“(Market) Predictions Are Difficult…Especially When They Are About The Future” – Niels Bohr

Okay, I took a little poetic license. However, the point is that while we try, we can’t predict the future. If we could, fortune tellers would win all of the lotteries. But, they don’t, we can’t, and we will not try to.

However, we can analyze what occurred previously, weed through the noise of the present, and discern the possible outcomes of the future. The biggest problem with Wall Street, both today and in the past, is the consistent disregard of the unexpected and random events they inevitability occur.

We have seen plenty from trade wars, to Brexit, to Fed policy, and a global pandemic in recent years. Yet, before each of those events caused a market downturn, Wall Street analysts were wildly bullish that wouldn’t happen.

There was once a study on the accuracy of “predictions.” The study took predictions from various professions, including psychics and meteorologists. The study came to two conclusions.

- “Meteorologists” are the MOST accurate predictors of the future; and,

- The predictive ability was accurate to just 3-days.

Most importantly, once predictions stretch beyond 3-days, the accuracy was no better than a coin flip.

With that in mind, we are now in the annual prediction period where Wall Street publishes its predictions for the next 12-months. It is essentially an exercise in futility.

Given the markets are affected by a broad spectrum of inputs from economics to geopolitics, monetary policy, rates, and financial events, should take any prediction with a very high degree of skepticism.

Let’s review two opposing outlooks and how we can prepare to take advantage of the risks and opportunities that lay ahead.

Goldman Sachs: S&P To Hit 5100

There is one thing about Goldman Sachs that is always consistent; they are “bullish.” Of course, given that the market is positive more often than negative, it “pays” to be bullish when your company sells products to hungry investors.

It is important to remember that Goldman Sachs was wrong when it was most important, particularly in 2000 and 2008.

However, in keeping with its traditional bullishness, Goldman’s chief equity strategist David Kostin forecasted the S&P 500 will climb by 9% to 5100 at year-end 2022. As he notes, such will be “reflecting a prospective total return of 10% including dividends.”

The assumptions for his market prediction are exceptionally bullish:

He starts by stating that while he expects the market S&P 500 index will climb by 9% to 5100, such will occur in the face of:

“Decelerating economic growth, a tightening Fed, and rising real yields suggest investors should expect modestly below-average returns next year.”

Notably, he also estimates that despite a slowing economy, rising yields, and tightening monetary supply that:

“Earnings growth, which accounted for the entire S&P 500 return in 2021, will continue to drive gains in 2022. S&P 500 EPS will grow by 8% in 2022 to $226 and by 4% in 2023 to $236. Aggregate sales for S&P 500 index will rise by 9% in 2022 and 5% in 2023.”

As noted, David Kostin is quite “bullish” heading into 2022.

Morgan Stanley: S&P Closing Lower At 4400

There are two sides to every coin, even on Wall Street. In this case, the other side of Goldman’s bullish call is Morgan Stanley’schief equity strategist Mike Wilson.

Mike Wilson’s market prediction for 2022 is for a more marked pickup in volatility.

We think there are a number of reasons to suggest that global equities’ serene progress will become more volatile as earnings growth slows, bond yields rise, and corporates continue to juggle the challenges of disrupted supply chains and elevated input costs. We think these issues weigh most heavily on the US equity market.

Here are his three main market predictions:

