As the collection of negative news keeps piling in with more countries in lock-down, one wonders how much is left to be discounted. By now, it's hard to argue that the unfolding COVID-19 black swan event has damaged the global economy engine in ways that were unimaginable just a month ago. The open of markets in Asia, with the S&P 500 limit down, tells us 'sell on rallies' mentality prevails. This week, will be all about a multi-trillion $ bill negotiated in the US, the progress of COVID-19 in the UK, the US and Australia, alongside staggeringly high US jobless claims set to be published

Quick Take

The same old story of US equities hitting a limit down has rapidly eventuated at the open of markets in Asia. So far, the relative calm in the form of short-term equity rallies as seen in the early stages of last Friday has been deceptive and continues to serve the purpose to offload the next round of further selling actions by a market mentally shifted to ‘sell the rally’.

If all the mammoth-size actions by Central Banks, from rate cuts, new QE programs, swap lines, new funding facilities, has barely achieved a short-lived 1 day rally in equities, there is clearly a statement by Mr. Market that the measures are not enough. Nobody knows where the bottom is as we are still in phase one where countries are busy shutting down cities. This week, the focus will shift towards more COVID-19 headlines, which are set to depress sentiment further as scientists predict that soon the US and UK, the two main financial centers, are the countries set to follow Italy in experiencing a creeping wave of COVID-19 cases and deaths. Traders should also brace themselves as we are in for another rollercoaster week. Be prepared not to be taken aback as the US is about to announce a staggering weekly surge in jobless claims the likes we’ve never seen in history (over 2 million eyed).

Amid this unfolding negative backdrop, and with more economies to enter a state of semi-paralysis (Australia last one to join), the market can’t cling to any positive development, as the political brinkmanship in the US causes further delays for the multi-trillion fiscal package in the US to pass the Senate. As a final note, the performance in currencies remains quite predictable based on the central themes of a USD liquidity crunch and risk-averse dynamics, which results in the world’s reserve currency as the indisputable king, followed by the JPY, CHF, EUR. The AUD, NZD, GBP are the three currencies most punished, while CAD remains surprisingly stable.

Narratives In Financial Markets

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Twitter, Institutional Bank Research reports.

US equities hit limit down: Judging by the open of prices in the Asian session, the market remains in a state of huge anxiety as the selling of US equities (S&P 500 futures) extends all the way to hit the 5% limit down mark. Further countries around the Western world went into full lockdown, with even stricter measures of confinements, while in the US, more and more regions also follow-suite with draconian measures to isolate people. Besides, the failure by the US Senate to pass the COVID-19 fiscal stimulus bill was the last straw to hit the limit down.

USD takes tiny breather on Fed swap lines: The epic USD squeeze from last week appears to have moderated following the aggressive action taken by the Fed to open up USD swap lines with central banks around the world. “The swap lines among these central banks are available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets,” the joint statement said.

Where is the focus this week? With so much negative news discounted by the market, one wonders what gives to keep the avalanche of selling orders in equities overwhelming buyers. This week is all about a multi-trillion $ bill negotiated in the US to stem the economic fallout, how bad it gets in countries not yet as severely hit in relative terms vs Europe. I am referring to the UK, the US and Australia (numbers are set to increase exponentially). The more strict measures to limit mobility in these big financial centers, the more unrest. Besides, get ready for the staggeringly high US jobless claims set to be published.

NY progressively shutting down: The NY Governor Cuomo announced that 100% of the non-essential workforce must stay home as the total shutdown of NY nears, which has become the most worrying cluster of the COVID-19 spread. The NY cases have been increasing at a staggering pace of 35-40%/day. About ⅓ of the US population is already under lockdown, including LA and Chicago.

London the next Italy? As Sky News reports, “the capital now has 90 deaths… representing ⅓ of all UK cases.” As a matter of fact, Business Insider notes that “the UK has just 2 weeks to stop a coronavirus outbreak as bad as Italy’s.” Business Insider published an article to help the readers understand why time’s running out in London as well.

