Major market indexes advanced strongly last year, but that does not tell the whole story. Not even close.

Historically, sustainable market advances characteristically exhibit strong market breadth (meaning there is participation from most stocks) and a risk-on environment.

That is the opposite of what we experienced last year and is a warning sign for 2022 unless conditions improve markedly.

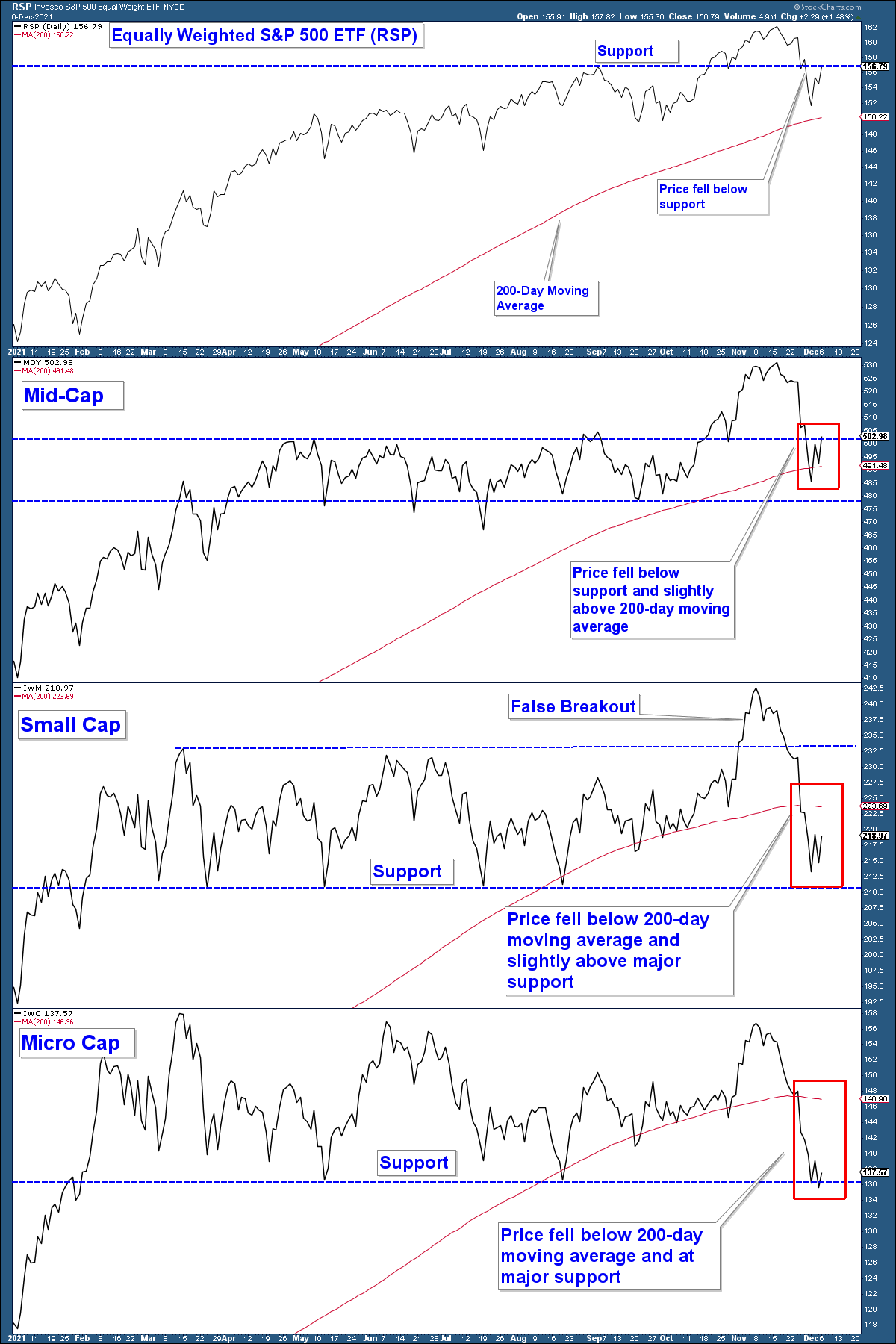

Mid, Small, And Micro Cap Indexes - All Underperform

When the stock market and economic conditions are positive the majority of stocks perform well. As a result, to confirm that an advance in the stock market is sustainable you want to see all market capitalization indexes advancing.

Below are charts of the Invesco S&P 500® Equal Weight ETF (NYSE:RSP), the Mid-Cap Index, via SPDR® S&P MIDCAP 400 ETF Trust (NYSE:MDY), the Small-Cap Index, via iShares Russell 2000 ETF (NYSE:IWM), and the Micro-Cap Index, via iShares Micro-Cap ETF (NYSE:IWC). The red line in each chart is the index 200-day moving average.

