Independent oil refiner and marketer Marathon Petroleum Corporation (NYSE:MPC) is set to release second-quarter 2017 results before the opening bell on Jul 27.

In the preceding three-month period, the Findlay, OH-based downstream operator delivered a positive earnings surprise of 700% on higher gross margins and solid operational performance from its Midstream unit.

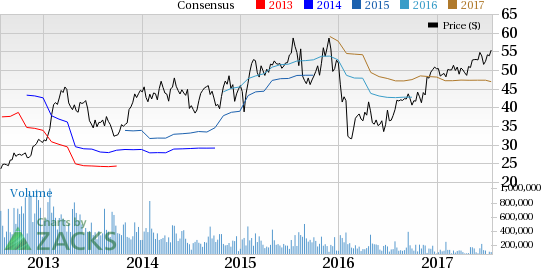

Coming to earnings surprise history, the company has surpassed estimates three out of four quarters with a positive average earnings surprise of 189.75%.

Let’s see how things are shaping up for this announcement.

Marathon Petroleum Corporation Price and EPS Surprise

Factors to Consider This Quarter

Marathon Petroleum is the third-largest domestic refiner with a combined crude oil processing capacity of approximately 1.8 million barrels per day through its portfolio of seven refineries. A major advantage for the company is its proprietary access to pipelines, which inhibits lower-cost competitors from operating in its key markets. Moreover, Marathon Petroleum remains exposed to the Brent-WTI spread, which showed a significant rise in the second quarter when compared with the year-ago quarter. This bodes well for the company. This is also reflected in the share price of Marathon Petroleum which rallied around 4% in the second quarter. Marathon Petroleum’s ‘Speedway’ (convenience stores) unit is also primed for a strong quarter on higher margins. The ‘Pipeline Transportation’ segment – with its stable fee-based income – will also provide an impetus to the second-quarter results.

Although crude ended the second quarter of this year 8.4% lower, the pricing environment of commodity prices was much healthier than the year-ago quarter, courtesy of the historical OPEC agreement. Improvement in oil prices is definitely not favorable for Valero as the input cost for refiners increase with the rise in oil prices. However, rising costs due to Tougher RIN obligations is likely to weigh on the earnings and margins of the company. The RIN expense has increased from $3.3 to $3.5 per barrel in the second quarter when compared with the year-ago quarter.

Earnings Whispers

Our proven model does not conclusively show that Marathon Petroleum is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP for the company is 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.04. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter

Zacks Rank: Marathon Petroleum currently carries a Zacks Rank #3, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

Please note that we caution investors against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

While earnings beat looks uncertain for Marathon Petroleum, here are some firms from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this quarter:

Diamond Offshore Drilling, Inc. (NYSE:DO) has an Earnings ESP of +12.5% and a Zacks Rank #3. The company is expected to release earnings on Jul 31. You can see the complete list of today’s Zacks #1 Rank stocks here.

Noble Corporation (NYSE:NE) has an Earnings ESP of +6.06% and a Zacks Rank #3. The company is expected to release earnings on Aug 3.

Rowan Companies plc (NYSE:RDC) has an Earnings ESP of +21.88% and a Zacks Rank #3. The company is likely to release earnings on Aug 2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Marathon Petroleum Corporation (MPC): Free Stock Analysis Report

Noble Corporation (NE): Free Stock Analysis Report

Rowan Companies PLC (RDC): Free Stock Analysis Report

Diamond Offshore Drilling, Inc. (DO): Free Stock Analysis Report

Original post

Zacks Investment Research