Australia goes down the same path as Europe: Australia (NSW and Victoria) announced severe measures to cut down the flow of mobility. Australia has been slow to react and is now catching up to the new reality with clubs, pubs, sporting venues, churches, cinemas, gyms and casinos all shutting their doors across the country. Australia’s PM was quoted as saying that “you should not put in place measures that you would not be prepared to have in place for six months”, which sets a bad omen of what’s to come.

Realistic to go on lockdown for just 1 month? Learning from other countries such as China, Hong Kong, and South Korea, the containment measures included complete isolation of society for around 15-30 days after lockdowns were implemented, with measures lifted only gradually even if concerns of a resurgence are high. However, many countries tend not to have either the mechanisms of big-data/surveillance nor the culture to enforce the rules in the same strict manner. Scientists have warned we may need to live with social distancing for a year or more. As Vox notes, “researchers say we face a horrible choice: practice social distancing for months or a year or let hundreds of thousands die.”

US jobless claims in the millions: Traders should brace themselves for a staggering US jobless claims figures this week, likely to shock the unprepared, with economists talking about 2 to 3 million Americans to file for claims insurance this week. This is the type of headline that when confirmed (Wednesday), may shock markets. GDP-wise, Fed’s Bullard flagged the US GDP could fall 50% in Q2, which only reinforces the need for a powerful fiscal response by the US Congress.

Coronavirus stimulus bill fails in Senate vote: But this mammoth-size fiscal package in the US is facing bipartisan opposition. At the conclusion of a Sunday meeting with top congressional leaders and Treasury Secretary Steven Mnuchin, House Speaker Pelosi told a staffer "We are so far apart." The coronavirus funding package has so far failed to gain enough votes in a procedural vote Sunday. According to the Financial Times, the White House is toying numbers in the $2tn vicinity to stem the fallout from coronavirus, to include cash handouts and loans to business.

Fed as an endless fountain of cash: Further elaborating on what the fiscal package entails, U.S. Treasury Secretary Steven Mnuchin said on Sunday, as Reuters reports, that “the coronavirus economic relief bill by the U.S. Congress will include a one-time $3,000 payment for families and allow the Federal Reserve to leverage up to $4 trillion of liquidity to support the nation’s economy.” Reinforcing the notion that the Fed will go above and beyond to support the economy, Fed’s Kashari bluntly said ‘the Fed has infinite cash…”

The precursor of what’s to come in the US: In terms of unprecedented jobless claims report to come, Canadian PM Trudeau notes that the employment department received over 500K applications for unemployment vs 27K normally, noting that this “puts an unprecedented amount of pressure on the system” and that the 500K number is only for one week. This insane number would translate into about 5 million Americans filing for claims insurance.

RBNZ, RBA resort to QE programs: The RBNZ announced additional measures via a new QE program worth $30bn. The RBNZ will buy NZ government bonds to help finance the fiscal efforts by the country. It will do so at pacing of around $750m each week for the next 12 months. Remember, last week, the RBA started its QE program to extend support to the economy and financial system.

Insights Into Forex Flows

- RORO (risk on, risk off) deteriorates again as broad selling resumes.

- The S&P 500 futures sold at the open of Asia hitting a limit down of 5%.

- US bond yields as a barometer of global yield, after holding up on global central bank stimulus actions, saw a major sell-off, reinforcing the risk-off narrative.

- With the VIX so hyper-inflated, it’s rather unrealistic to be expecting a bottom in equities, there is just way too much uncertainty in such a fluid situation.

- The industrial commodity complex (CRB index) is approaching recent lows once again, resonant with the sell-side action seen in instruments elsewhere.

- Gold priced in USD has seen a recovery, which gives us some early clues that investors might be finally jumping back into the safe-haven attributes of the precious metal.

- The EUR index daily chart continues to show major interest to be bought on weakness.

- The daily shows we are in the midst of what might be a third drive up towards a retest of the last high.

- There is a resistance overhead as an area where buyers may find a major stumbling block as EUR sellers have shown interest to defend it on multiple occasions.

- As long as risk-off prevails, EUR weakness is not the base case to be expecting as a paradigm shift of EUR demand on risk aversion is well and alive.

