Most global equity indices traded in the green yesterday and today in Asia, despite the accelerating US CPIs. That said, with market participants bringing forth their expectations regarding a Fed rate increase, we remain reluctant to conclude that we are back in uptrend mode.

We believe that the markets' fundamental background has not changed yet, which could keep any further recovery short-lived.

Equities Rebound Despite an Assured November Fed Taper

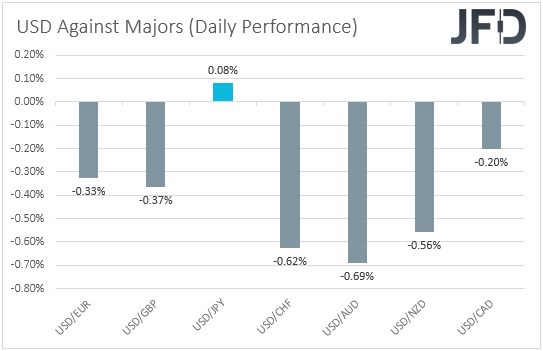

The US dollar traded lower against all but one of the other major currencies on Wednesday and during the Asian session today.

It eked out some gains only against JPY, while it underperformed the most against AUD, CHF, and NZD in that order.

The strengthening of the risk-linked Aussie and Kiwi and the weakening of the dollar and the yen suggest that trading turned to risk-on yesterday and today in Asia. The only reaction that doesn't fit the equation is the strengthening of the Swiss franc.

Looking at the performance in the equity world, we see that, indeed, most major EU indices traded in the green, with the relative optimism rolling into the US session as well.

The only exceptions were Italy's FTSE MIB and Spain's IBEX 35, which slid, as well as Wall Street's Dow Jones Industrial Average, which finished virtually unchanged. Investors' appetite sustained during the Asian session today as well.

European stocks rose due to the bloc's most valuable tech company, SAP (NYSE:SAP) raising its full-year outlook for the third time.

French luxury goods maker Moet Hennessy Louis Vuitton SE (PA:LVMH) revealed that its fashion and leather goods division sales rose strongly during the third quarter.

What may have also helped investors' morale may have been China's trade data, with exports surprisingly accelerating in September.

Wall Street and Asian markets remained somewhat supported despite the US CPI data revealing that headline inflation ticked up unexpectedly.

Minutes of the latest FOMC gathering revealed that policymakers continued to judge that the risks around the inflation projections were tilted to the upside.

In our view, yesterday's market action may have been another short-covering activity. In the absence of any new negative headlines, investors have become confident of adding more stocks to their portfolios.

However, we are reluctant to conclude that the downside is over, and we are back in an uptrend. After all, the fundamental outlook has not changed yet.

Despite pausing their rally, oil prices remain elevated, meaning that inflation could accelerate further, resulting in faster tightening by central banks.

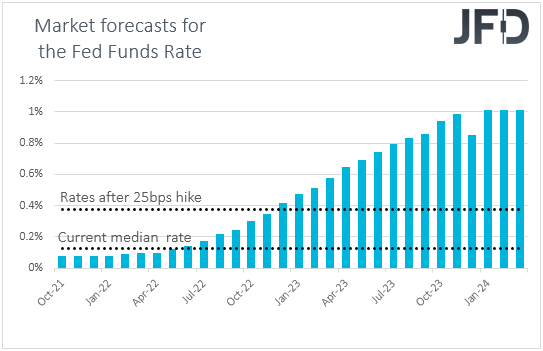

Following yesterday's US CPIs and the Fed minutes, market participants brought their expectations of when the Committee may hit the hike button for the first time since the pandemic outbreak.

According to the Fed funds futures, a 25 bps rate increase is now nearly fully priced for November 2022.

Today, we get the US PPIs for September, with both the headline and core YoY rates expected to have risen further, something that could intensify concerns over rising consumer prices in the coming months.

That's why we believe that any additional recovery in equity markets could stay short-lived, and another setback could be possible. As for the US dollar, we expect it to rebound soon and resume its uptrend.

