Global stock index charts are poised for massive advance pending a breakout (but, will it happen?)

[Note: Factor LLC is a proprietary trading firm dating back to 1981 at the Chicago Board of Trade. Factor basis its prop trading on classical charting principles. Factor shares the bulk of its internal research with members of the Factor service.]

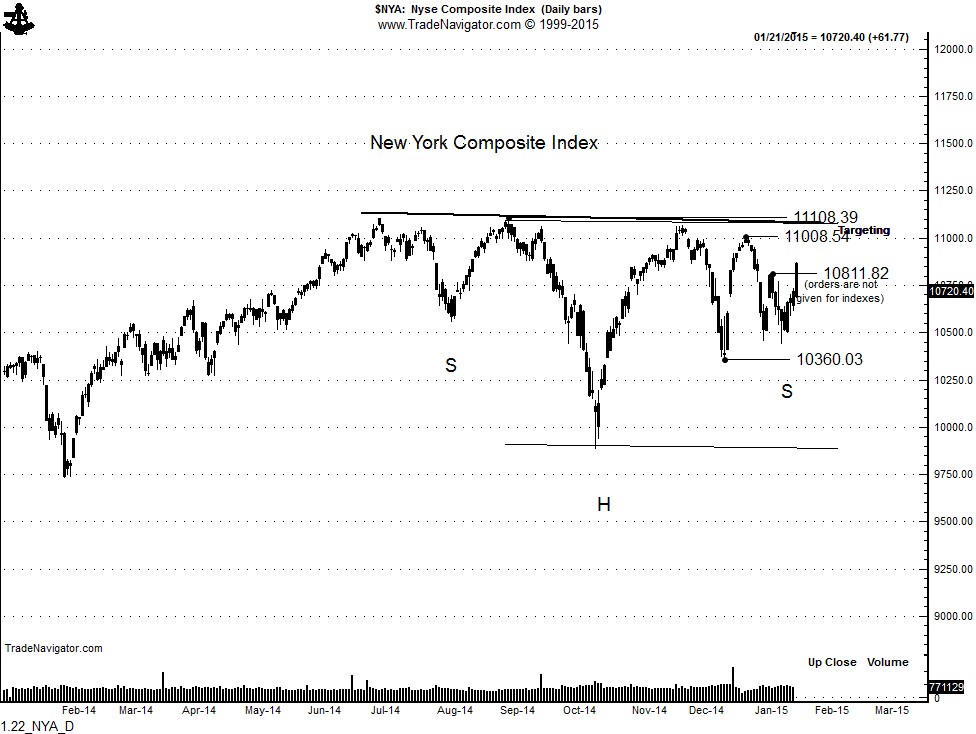

I have for several weeks and months maintained that the NYSE Composite will be the bell-weather for U.S. stocks. It has the clearest chart picture. The NYSE Composite is forming a near textbook continuation H&S pattern. The key upside levels are indicated on the chart. An upside penetration of these chart levels will usher in a sustained advance in U.S. equity prices.

