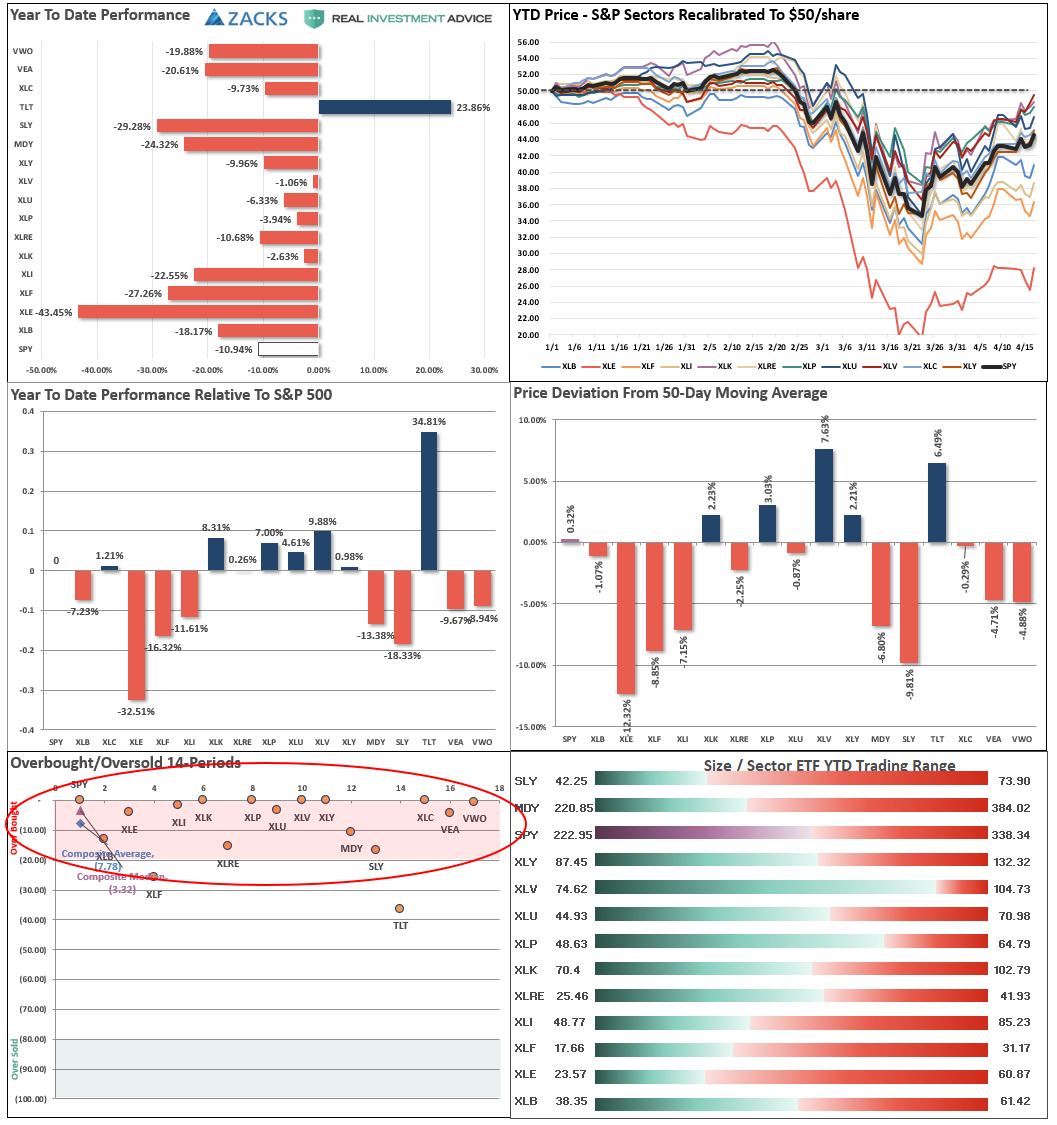

Performance Analysis

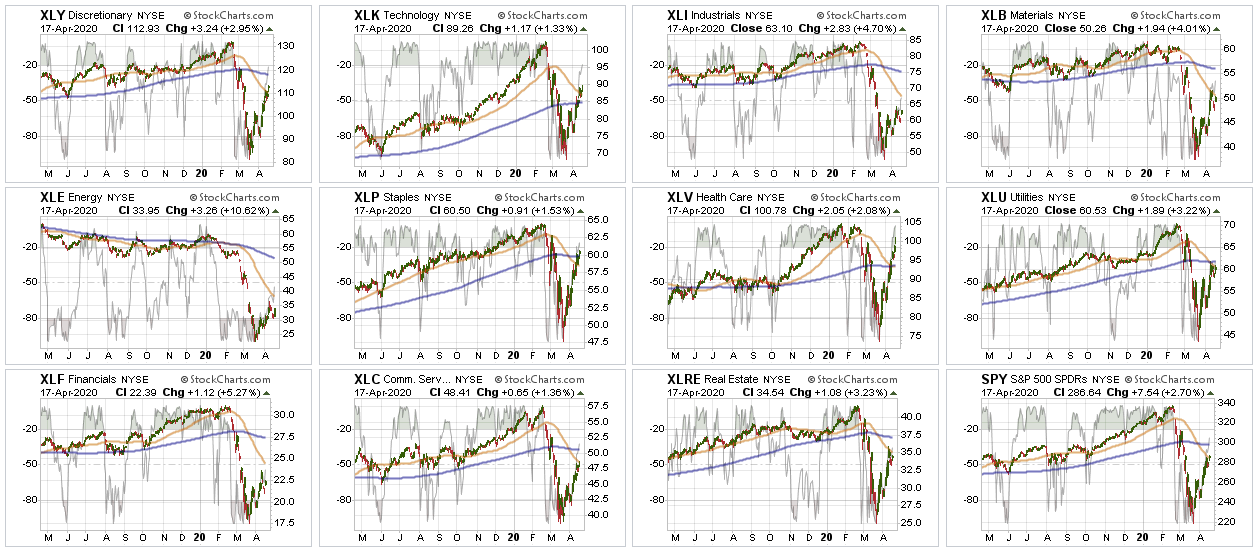

NOTE: I have rarely seen EVERY SECTOR overbought this much all at the same time. The market WILL CORRECT from these levels.

Technical Composite

Note: The technical gauge bounced from the lowest level since both the “Dot.com” and “Financial Crisis.” However, note the gauge bottoms BEFORE the market bottoms. In 2002, lows were retested. In 2008, there was an additional 22% decline in early 2009.

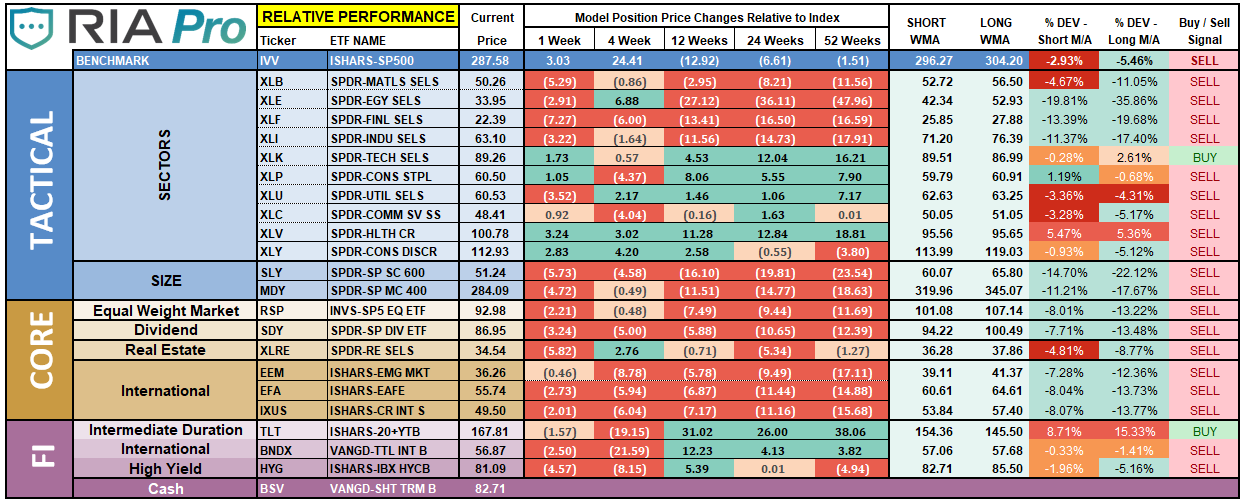

ETF Model Relative Performance Analysis

Sector & Market Analysis:

Be sure and catch our updates on Major Markets (Monday) and Major Sectors (Tuesday) with updated buy/stop/sell levels

Sector-by-Sector

There are no changes to our sector recommendations from last week.

Improving – Discretionary (XLY), and Materials (XLB)

As noted last week, there is no rush to get into either Discretionary or Materials stocks until AFTER we get through earnings season. The economic shutdown is going to devastate the discretionary sector, focus on Staples for the time being.

