Patience has paid off for Netflix Inc (NASDAQ:NFLX) as it can now enter China after a licensing deal with Chinese search giant Baidu Inc. (NASDAQ:BIDU) . Though yet to be directly accessible to Chinese people, Netfilx’s shows will now be available on Baidu’s online video portal, iQiyi, per media reports. Shares jumped nearly 6% yesterday to close at $152.16.

Reportedly, with nearly 500 million users, iQiyi is one of the leading online video platforms in China along with Youku Tudou (owned by Alibaba (NYSE:BABA)), Sohu Video and Tencent Video.

The announcement was made by VP of Netflix, Robert Roy at the APOS conference held in Indonesia, cites Variety. There are no details available on which shows will be streamed in the region or the exact terms of the deal.

Over the past many years, Netflix has been trying hard to break the China Wall,keeping in mind the sheer demographic strength of the country. Unfortunately, stringent regulations proved an impediment so far. On earlier occasions, Netflix’s attempts to enter the country as a service operator, reportedly, were rebuffed by the Chinese government. The government has stringent censorship laws and has denied entry to big foreign names like Netflix or Facebook (NASDAQ:FB) , Google (NASDAQ:GOOGL) and Twitter into the mainland.

The Chinese government has also banned American sitcoms on numerous occasions. In 2014, it banned the American show “The Big Bang Theory” from Sohu’s website amid a crackdown on the content which was considered “offensive”. Even “House of Cards,” licensed by Netflix to Sohu, was banned. Other shows like "The Good Wife," "NCIS" and "The Practice" were also reportedly banned.

Analysts observe that though prima facie the collaboration with iQiyi seems a big victory for Netflix, it remains to be seen how IQiyi succeeds in getting the Chinese government’s approval to air American sitcoms. Per a CNN report, the government has an acute dislike for promotion of western way of living, overt display of skin, homosexuality, time travel as well as drinking and smoking. It even pulled the plug on Apple’s (NASDAQ:AAPL) iBooks and iTunes services, last year.

In January last year, Netflix made an impressive rollout of its service to 130 countries simultaneously. With the exceptions of North Korea, Syria, Iran and China, Netflix is now available in almost all countries. The company boasts nearly 100 million subscribers driven by rapid international expansion and focus on original content. In Sep 2016, CFO David Wells commented that the company plans to make 50% of its total content original over the next few years.

The company is also snapping up Hollywood talent to boost its movie business. Veteran Hollywood producer, Scott Stuber will spearhead its movie division from now on. Netflix plans to release 30 original moves in 2017.

To attract subscribers, Netflix will offer free service in the first month. It also plans to add more regional languages to make the service more appealing. As of now, it offers content in nearly 24 languages.

In 2017, the company expects to spend over $6 billion mostly in producing original content and on licensing deals.Also, it is likely to spend another $1 billion on marketing its content.

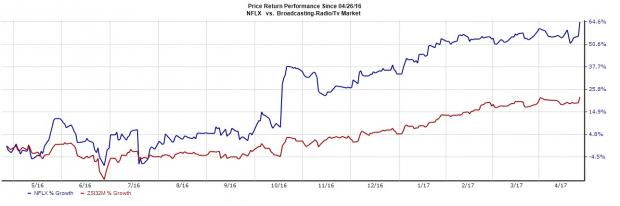

At present, Netflix carries a Zacks Rank #3 (Hold). Over the past one year, Netflix shares have outperformed the Zacks categorized Broadcast Radio/TV industry. While the industry gained 22.07%, the stock saw a return of 64.62%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more.Click here for a peek at this private information >>

Netflix, Inc. (NFLX): Free Stock Analysis Report

Baidu, Inc. (BIDU): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research