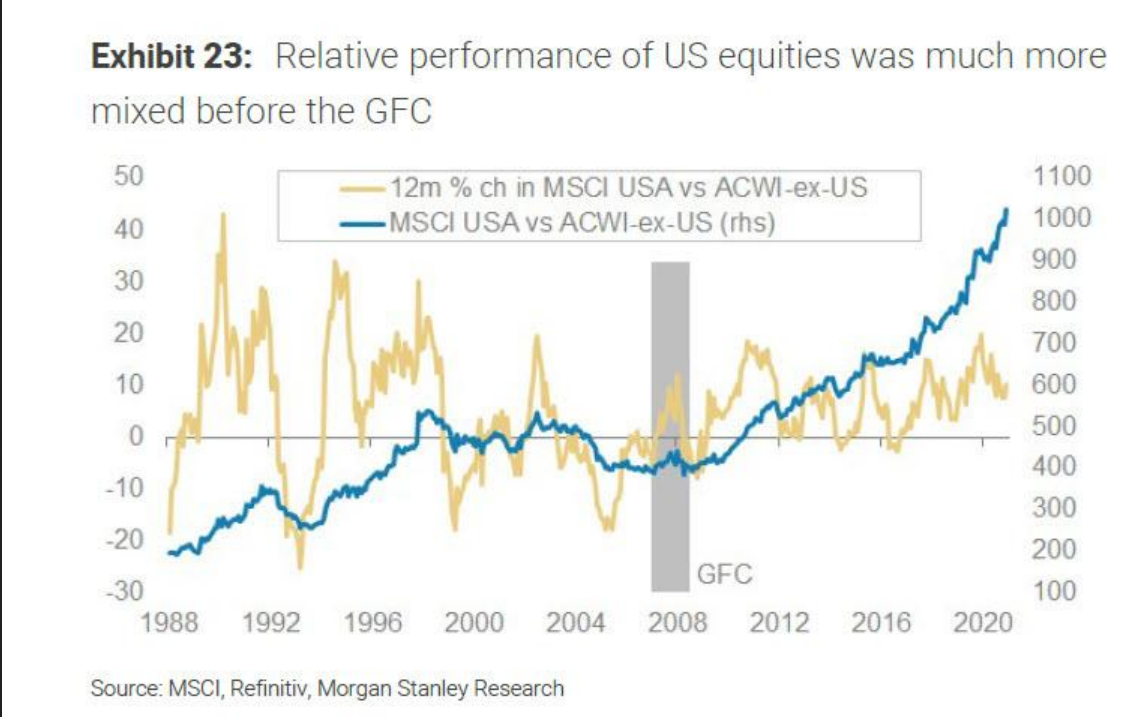

- Earnings Uncertainty: As opposed to Goldman Sachs, Wilson expects that much of the persistent price outperformance of the US versus world markets over the last decade was driven by superior and durable earnings trends. While they expect earnings growth in 2022, expectations weaken materially given cost pressures, supply issues, and tax/policy uncertainty.

- Premium Valuations: The S&P valuation multiples remain at a premium with current trailing P/E’s of 21 still close to a 20-year high. Consequently, US equities currently trade at a record valuation premium to global peers.

- Higher real bond yields: The record valuation premium also exists at a time when the US’s high exposure to growth stocks means its relative performance remains inversely correlated to real bond yields in recent years. Our bond strategists expect the latter to increase materially through 2022

While US equity underperformance has been rare post-GFC, the secular backdrop is likely shifting. Wilson suggests the decade of outperformance of US stocks may shift to underperformance versus global peers.

The question is, who will be correct?

Unfortunately, we don’t know. All we can do is analyze the risk to both views.

The Risk To Market Predictions

Both Goldman and Morgan make some critical assumptions to justify their outlook for 2022. If those outcomes fail to come to fruition, so will their forecast.

While we don’t make market predictions, we analyze the “risk” of what could reverse the current bullish bias.

So, as we head into 2022, here is a shortlist of the things we are either currently hedging portfolios against or will potentially need to in the future.

- Economic growth slows as year-over-year comparisons become far more challenging.

- Inflationary pressures remain far more persistent than anticipated which impedes consumption and compresses profit margins.

- Rising wage and input costs reduce corporate earnings disappointing earnings growth expectations.

- Valuations begin to weigh on investor confidence.

- Corporate profits weaken due to slower economic growth, reduced monetary interventions, and rising costs.

- Consumer confidence continues to weaken as consumption is crimped by rising costs and slowing economic growth.

- Interest rates rise which trips up heavily leveraged consumers and corporations.

- A credit-related event causes a market liquidity crunch.

- The Fed makes a “policy error” by tightening monetary accommodation as the economy slows suddenly.

- A mid-term election resulting in a broad sweep by Republicans in both houses further reducing monetary accommodation and spending.

- The “housing bubble 2.0” implodes.

- Corporate stock buybacks, which accounted for 40% of the market’s appreciation since 2011, slow as companies begin to hoard cash as the economy slows.

- The massive inflows into US equity markets over the last year slows.

- The avalanche of M&A activity, IPOs, and SPACs of poor quality companies results in negative outcomes.

I could go on, but you get the idea.

While analysts on Wall Street are confident the bull market will continue uninterrupted into 2022, there are more than enough risks to derail those market predictions.

It Never Hurts To Carry An Umbrella

While we will enter 2022 carrying a nearly fully weighted equity allocation, we are keenly aware of the risks ahead. Our risk management philosophy is well defined by Robert Rubin, former Secretary of the Treasury:

“First, the only certainty is that there is no certainty. Second, every decision, as a consequence, is a matter of weighing probabilities. Third, despite uncertainty we must decide and we must act. And lastly, we need to judge decisions not only on the results, but on how they were made.

Most people are in denial about uncertainty. They assume they’re lucky, and that the unpredictable can be reliably forecast. This keeps business brisk for palm readers, psychics, and stockbrokers, but it’s a terrible way to deal with uncertainty.

If there are no absolutes, then all decisions become matters of judging the probability of different outcomes, and the costs and benefits of each. Then, on that basis, you can make a good decision.”

The markets can defy logic, fundamentals, and reality in the very short term. However, those are the only things that matter in the long term.

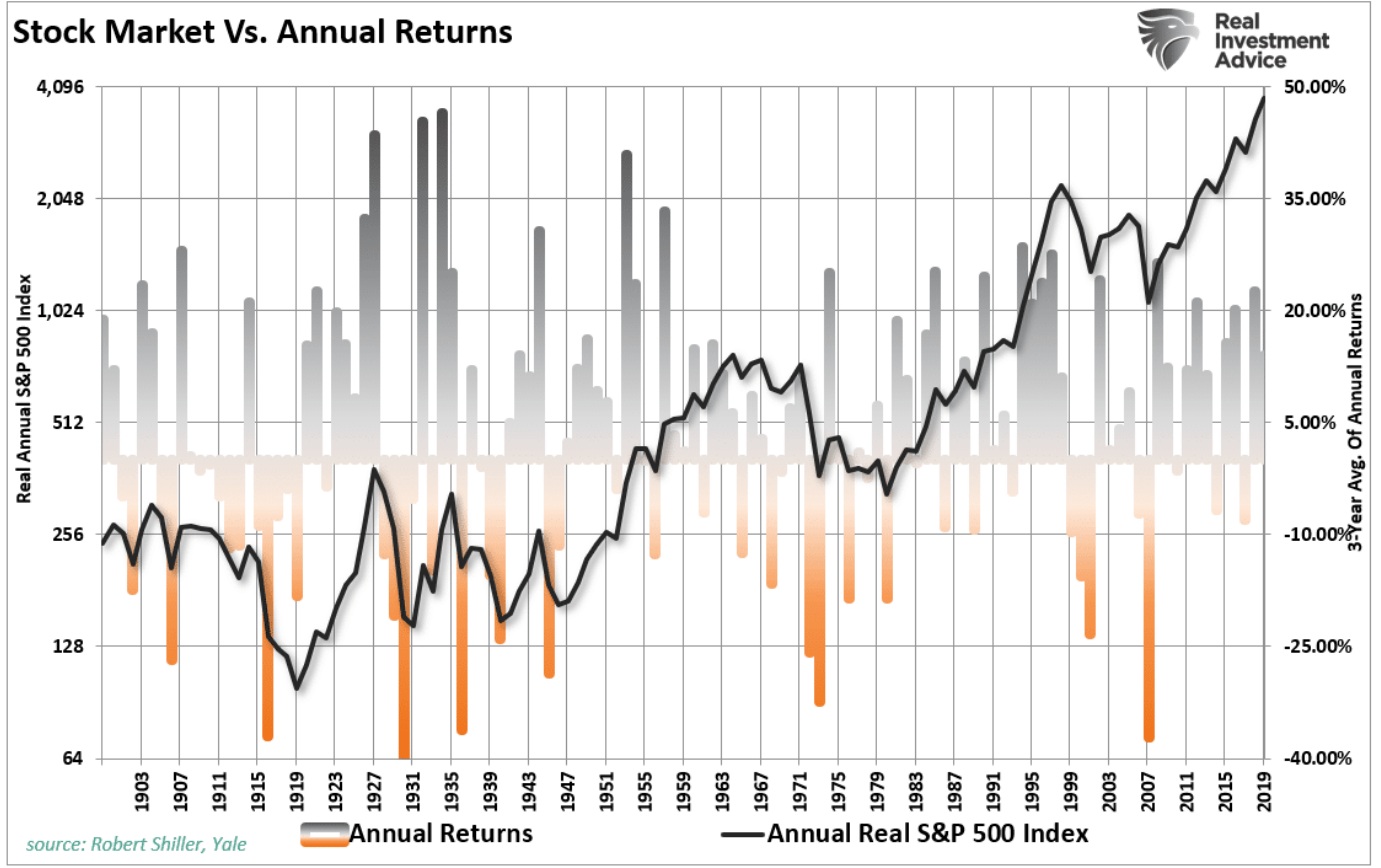

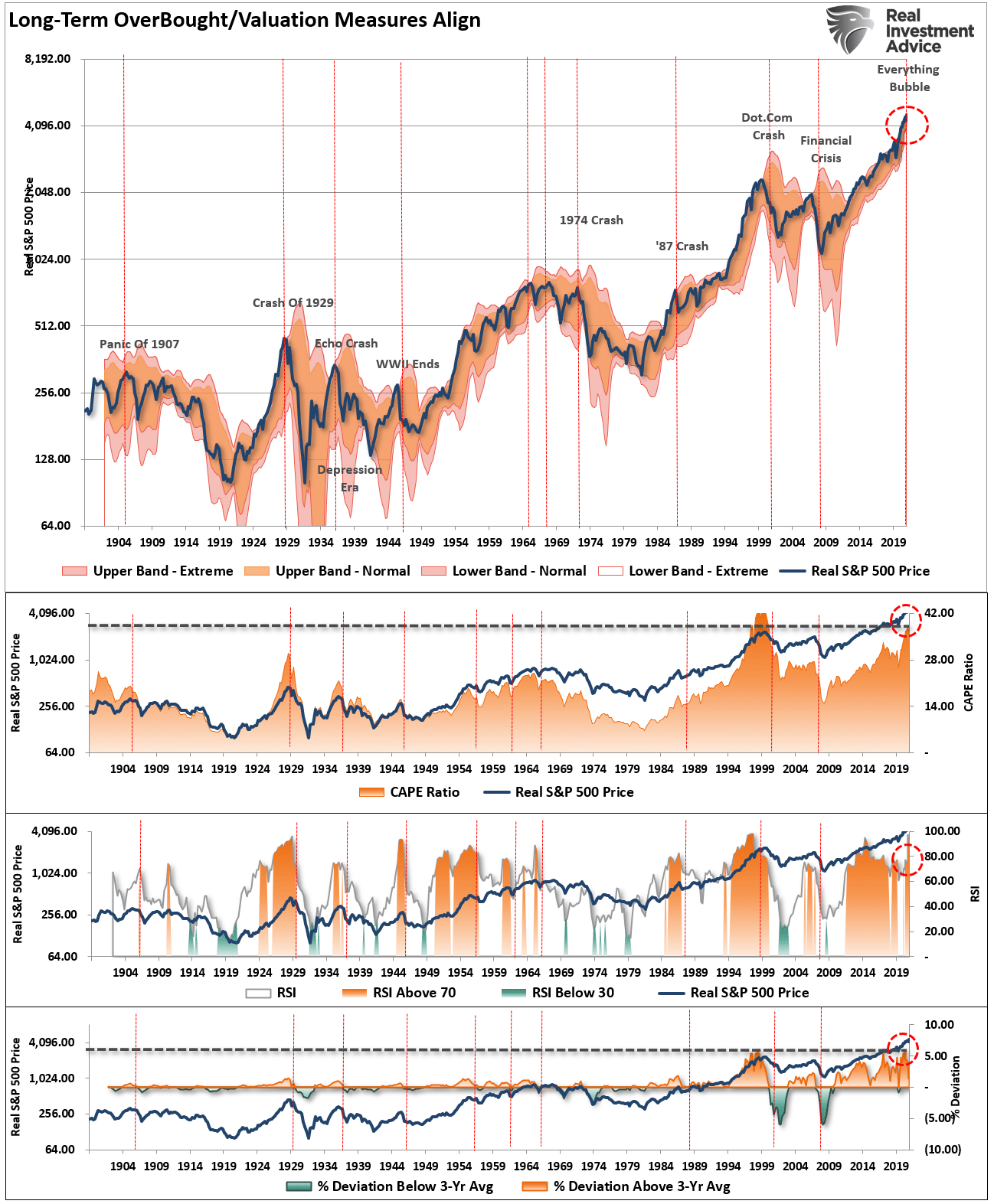

Stock market cap-to-GDP, price-to-sales, margin balances, cyclically-adjusted price-to-earnings ratios, and others argue convincingly the stock market is grossly overvalued. Moreover, the relationships between valuation and fundamentals remain grossly dislocated. Markets may move higher, but to advocate aggressive equity allocations under current circumstances ignores warnings of bubbles past.

Owning well-selected fundamentally cheap companies makes sense. Otherwise, limiting equity allocation exposure is prudent until reasonable opportunities return. Raising cash, setting stop losses, and hedging risk will be critical in 2022.

We can’t predict market outcomes. The most we can control is the impact of outcomes through the risk management process.

“If you don’t have an umbrella when it starts raining, it’s too late. “