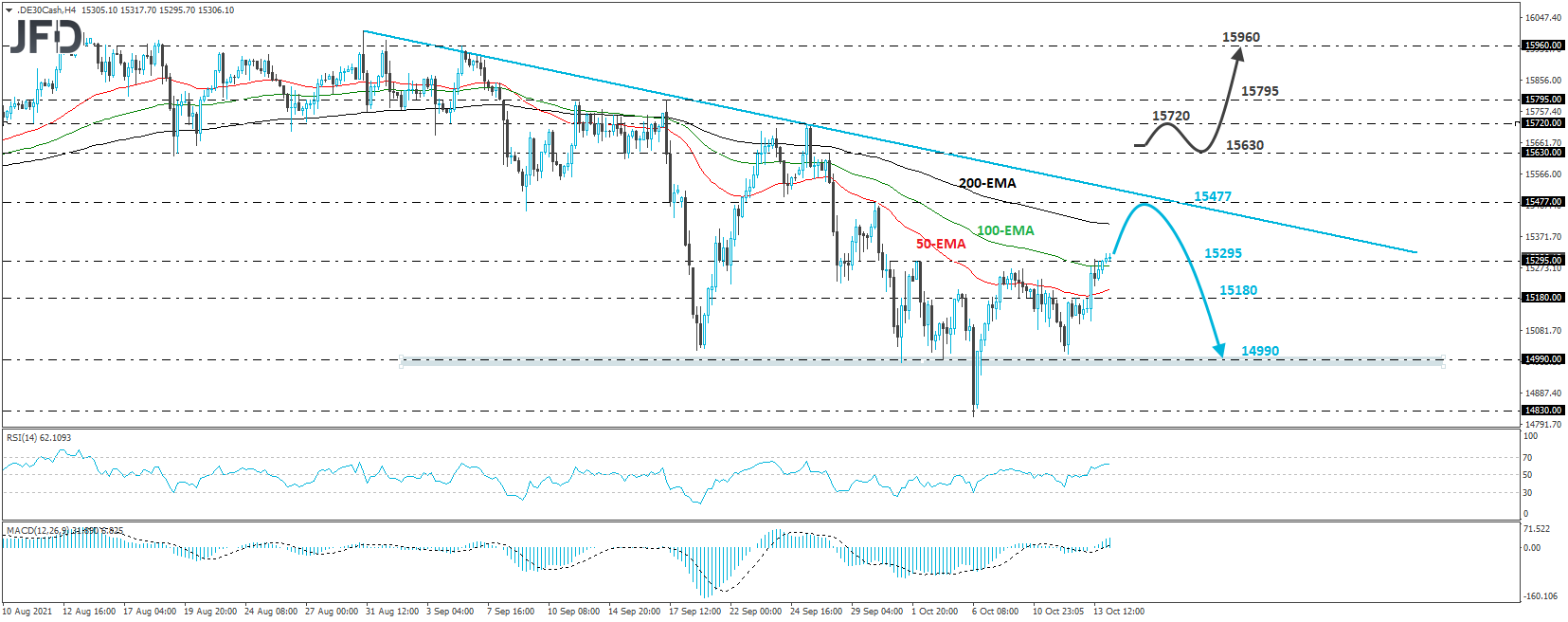

DAX – Technical Outlook

The German DAX cash index traded higher yesterday, and today, during the Asian morning, it managed to break above the high of Oct. 3, at 15295.

This suggests that some further recovery may be in the works, but as long as the index remains below the downside line taken from the high of Aug. 31, we would expect it to stay short-lived.

If the bears take charge near the downside line, or the 15477 barrier, marked by the high of Sept. 30, we could see a slide back below 15295, targeting the inside swing high of Oct. 12, at 15180.

If the price breaks below that level, we could see a decline towards 14990. Except Oct. 6, that territory has acted as a support since Sept. 20.

To start examining whether the outlook has turned positive, we would like to see the recovery extending above 15630, the high of Sept. 28.

Above the downside resistance line, DAX could target a high of Sept. 27, at 15720, or the peak of Sept. 17, at 15795 as a target.

If neither hurdle can stop the bulls, we could see advances towards the 15960 area, defined as resistance by the high of Sept. 6.

EUR/USD – Technical Outlook

EUR/USD edged north yesterday, breaking above the downside resistance line taken from the high of Sept. 14, as well as above 1.1587, marked by the highs of Oct. 8 and 11.

However, the pair remains below another downside line, drawn from the high of Sept. 3, suggesting that any further recovery may be limited.

We believe that the bears may jump back into action near the crossroads of that line and the 1.1640 barrier, marked by the high of Oct. 4.

This could result in a slide towards 1.1587. Breaking which, the pair could move towards 1.1524, defined by the low of Oct. 12.

In our view, the bulls may gain complete control upon a break above the 1.1690 territories, marked by the high of Sept. 29.

This may cement the break above the downside line taken from the high of Sept. 3 and could allow advances towards the 1.1749 level, defined by the high of Sept. 17.

Another break, above 1.1749, could carry extensions towards the high of Sept. 15, at 1.1837.

Elsewhere

During the Asian session today, we got Australia's employment report for September. The economy lost more jobs than anticipated, while the unemployment rate slid due to more people being discouraged from applying for unemployment benefits.

This may have been a reality check for those who have recently started to place bets that the Reserve Bank of Australia (RBA) might hike rates late next year, despite the bank itself stating that any such move is unlikely before 2024.

The Aussie pulled back at the time of the release, and yet, it still was the leading gainer among the major currencies.

Later in the day, at the same time with the US PPIs, we get the nation's initial jobless claims for last week, with expectations pointing to a slight decline.

The EIA report on crude oil inventories for last week is also coming out, and the forecast suggests a 0.702mn barrels inventory build after a 2.346mn rise the week before.

ECB Executive Board member Frank Elderson, BoE MPC member Silvana Tenreyro, Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin, and New York Fed President John Williams are due to speak today.