While the S&P 500 has advanced strongly and is comfortably above its 200-day moving average, smaller market capitalization indexes have not done well.

The Mid Cap index has consolidated since May and is sitting slightly above its 200-day moving average. This index has gone virtually nowhere since April.

Small Caps look worse. This index has fallen below its 200-day moving average and now is at about the same level it hit back in February.

And worse yet is the Micro Cap index, decisively breaking below its moving average and below the highs of February.

Keep in mind that the S&P 500 is capitalization-weighted. This means the stocks with a higher market cap will receive a higher weighting in the index and thus more heavily impact performance.

The S&P 500 has advanced on the backs of a small group of large-capitalization stocks. This is a warning sign that continues to plague this market.

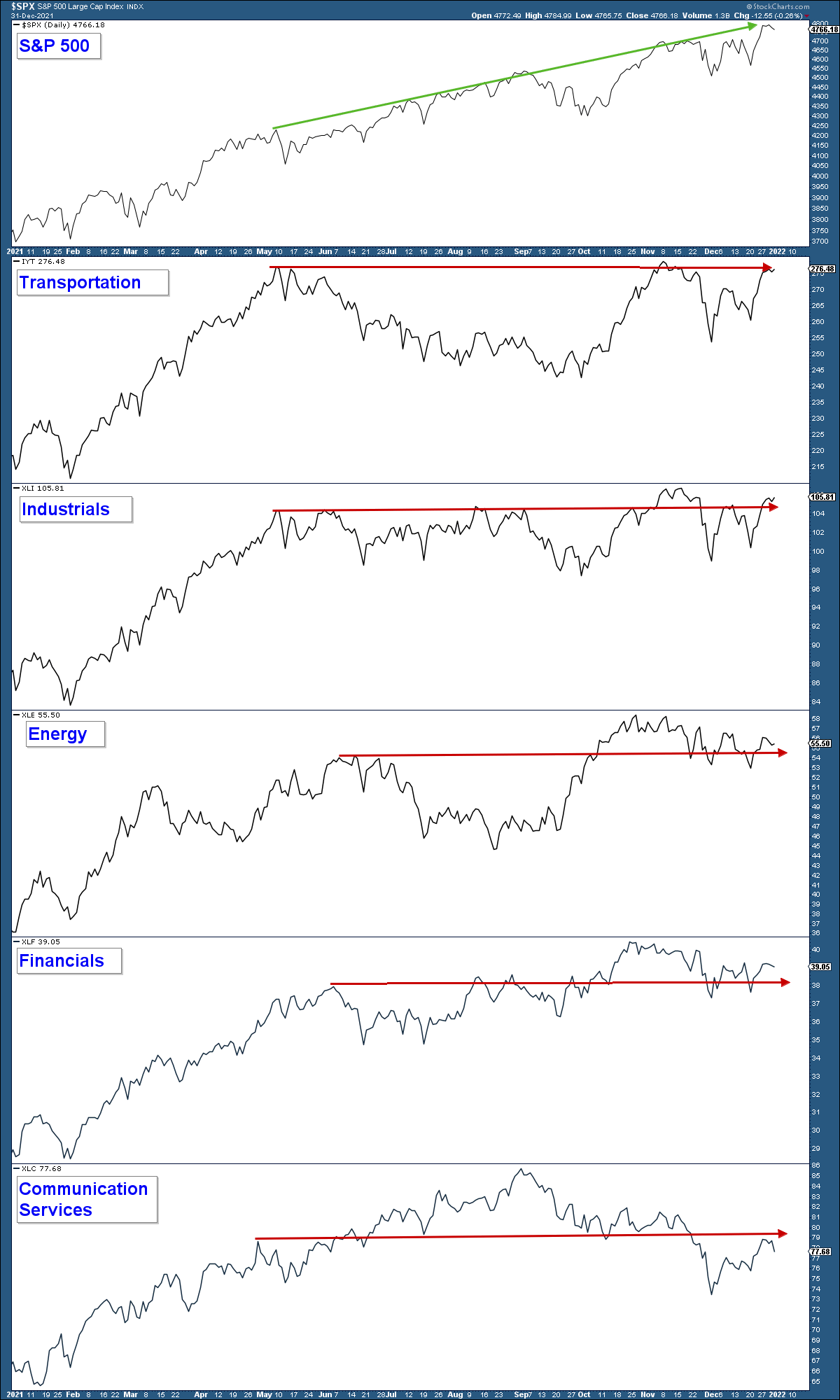

Lagging Sectors And Industry Groups

Now, let’s look at some very important sectors and industry groups. It is hard to imagine a sustainable stock market advance without the participation of key groups such as the ones charted below.