Current Positions: No Positions

Outperforming – Technology (XLK), Communications (XLC), Staples (XLP), Healthcare (XLV), Utilities (XLU), and Real Estate (XLRE)

Two weeks ago, we shifted exposures in portfolios and added to our Technology and Communications sectors, bringing them up to weight. We remain long sectors that are currently outperforming the S&P 500 on a relative basis and have less “virus” exposure. We added a position in Utilities previously, and added to our Staples holdings last week. We are getting more interested in REIT’s again, but are going to select individual holdings versus the ETF due to leverage concerns in the REITs.

Everything is getting very overbought and extended in these sectors, we need a corrective pullback to add more to our holdings.

Current Positions: XLK, XLC, 1/2 weight XLP, XLV, XLU

Weakening – None

No sectors in this quadrant.

Current Position: None

Lagging – Industrials (XLI), Financials (XLF), and Energy (XLE (NYSE:XLE))

No change from last week, with the exception that performance continued to be worse than the overall market. This is particularly the case with Financials. As noted last week, these sectors are THE most sensitive to Fed actions (XLF) and the shutdown of the economy. We eliminated all holdings in late February and early March.

Current Position: None

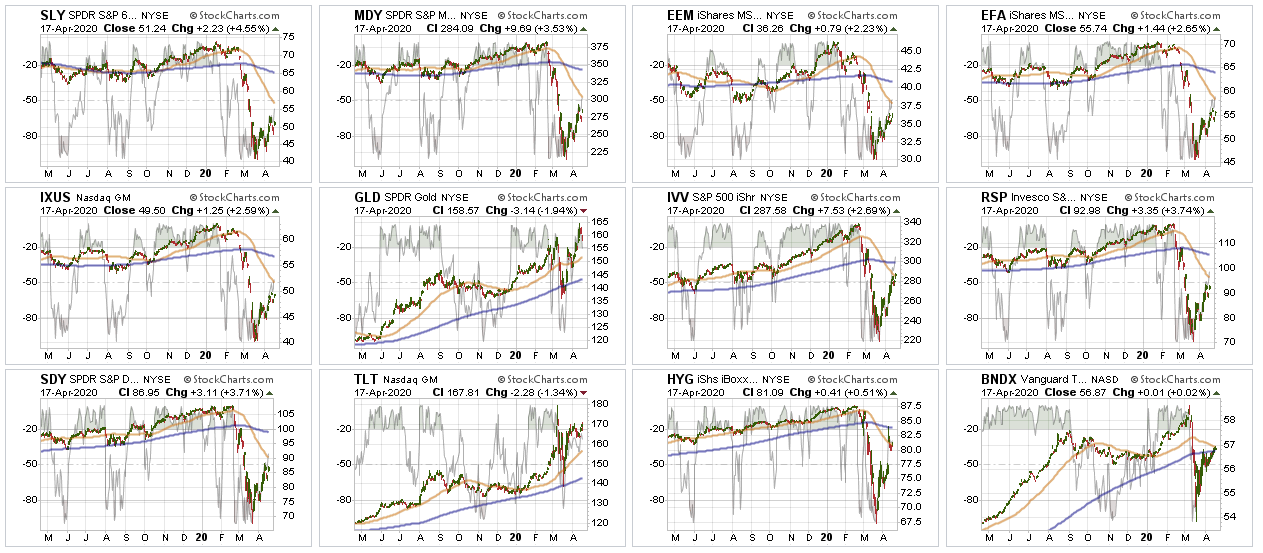

Market By Market

Small-Cap (SLY) and Mid Cap (MDY) – We sold all small-cap and mid-cap exposure earlier this year over concerns of the impact of the coronavirus. We remain out of these sectors for now, and there is no rush to add them anytime soon. Be patient, small and mid-caps are lagging badly.

Current Position: None

Emerging, International (EEM) & Total International Markets (EFA)

Same as Small-cap and Mid-cap. Given the spread of the virus and the impact on the global supply chain.

Current Position: None

S&P 500 Index (Core Holding) – Given the overall uncertainty of the broad market, we previously closed out our long-term core holdings. We will re-add a core once we see a bottom in the market has formed.

Current Position: None

Gold (GLD (NYSE:GLD)) – We previously added additional exposure to both our GDX (NYSE:GDX) and IAU positions and are comfortable with our exposure currently. With the Fed going crazy with liquidity, this will be good for gold long-term, so we continue to add to our holdings on corrections.

We also added a position in the Dollar this past week (UUP) as the U.S. dollar shortage continues to rage and is larger than the Fed can offset.

