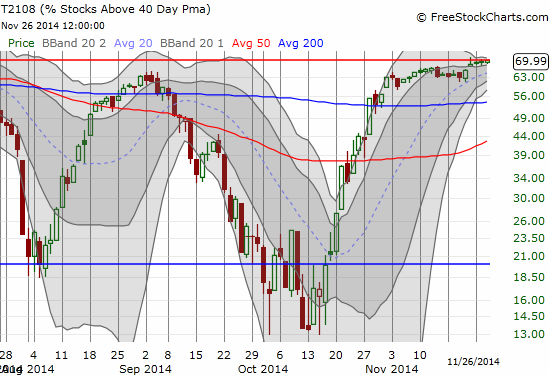

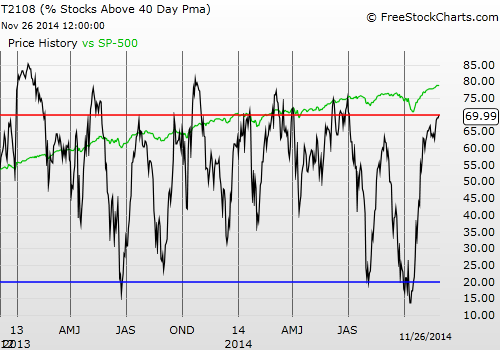

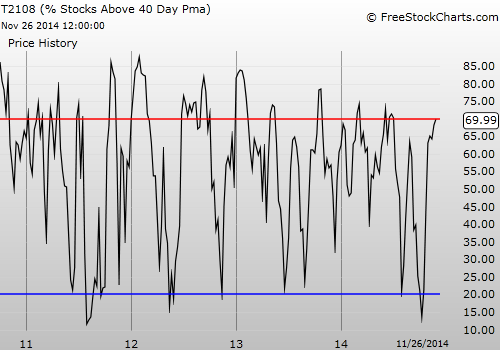

T2108 Status: 69.99%

T2107 Status: 54.6%

VIX Status: 12.1

General (Short-term) Trading Call: Hold (bullish positions)

Active T2108 periods: Day #28 over 20%, Day #26 over 30%, Day #23 over 40%, Day #21 over 50%, Day #16 over 60% (overperiod), Day #98 under 70% (underperiod)

Hard to believe, but, yes, T2108 closed at 69.99% yesterday.

T2108 continues to tease along the overbought threshold

This is a rounding away from 70% and so essentially represents overbought, especially after T2108 first crossed the 70% threshold 3 days ago and scraped along it since. Because my code that calculates historical relationships defines overbought strictly as 70.0% and above, I am not starting the counter just yet. For trading purposes, this milestone of 69.99% is definitely good enough to trade as if T2108 is overbought. Refer to the last T2108 Update for related trading rules.

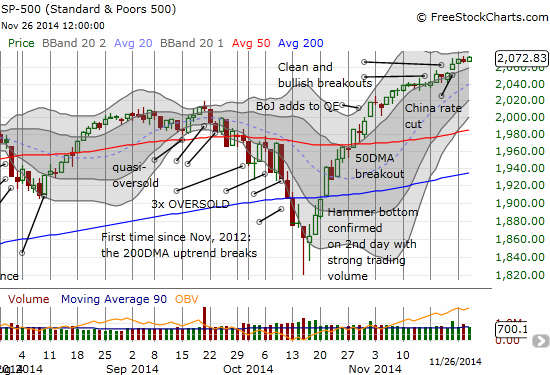

The S&P 500 closed strong at its high of the day and a new closing all-time high. It did not beat out the intraday high though.

Looks like yet more room to run for the S&P 500

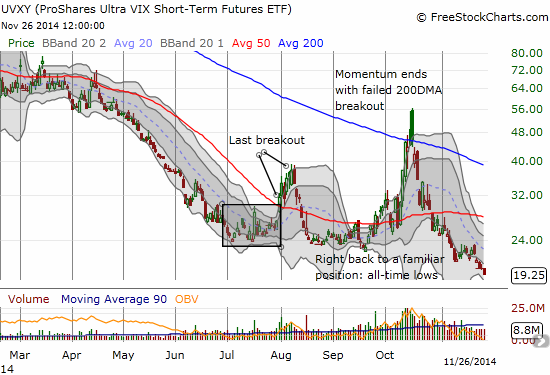

The VIX is continuing its downtrend as it hit 12.1%. Since a major fade from the 15.35 pivot last week, the VIX has been going down in a straight line by steady and nearly equal increments. There is still a short runway to go lower still. I have not shown the destructive impact on ProShares Ultra VIX Short-Term Futures (ARCA:UVXY) in a while. Too bad I have not focused on put options on UVXY over the past week…