In the top panel is the S&P 500 and in the panels underneath are sectors/industry groups that are dependent on a healthy economy and thus their lack of participation should be viewed as a warning sign that the market is not on firm footing. They have all consolidated sideways since about April/May of last year. This is not indicative of a strong stock market.

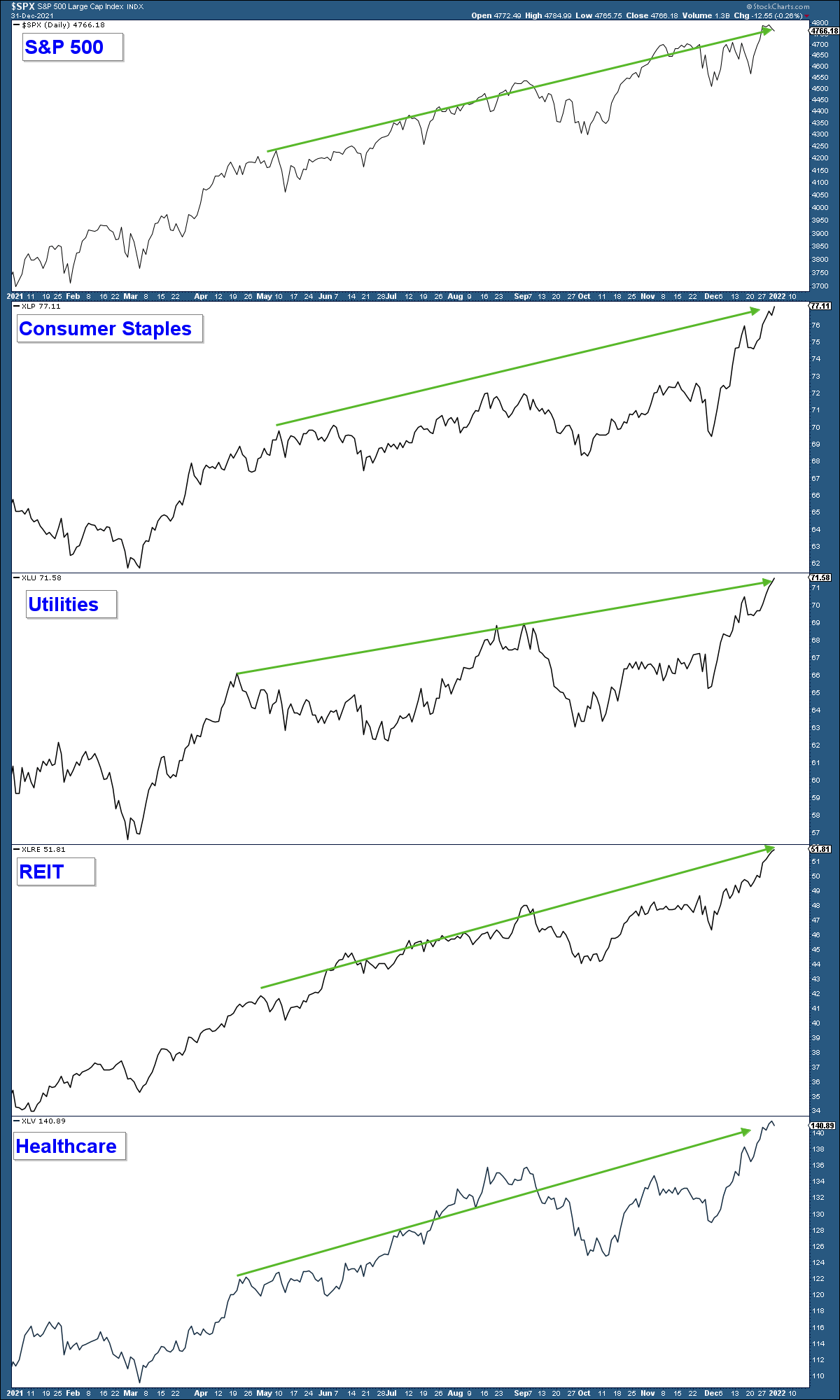

Defensive Sectors Outperform

What has done well over the past year? Defensive (risk-off) sectors. Namely, consumer staples, utilities, REITs and healthcare. All of which are charted below.

Good performance in defensive sectors would not be a concern if it was accompanied by strong performance in both risk-on sectors and economically sensitive sectors, but that is not what is occurring.

The outperformance of defensive sectors over the aforementioned sectors and industry groups is indicative of investors’ lack of confidence in market and/or economic conditions.

The Bottom Line

Market breadth is poor, defensive sectors are outperforming, and major sectors/industry groups that are dependent on a healthy economy are not confirming the market’s advance.

Additionally, stocks are severely overvalued and extended, the Fed is going to be removing liquidity this year, and inflation is going to be a persistent problem.

Unless conditions change dramatically, the stock market is at an increased risk of some type of correction