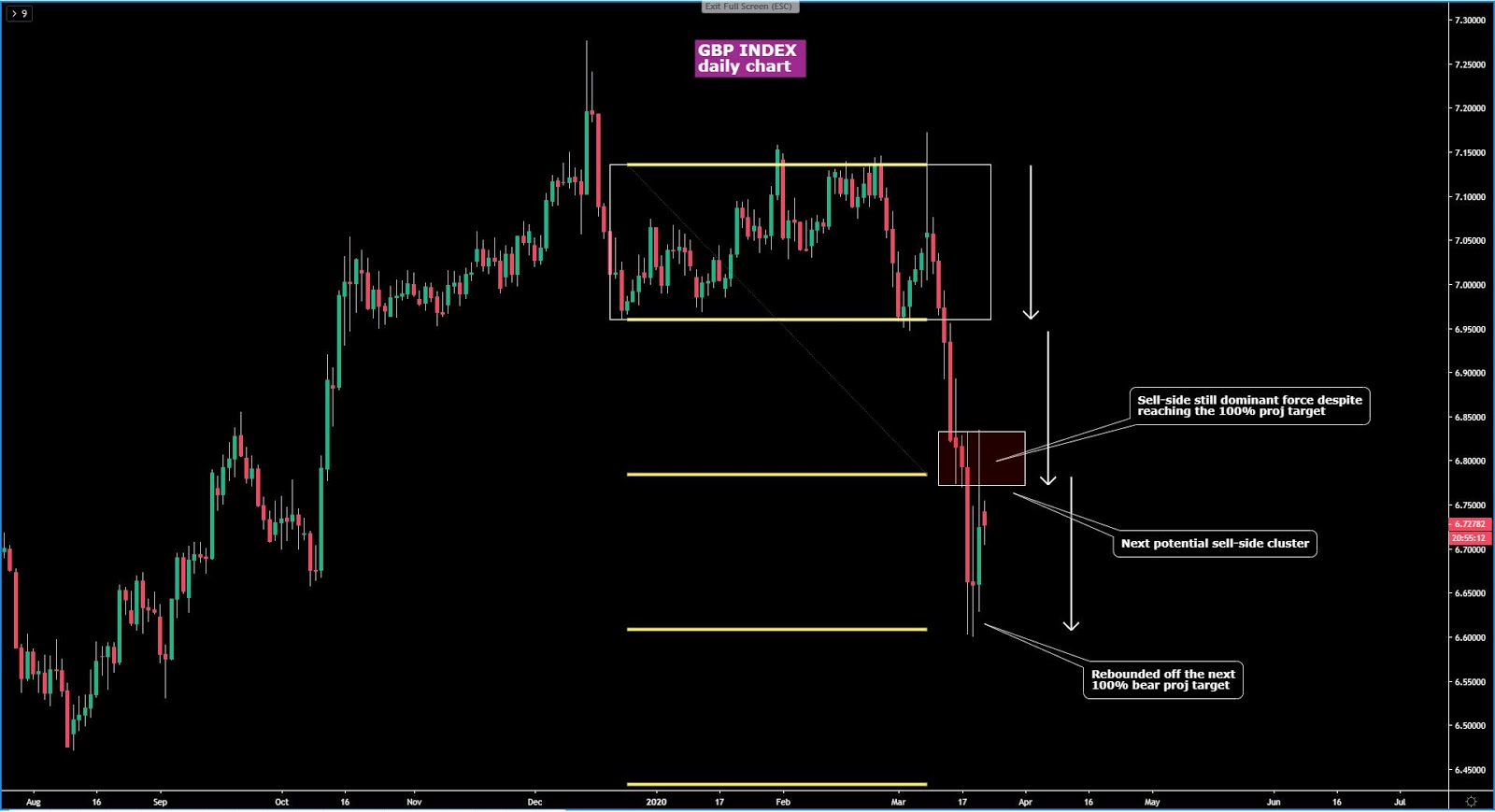

- The GBP index has sold extremely hard, with the movement unfolding in a very fast manner, one that in normal circumstances would be far from sustainable.

- Nonetheless, these are not normal times, and based on the projections of London being the next major hub for the COVID-19 to spread, anything is possible for the GBP.

- GBP tends to underperform G8 FX indices in a global crisis as the one seen unfolding, with the last GFC and Brexit leading to the GBP index falling to the tune of 20%.