UVXY still knows no bottom

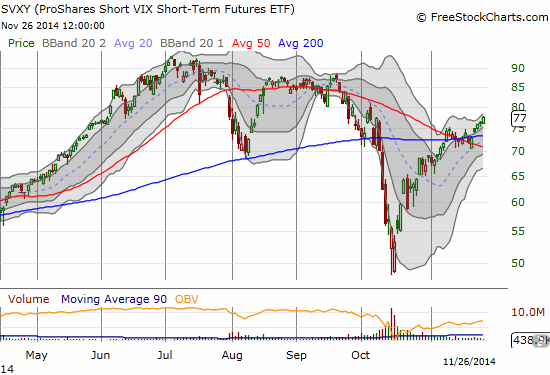

Or maybe I should have just stayed long ProShares Short VIX Short-Term Futures (ARCA:SVXY):

The “right” way to play volatility…although it is very likely to print a lower high soon

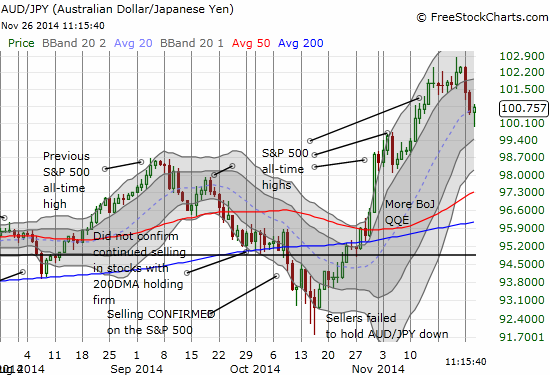

Even the Australian dollar (via Rydex CurrencyShares AUD Trust (NYSE:FXA)) versus the Japanese yen (JPY) has turned sharply upward. AUD/JPY bounced nicely off the psychologically important 100 level in what is starting to look like a hammer bottom that signals an end to the downward pressure. Good thing I used the opportunity to buy and did not jump on the bearish warning right away.

Keeping a close eye on developments with AUD/JPY as it could provide THE key signal for whether the overbought period is short-lived and bearish or long-lived and bullish

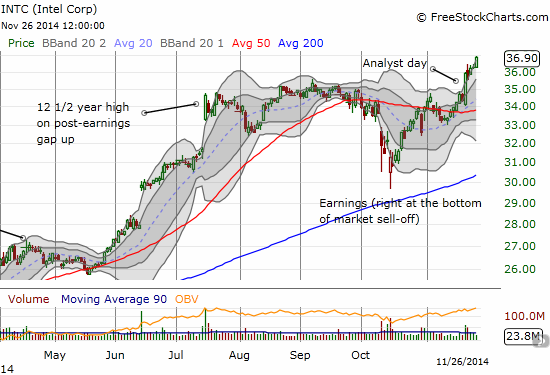

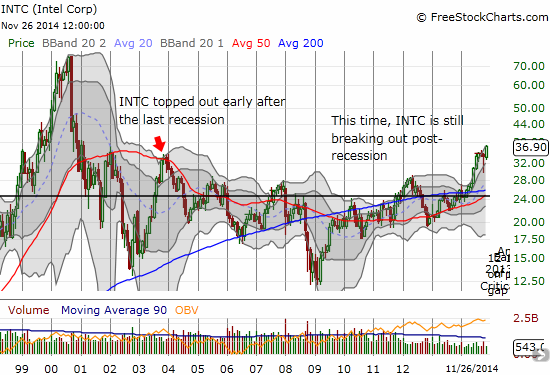

Charts of the day go to post-earnings Deere & Company (NYSE:DE) and post analyst day Intel (NASDAQ:INTC).

Deere & Company (DE) remains perfectly trapped between its 50DMA on the low side and its 200DMA on the high side. Earnings did not resolve the stalemate. In fact, it highlighted the stalemate by touching BOTH ends of the range on the day. DE now has my attention, and I am assuming a breakout, whether up or down, will likely be the start of a strong and sustained move in the given direction. Advantage is likely with the bulls given the 50DMA is now sloping upward.

Deere & Company is on the edge of what could (should) be a major breakout or breakdown

Almost nothing says “bullish stock market” better than Intel at or around 14 year highs. Absolutely amazing. ‘Nuff said.

A very bullish run from a post-earnings gap down

It’s a different Intel this time

My strategy to trade INTC between earnings continues to work very well…except this time I bailed far too early!

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Disclosure: long SSO shares, long NFLX put spread

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI