- Wall Street’s Q4 earnings season shifts into high gear next week

- There will be a lot on the line when Microsoft and Tesla report earnings

- Here’s what to watch for in their latest results

- *Earnings Date: Tuesday, Jan. 24

- *EPS Growth Estimate: -6.4% yoy

- *Revenue Growth Estimate: +2.8% yoy

- *Earnings Date: Wednesday, Jan. 25

- *EPS Growth Estimate: +32.9% yoy

- *Revenue Growth Estimate: +37.8% yoy

Wall Street’s Q4 earnings season shifts into high gear next week with two of the biggest names in the market set to release financial results.

After starting off the new year with modest gains, U.S. stocks have come under renewed selling pressure amid mounting fears over an economic slowdown. Market sentiment also took a hit from hawkish comments from several Federal Reserve officials stressing that interest rates will stay higher for longer to beat inflation.

As such, there will be a lot on the line when Microsoft (NASDAQ:MSFT) and Tesla (NASDAQ:TSLA) report their respective results in the days ahead.

Microsoft

Microsoft will be the first mega-cap tech company to report earnings when it delivers its latest quarterly results after U.S. markets close on Tuesday, Jan. 24.

The Redmond, Washington-based software-and-hardware giant is forecast to suffer a rare profit decline as well as its slowest revenue growth in several years, underscoring the several challenges the tech company currently faces.

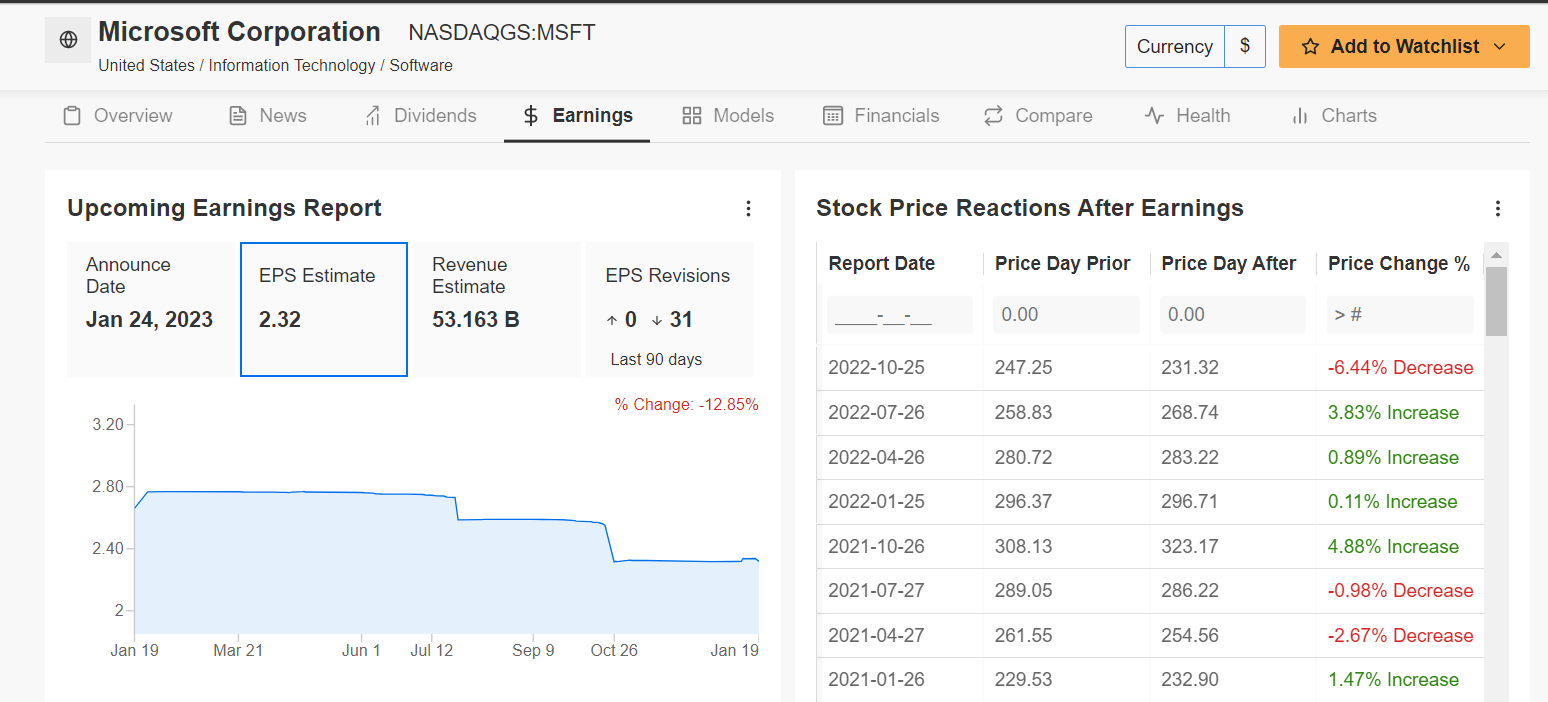

Unsurprisingly, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of Microsoft’s report, with analysts cutting their EPS estimates 31 times in the last 90 days.

