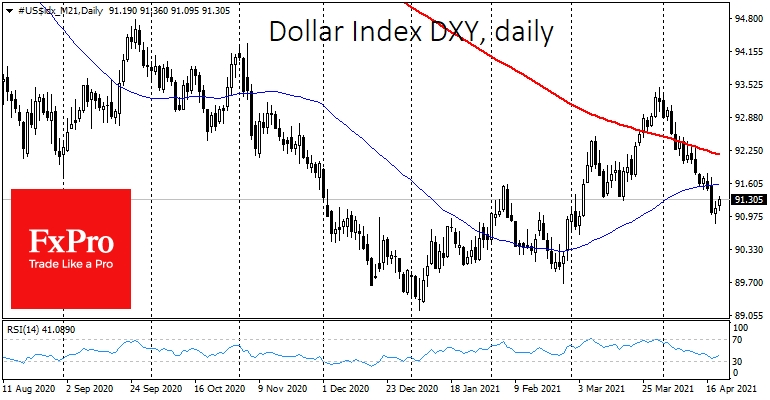

The US dollar has halted its decline near 7-week lows in the DXY index amid a pullback in stock indices from recent highs. The 0.4% DXY rise from intraday lows on Tuesday was the strongest in this month, which shows well how much the Dollar was pressured during this period.

Demand for the dollar intensified due to a corrective pullback in key equity indices. The NASDAQ lost around 1% over Tuesday, reinforcing the retreat from the historic highs reached late last week.

It is important for traders now to determine how long the pullback may last. To do so, let's look at some indirect indicators.

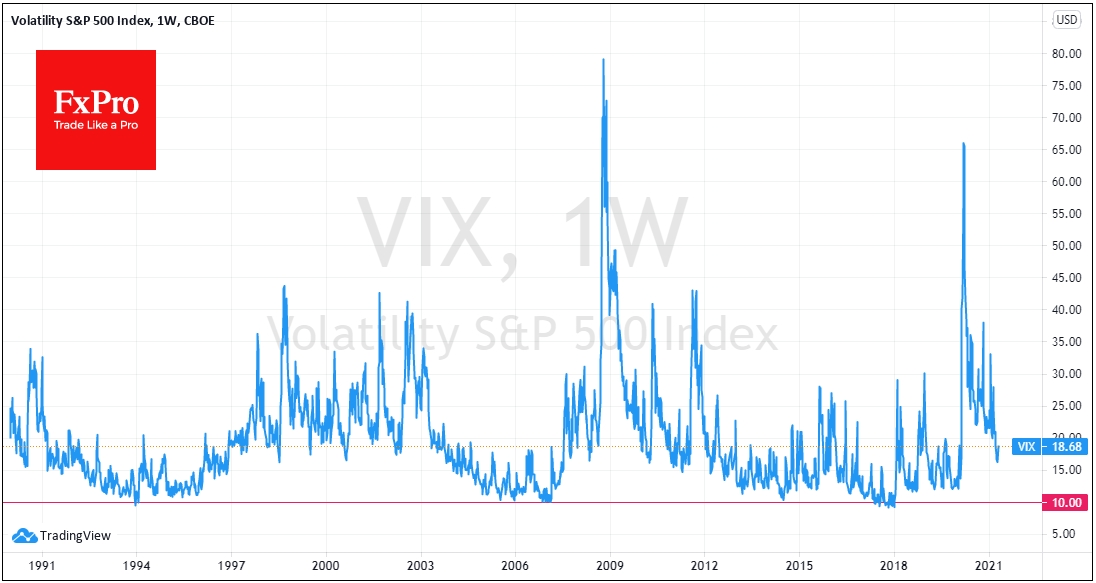

The VIX, so-called fear index, fell to 16.25 last Friday, a low of 14 months before its blip to 18.2 now. Often its shallow values are seen as a sign of market complacency, foreshadowing a sell-off. However, the turning point in recent history has been near 10, which is markedly lower than recent figures. The current surge will likely prove to be short-lived, and there is still room for a decline.

The euro and the pound have slowed down their gains against the Dollar near significant round levels. However, it looks more like a brief technical correction to recharge the bulls than the exhaustion of the rally. EUR/USD and GBP/USD remain above the 50 and 200-day averages, signalling a bullish trend.

USD/CNH is developing a decline despite the Dollar's attempts to add to the European currencies. This currency pair is less exposed to market noise, clearly indicating that pressure on the Dollar has been restored after a two-month pullback.

Gold is also developing its gains, building on April's rising trend.

The pressure on stock markets and the associated slight increase in dollar pull towards several European currencies may be due to investors' desire to lock in profits by the end of April. Something of an attempt to front-run the proverb "sell in May and go away". Trading volumes on exchanges have fallen by a quarter from the average levels of previous months, marking the possible start of the summer lull.

Simultaneously, a period of reduced activity does not promise a broken trend but will only make the current trends more sluggish.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Pullback Halts U.S. Dollar Fall

Published 04/21/2021, 10:24 AM

Updated 03/21/2024, 07:45 AM

Market Pullback Halts U.S. Dollar Fall

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.