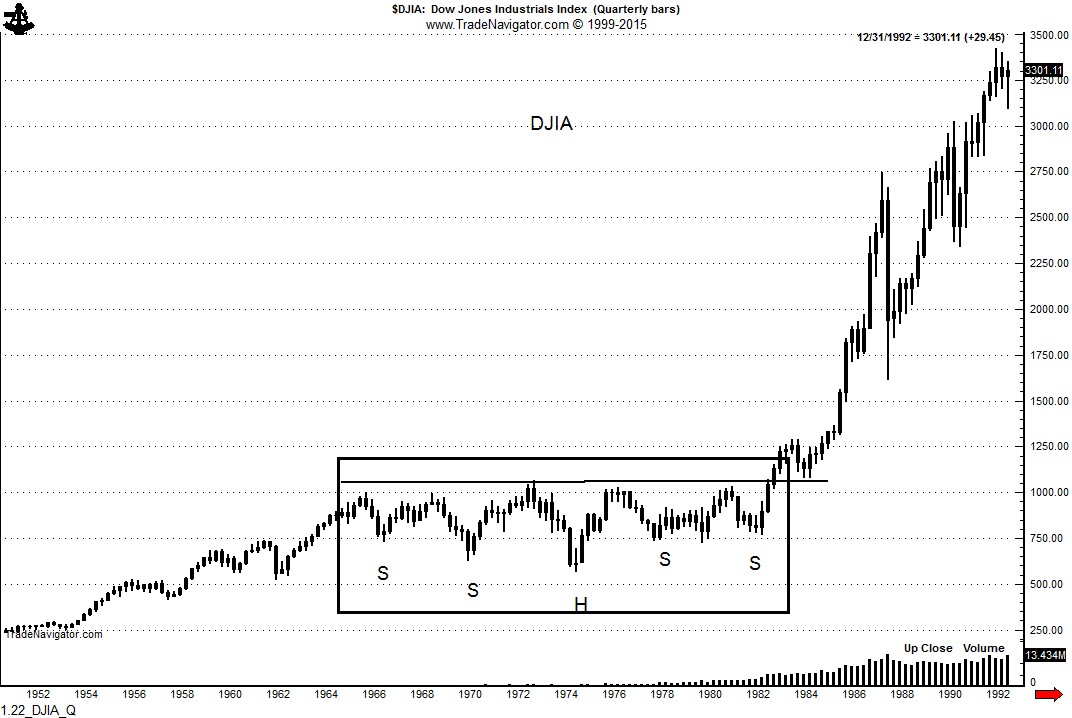

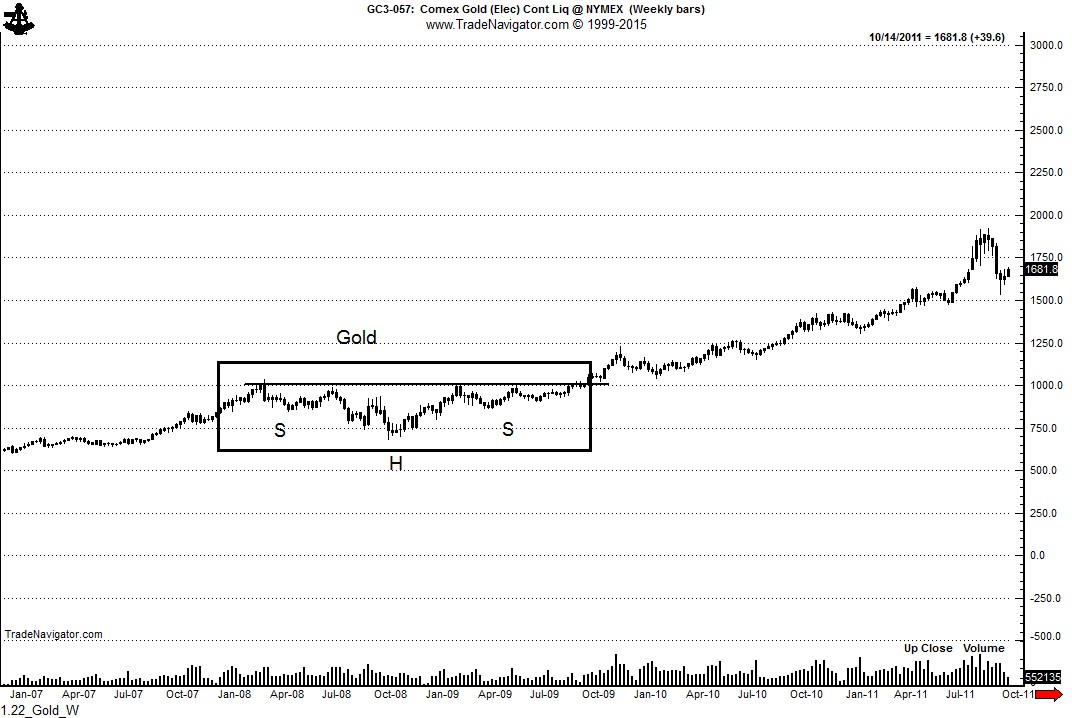

It should be noted that this exact price configuration has produced giant price advances in the past. Charts of Gold and the DJIA are shown as examples, below:

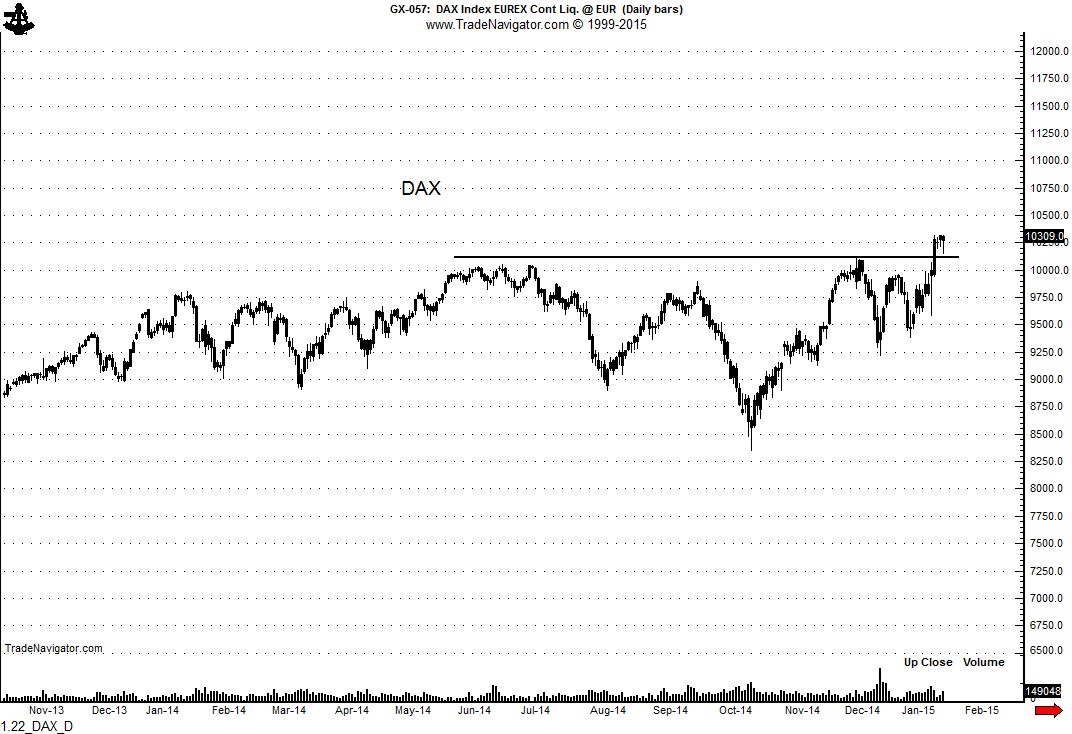

The remaining stock index charts below are presented with just two comments. The first is that the patterns shown in some cases must become completed for a bull case to exist. The second is that many of these indexes could advance simply due to currency devaluations. For example, the DAX is advancing largely due to the decline in the euro.

The wonderful thing about trading these indexes (STOXX 600, MSCI Singapore, FTSE 100, Hang Seng, Nifty 50, DAX) via futures is that the currency exposure is limited only to the margin requirement.