Source: InvestingPro

Consensus estimates call for earnings per share of $2.32 for its fiscal second quarter, according to Investing.com, falling 6.4% from EPS of $2.48 in the year-ago period due to rising operating expenses. If confirmed, it would mark the first year-over-year decline in adjusted earnings since Q3 2015.

With this in mind, cost-control will be key even after Microsoft recently announced plans to lay off about 10,000 employees, or roughly 5% of its workforce, in the weeks ahead.

Meanwhile, sales are expected to grow at their slowest pace in over five years, increasing just 2.8% y-o-y to $53.1 billion, as customers rein in cloud spending amid the uncertain economic environment.

The Key Metric

As always, most of the focus will be on the performance of Microsoft’s Intelligent Cloud segment, which includes Azure cloud services, GitHub, SQL Server, Windows Server, and other enterprise services.

Wall Street expects revenue from the segment to grow 17% y-o-y in the December quarter, down from growth of 26% a year earlier, amid weaker corporate spending.

Perhaps of greater importance, Azure's cloud revenue will be closely watched after revenue growth in the last quarter slowed to 35% from 50% a year earlier.

Microsoft CEO Satya Nadella said in a blog post on January 18:

“We’re living through times of significant change, and as I meet with customers and partners, a few things are clear. First, as we saw customers accelerate their digital spend during the pandemic, we’re now seeing them optimize their digital spend to do more with less. We’re also seeing organizations in every industry and geography exercise caution as some parts of the world are in a recession and other parts are anticipating one."

Performance

Microsoft shares have fallen almost 34% since peaking back at nearly $350/share in November 2021, with the downtrend still firmly in play.

MSFT stock — which fell to a recent 52-week low of $213.43 in mid-November — closed at $231.13 last night. With a market cap of $1.73 trillion, Microsoft is the world’s second-most valuable company.

From a technical standpoint, shares remain below their 50-day, 100-day, and 200-day moving averages, which usually signals more selling in the near term.

As can be seen on the chart, MSFT remains stuck in a falling wedge pattern and may continue to spiral downwards to test the lower end of the range close to the $200-220 zone. If it fails to hold above this range, then I expect shares to test pre-COVID lows of $165-180.

Tesla

Tesla is anticipated to release Q4 and full-year financial results on Wednesday, Jan. 25 after the closing bell. A call with analysts is set for 5:30 PM ET (10:30 PM GMT).