- The Pound has so far been respected with surgical precision, as it’s usually the case, the symmetrical projection in targets drawn in the chart.

- Fundamentally, the re-introduction of a bold QE program by the BOE, equivalent to almost 2% off interest rates as such, argues for supply in the GBP to still be justifiable.

- The unbelievable rally in the USD is a very seldom episode of strength as part of a rare ‘liquidity event’ that sees the whole financial system scrambling to buy dollars.

- The measures by the Fed to reactive swap lines by adding additional Central Banks as part of its borrowing facility access has assisted USD weakness at the margin.

- The macro theme remains a Fed failing to move the needle to prevent the currency from showing disorderly appreciation as the world heads into a recession/depression.

- What may turn the trend around is coordinated, in mass intervention in the USD by Central Banks and the Fed to slow down the rapid appreciation.

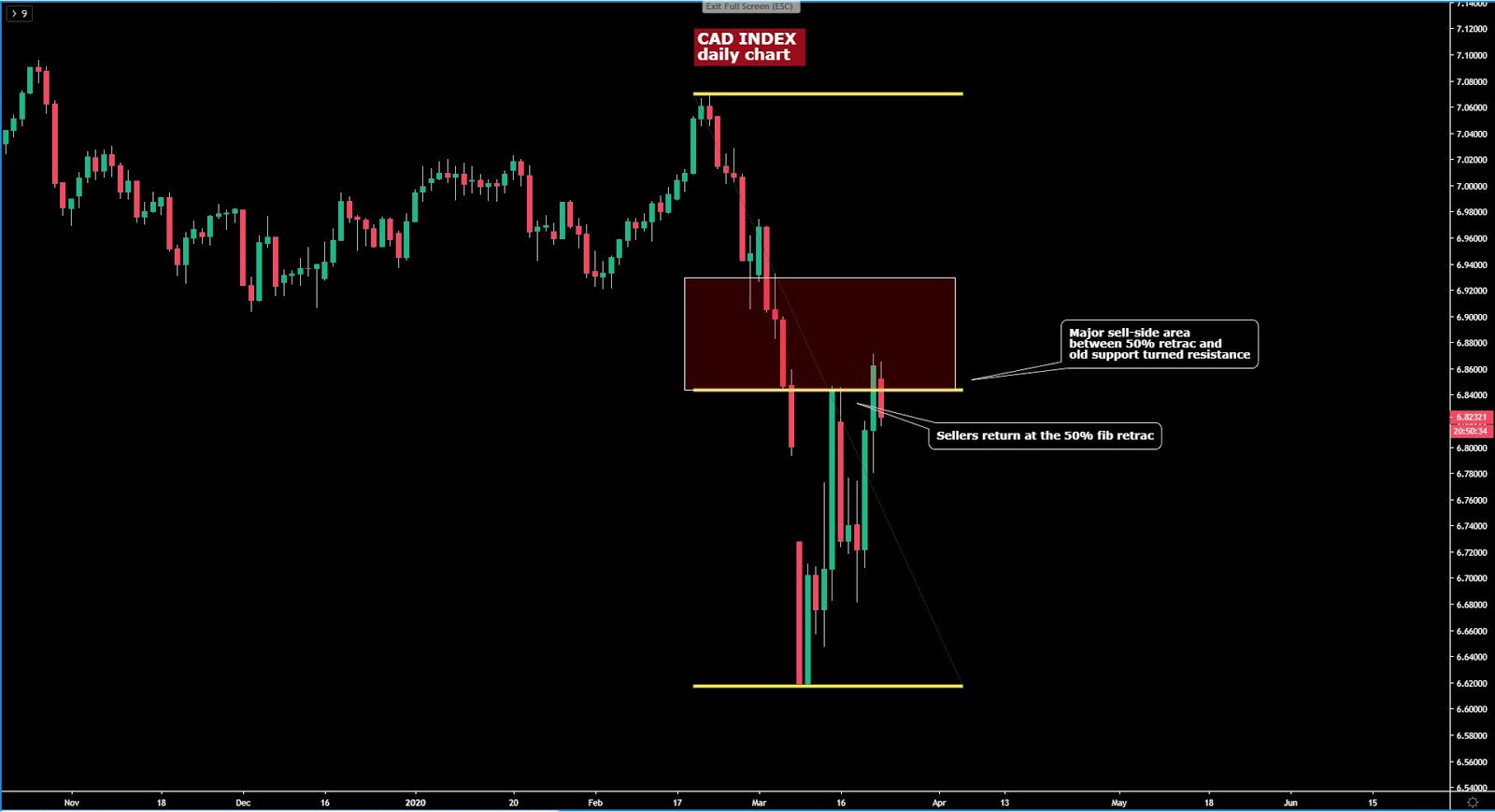

- The CAD index continues to trade at an area that I predict to be quite attractive to consider building short inventory in the coming days/weeks.

- This bearish view is predicated on the technical basis that the currency has returned back to the 50% Fibonacci retracement after the sharp selloff seen earlier this month.

- Considerations to re-engagement in CAD shorts have the fundamental backing of a world rapidly descending into a global recession and a new era of low oil prices.

- Very few currencies show levels where I would qualify them as providing technical value given the overstretched movements. The CAD appears to be the exception.

- The JPY index remains on a one-way street to the upside, with its upward stepping formation yet to be challenged by sellers.

- The true ‘risk-off’ conditions out there is fuel that should keep igniting the JPY fire.

- An important macro-oriented observation: If the JPY only appreciates half in magnitude relative to the moves seen in the GFC, there is about 20% of upside potential!

- Moves in the JPY, in terms of vol, are still poultry compared to the 2008 GFC, hence the JPY remains at risk of a significant pick up in vol in the coming months.

- The AUD has discounted an awful amount of negative news and one wonders how much further it can fall before it starts to look historically too cheap.

- In such a dicey environment, a trend can go on for longer than a bottom picker can stay solvent, so be mindful that these are extraordinary times.

- The Aussie has been bashed from all angles as the ultimate proxy to play a global recession story and as emerging markets get decimated.