Current Position: 1/2 weight GDX, 2/3rd weight IAU, 1/2 weight UUP

Bonds (TLT) –

Bonds have rallied as the Fed has become THE “buyer” of bonds on both a “first” and “last” resort. Simply, “bonds will not be allowed to default,” as the Fed will guarantee payments to creditors. We have now reduced our total bond exposure to 20% of the portfolio from 40% since we are only carrying 10% equity currently. (Rebalanced our hedge.)

Current Positions: SHY, IEF, BIL

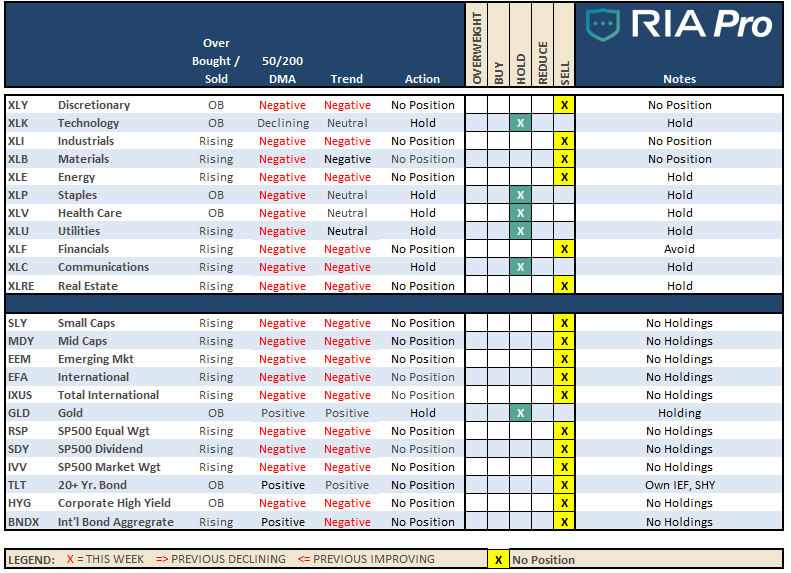

Sector / Market Recommendations

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

Update:

This past week, we continue to look for opportunities where we can add exposure while still controlling overall risk. I encourage you to read this week’s missive newsletter in full if you are “getting all bullish” on the market, and think you want more exposure to equity risk.

While there is indeed short-term upside, the relative risk/reward ratio is not in your favor. Furthermore, the earnings and economic data are going to matter, and that data is shockingly horrible. While investors are scrambling to chase markets currently, they are buying stocks with absolutely no visibility into earnings or outlooks. This type of investing tends to turn out badly.

This past week, we did add exposure to a couple of our core holdings to increase weightings in healthcare and staples, and our next goal will be to opportunistically bring up the weightings in all of our current holdings.

However, as we add equity risk, we are managing the risk exposures by hedging accordingly. Recently we increased our gold exposure, and this past week added a position in the U.S. Dollar to offset the risk of a global “dollar funding shortage.” This was a point we made in Friday’s report:

“The Federal Reserve has identified the Achilles heel of the world economy: the enormous global shortage of dollars. The global dollar shortage is estimated to be $13 trillion now if we deduct dollar-based liabilities from money supply including reserves.

How did we reach such a dollar shortage? In the past 20 years, dollar-denominated debt in emerging and developed economies, led by China, has exploded. The reason is simple, domestic and international investors do not accept local currency risk in large quantities knowing that, in an event like what we are currently experiencing, many countries will decide to make huge devaluations and destroy their bondholders.

According to the Bank of International Settlements, the outstanding amount of dollar-denominated bonds issued by emerging and European countries in addition to China has doubled from $30 to $60 trillion between 2008 and 2019. Those countries now face more than $2 trillion of dollar-denominated maturities in the next two years and, in addition, the fall in exports, GDP and the price of commodities has generated a massive hole in dollar revenues for most economies.

If we take the US dollar reserves of the most indebted countries and deduct the outstanding liabilities with the estimated foreign exchange revenues in this crisis … The global dollar shortage may rise from 13 trillion dollars in March 2020 to 20 trillion in December … And that is if we do not estimate a lasting global recession.” – Mises Institute

Well, guess what? We are likely in a lasting global recession.

This is why we added the dollar to your portfolio.

As noted last week, we are down to our core “long-term” equities that we will begin to add to opportunistically as the market bottoms and begins to recover.

We will continue to trade opportunistically, but as noted last week, ultimately we WILL MISS the bottom. We are going to wait to clearly see “the bottom” has been put in; then we will aggressively add exposure. At such a point, risk and reward will be clearly in our favor.

We continue to remain very defensive and are in an excellent position with plenty of cash, reduced bond holdings, and minimal equity exposure in companies we want to own for the next 10-years. Just remain patient with us as we await the right opportunity to build holdings with both stable values, and higher yields.