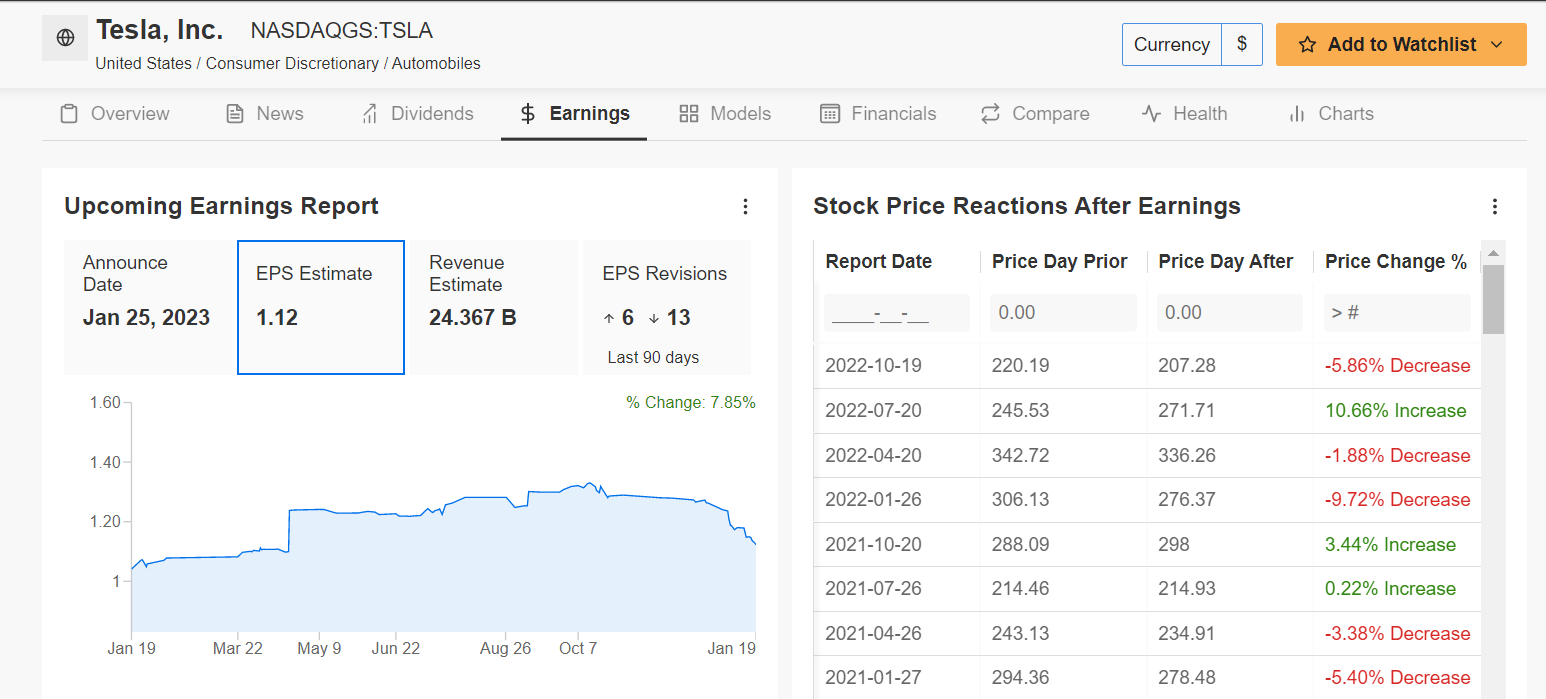

An InvestingPro survey of analyst earnings revisions reveals growing optimism ahead of the report, with analysts raising their EPS estimates six times over the last 90 days to reflect an increase of roughly 8% from their initial expectations.

Source: InvestingPro

According to Investing.com, the Elon Musk-led electric vehicle maker is forecast to report Q4 adjusted earnings of $1.13 per share, rising nearly 33% from EPS of $0.85 in the same quarter last year. Revenue is expected to increase 37.8% from the year-ago period to $24.4 billion.

If achieved, it would mark the highest quarterly profit and sales total in Tesla’s history in the latest sign that it is weathering the macroeconomic storm better than most legacy automakers.

The Key Metric

As concerns grow over Tesla’s ability to meet its ambitious goal to grow volumes by 50% in 2023, I will be paying close attention to the EV maker’s forward guidance for the current quarter and beyond amid the tough economic climate.

Wall Street is expecting Tesla to manufacture 1.947 million vehicles this year and deliver 1.853 million, putting both metrics on track to rise roughly 41% to 42% in 2023.

Tesla’s automotive gross margin, which is forecast to fall to 27.6% from the 29.3% recorded the year ago, will also be closely eyed, especially amid recent price cut announcements, which have fueled concerns that the company is having to offer discounts to retain market share in the face of waning demand.

Tesla is still the market leader in North America with about 65% of the EV industry in 2022, but that is down from 70% in 2021 and 79% in 2020 amid rising competition from traditional automakers as well as Chinese EV startups.

Performance

2022 was a difficult year for Tesla as its stock lost nearly two-thirds of its value amid worsening macroeconomic headwinds, such as rising interest rates, persistently high inflation, and worries about a possible recession.

After rallying to a record high of $414.50 in November 2021, TSLA stock — which is down 61.7% in the last 12 months — tumbled rapidly to a low of $101.81 on Jan. 6, a level last seen in August 2020.

Tesla shares have since staged a modest rebound, closing at $127.17 on Thursday, but they still stand roughly 70% below their all-time peak, amid an aggressive reset in valuations throughout the entire EV sector.

At current levels, Tesla has a market cap of $401.5 billion, compared to $1.23 trillion at its peak.

While the stock has bounced back from deeply oversold levels, Tesla’s chart signals that the downtrend remains intact as shares linger well below key resistance levels. As such, I would not be surprised to see TSLA move back toward the recent 2020 low before finding support at the key psychological level of $100/share.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.