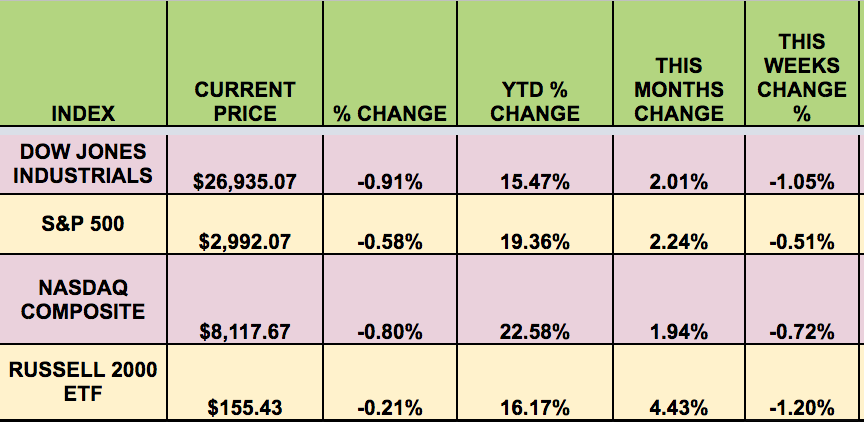

Market Indexes:

Market indices fell in this eventful week, with small caps falling the most, and the S&P 500 falling the least. The week started off with oil surging the most since 2016, after a weekend bombing of a major Saudi oil complex. The Fed lowered its rate by .25% on Wednesday, as expected, but was divided on future rate hikes. Stocks fell on Friday after Chinese officials unexpectedly canceled a visit to farms in Montana and Nebraska as deputy trade negotiators wrapped up two days of negotiations in Washington.

“Oil futures headed for their sharpest daily rise in years on Monday after a weekend drone attack on major crude facilities in Saudi Arabia threatened to create a supply crunch that was roiling global crude markets. West Texas Intermediate crude for October delivery was up 11.6%, or $6..38, at $61.23 a barrel. A gain of that magnitude, if prices hold, would represent the largest daily gain for the most-active contract since Feb. 12, 2016, according to FactSet data.

Price spikes in crude come after a Saturday attack on Saudi Arabia’s Abqaiq plant and its Khurais oil field, which has thrown offline an estimated 5.7 million barrels of the kingdom’s crude oil production a day, equivalent to more than 5% of the world’s daily supply. The Wall Street Journal, citing Saudi officials, have said 1/3rd of the output would be restored on Monday, but a return to full production may take weeks, experts have said.” (MarketWatch)

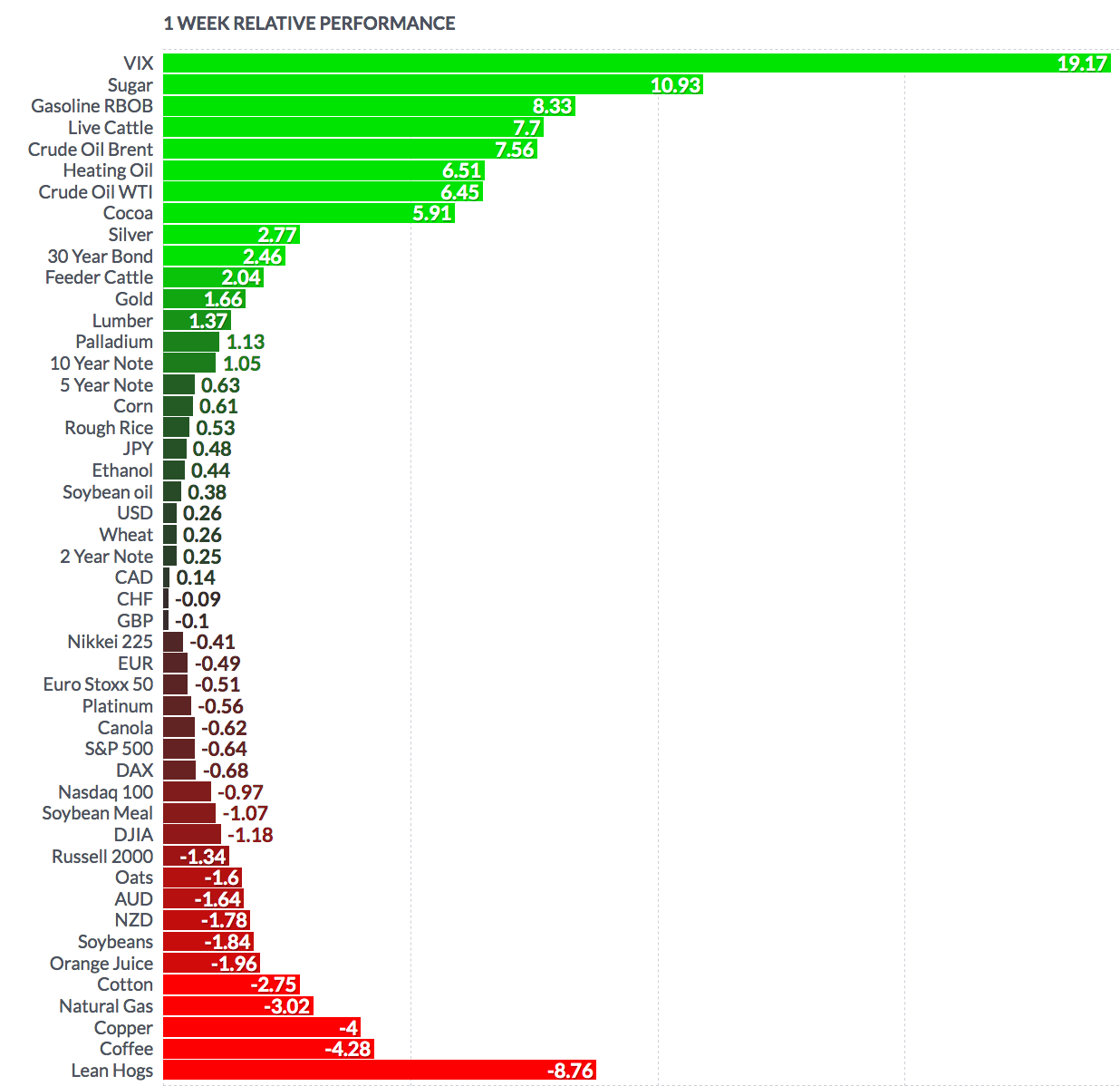

Volatility:

The VIX rose 11.5% this week, ending the week at $15.32.

High Dividend Stocks:

These high yield stocks go ex-dividend next week: ABDC, RPAI, PEGI.

Market Breadth:

Only 7 out of 30 DOW stocks rose this week, vs. 20 last week. 40% of the S&P 500 rose, vs. 67% last week.

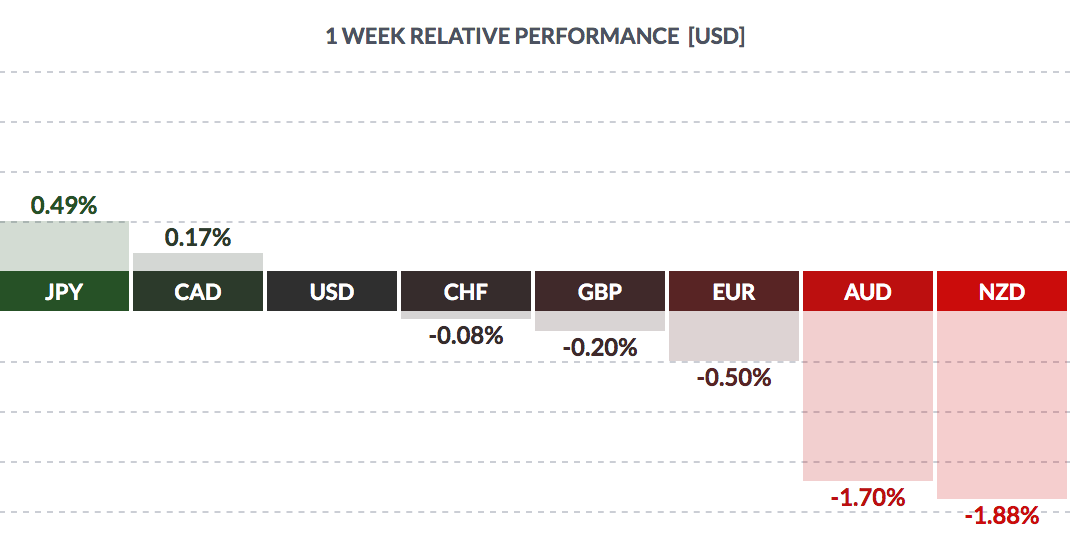

FOREX:

The USD rose vs. most major currencies but rose vs. the Loonie and the yen.

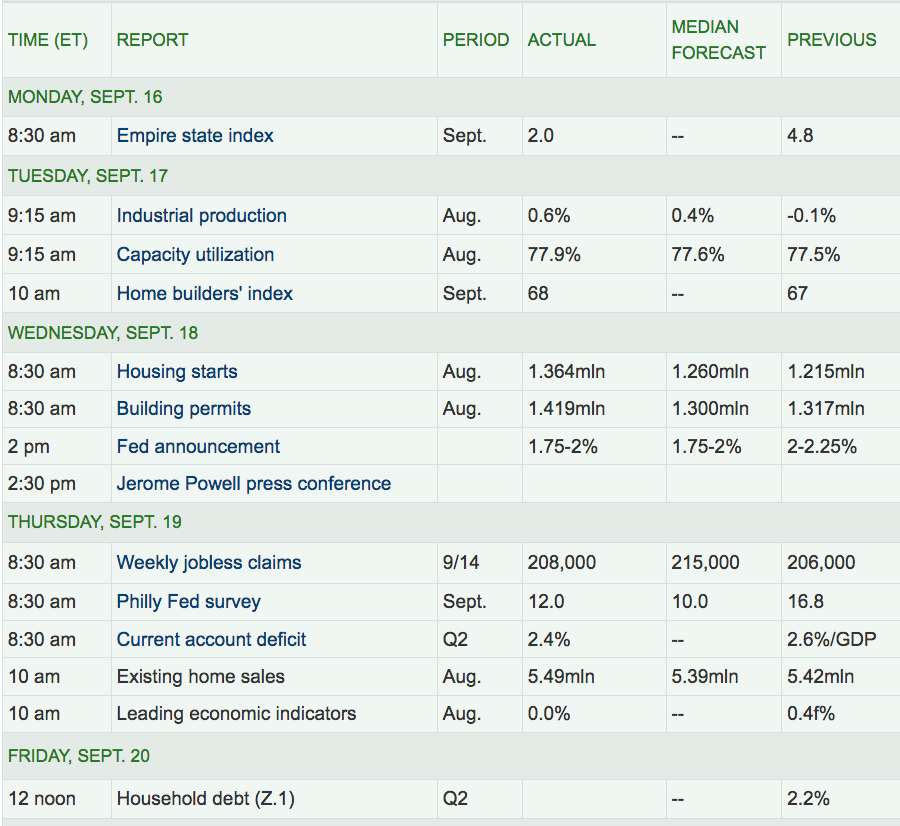

Economic Reports:

“The US central bank has cut interest rates for only the second time since 2008, amid concerns about slowing global growth and trade wars. As expected the Federal Reserve lowered the target range for its key interest rate by 0.25 basis points to between 1.75% and 2%. The bank said the cut is aimed at shoring up the US economy, amid “uncertainties” about future growth. Mr Powell said policymakers decided on a second cut after global growth slowed and trade tensions worsened over the summer.

But officials were divided about the decision and over the need for future rises. Seven members of the Federal Reserve Open Markets Committee, which sets the rates, voted in favour of Wednesday’s cut, including Mr Powell. Two members wanted to hold the rate steady, while one wanted to cut further.” (BBC)

“The central bank now expects GDP to grow at a 2.2% pace for 2019, versus the 2.1% forecast in June. The unemployment rate is expected to rise to 3.7% this year, slightly above the 3.6% projection in June. The GDP outlook for 2020 stayed unchanged at 2%. The Fed still expects the headline inflation to grow at 1.5% this year, while its expectations for core inflation, which excludes volatile food and energy prices, stayed at 1.8%.” (CNBC)

Week Ahead Highlights:

The revised Q2 GDP figure will be released, in addition to several Consumer-related reports.