- The measures by the RBA to cut rates and dip its toes on a QE program to buy government bonds is a negative input.

- The only piece of news that has caused a rethink of AUD shorts is the warning by RBA Lowe that intervention is not ruled out if further disorderly movements occur.

- The NZD index is as vulnerable as the Aussie in what constitutes two of the most battered currencies to the rapid risks of a transition into a depressive global outlook.

- The NZD has a lot of catch down to do, more than the Aussie, based on the technicals, and now supported by the fundamentals as the RBNZ announces QE.

- The breakout of a macrostructure in the index validates the notion that the currency is likely to face a protracted bearish trend this year.

- If the NZD losses play out as envisioned this year, the low that would be put in comes in stark alignment with the low reached during the GFC in 2008.

- If the risk-off conditions keep extending, unless a circuit breaker is put in place, the CHF is poised to keep appreciating with technicals backing up the bullish call.

- Buying on dips remains the base case as this is a trend that has been paying enormous dividends for those committed to the long side since the start of 2020.

- The index has broken its previous GFC high, which speaks volumes about the huge amount of capital repatriation that has taken place + safe haven attributes aiding.

- The vol realized so far in CHF has been tepid relative to the GFC, therefore, I wouldn’t be surprised that we see a further pick up in vol moving forward.

Important Footnotes

- Market structure: Markets evolve in cycles followed by a period of distribution and/or accumulation.

- Horizontal Support/Resistance: Unlike levels of dynamic support or resistance or more subjective measurements such as Fibonacci retracements, pivot points, trendlines, or other forms of reactive areas, the horizontal lines of support and resistance are universal concepts used by the majority of market participants. It, therefore, makes the areas the most widely followed and relevant to monitor.

- Fundamentals: It’s important to highlight that the daily market outlook provided in this report is subject to the impact of the fundamental news. Any unexpected news may cause the price to behave erratically in the short term.

Projection Targets: The usefulness of the 100% projection resides in the symmetry and harmonic relationships of market cycles. By drawing a 100% projection, you can anticipate the area in the chart where some type of pause and potential reversals in price is likely to occur, due to 1. The side in control of the cycle takes profits 2. Counter-trend positions are added by contrarian players 3. These are price points where limit orders are set by market-makers.