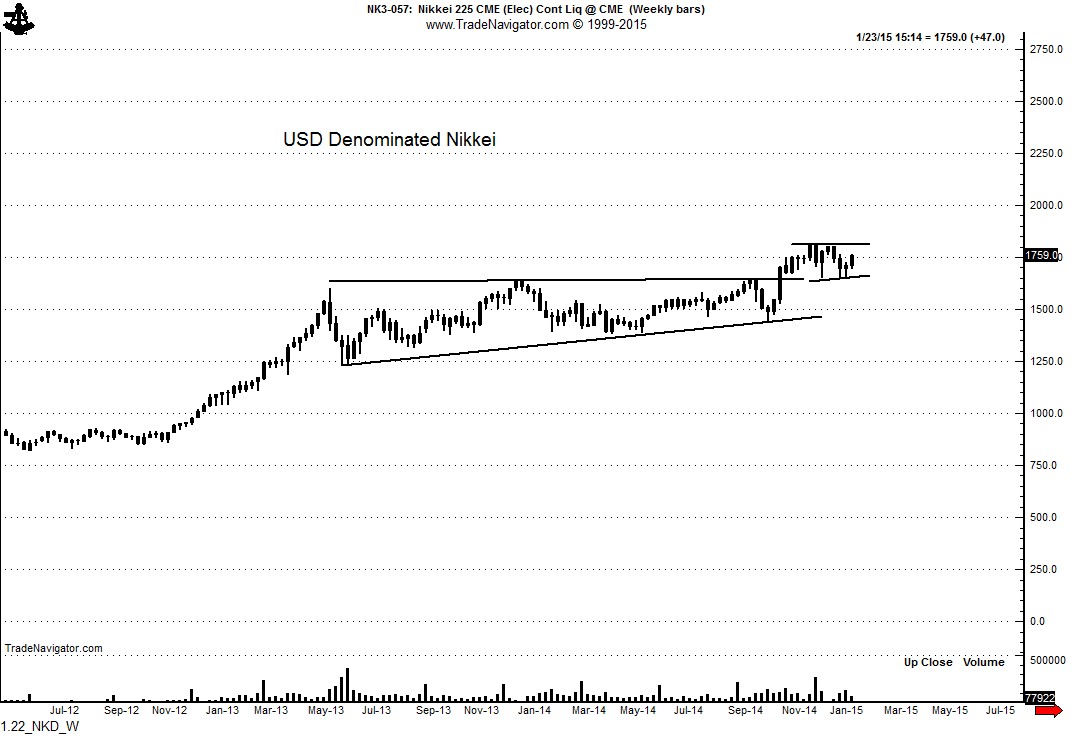

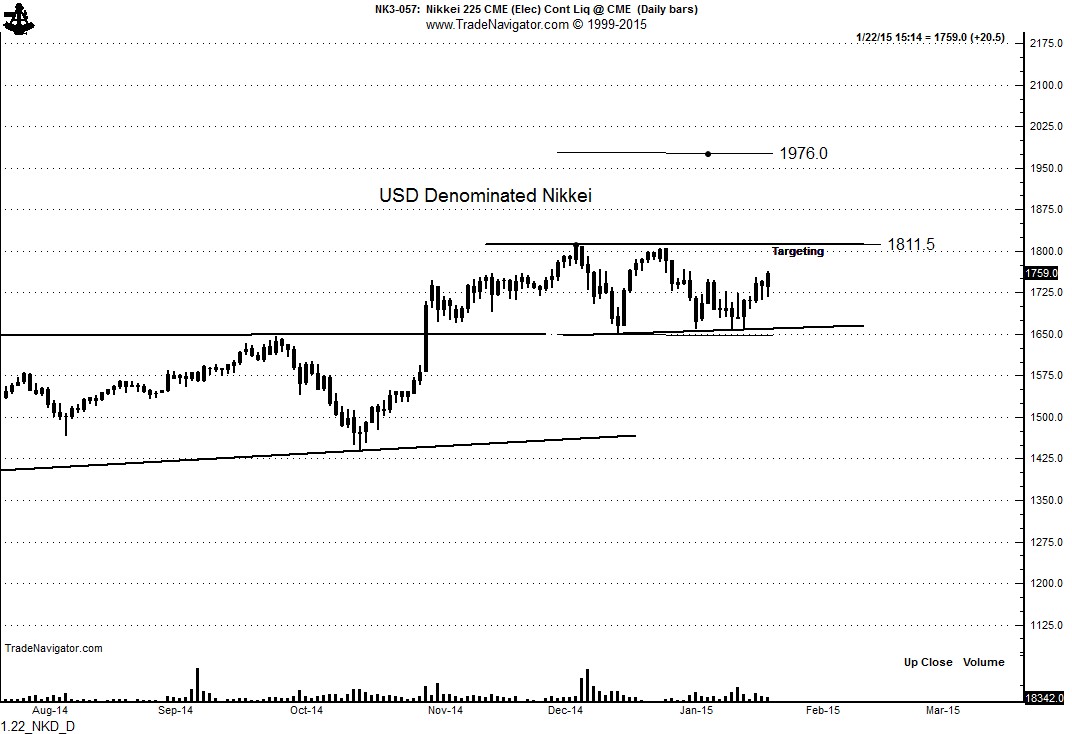

A stock index not subject to home-currency devaluation against the USD is the USD Denominated Nikkei traded at the CME. This index is forming a tight ascending triangle on the daily graph that should produce the next advancing leg in the Japanese market. The weekly and daily charts are shown:

By way of commentary, I believe the upside advance in global markets, if it occurs, will be the final bubble to the bull trend that began in 2008.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.