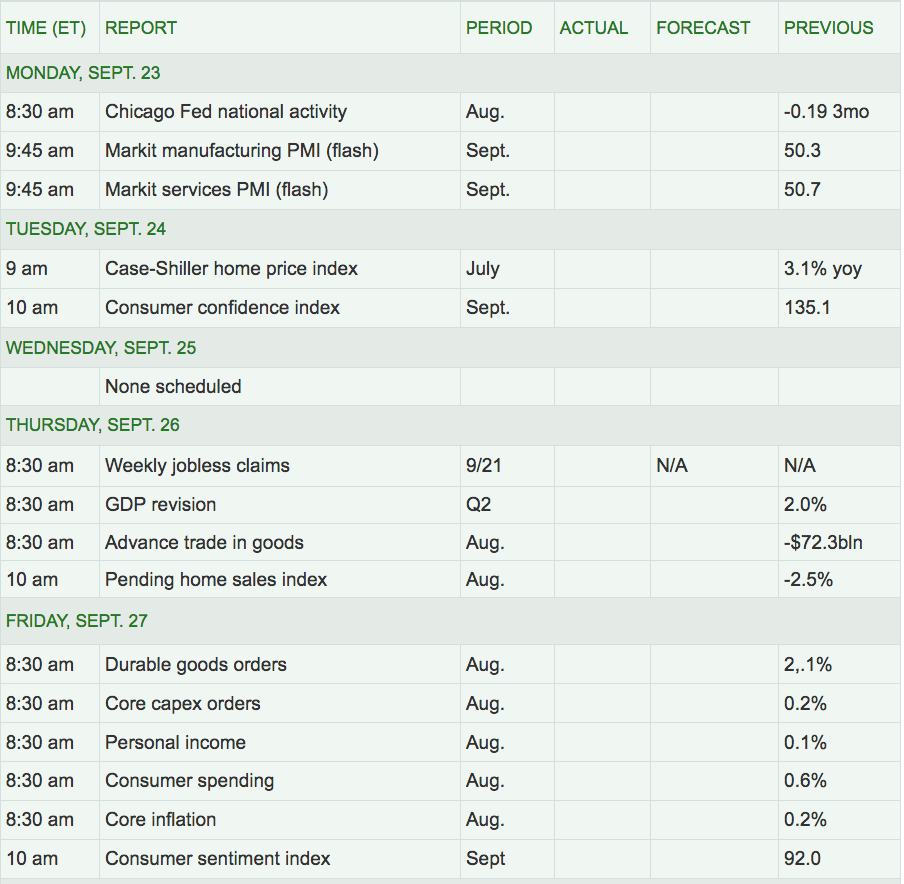

Next Week’s US Economic Reports:

Sectors:

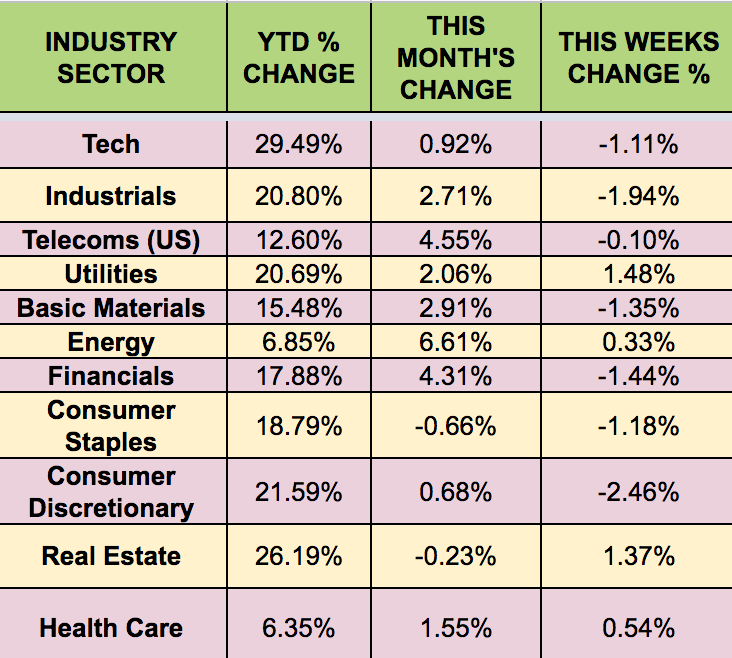

Defensive Utilities and Real Estate led this week, with Consumer Discretionary lagging.

Futures:

WTI Crude rose 6.45% this week, ending at $58.39. Natural Gas fell 3.02%.

“Saudi Arabia sought to calm markets on Tuesday after an attack on its oil facilities, with sources in the kingdom saying output was recovering much more quickly than initially forecast and could be fully back in two or three weeks. The attack knocked out half of Saudi Arabia’s oil production, or 5% of global output, sending prices soaring when trading resumed on Monday. So the new prediction of a quick return to normal output sent prices down sharply on Tuesday. (REUTERS)