Despite identifying their lows reasonably well, forecasting accelerations in the PMs has repeatedly proved unsuccessful. That did not affect identifying the August lows in the stock market with precision, however.

Today, whether looking at PMs, 10-year bonds or the Dow, intermediate-term patterns and indicators suggest turning points in the offing.

The PMs' momentum indicators are diverging bullishly, including a divergence between the silver premiums (VXSLV) and Silver, a phenomenon that prior articles have covered.

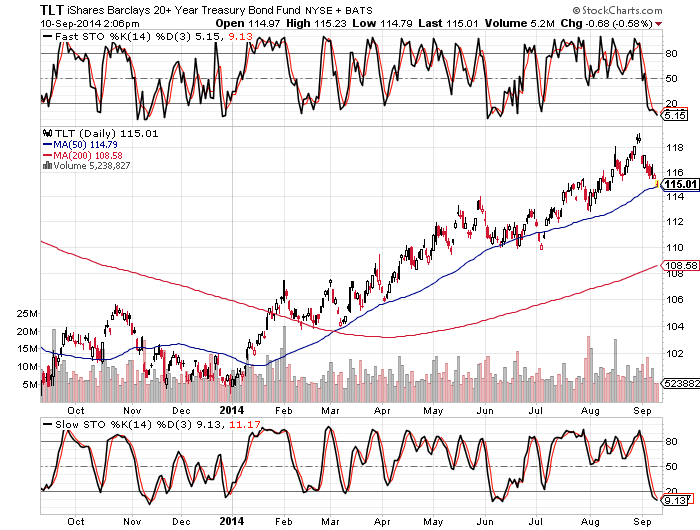

While its 50-day MA is being hit, stochastics are oversold and apparently attempting to turn positive in the 10-year bonds as well.

The PMs and (ARCA:TLT) together suggest an imminent return to 'fear' trading.

Therefore, entirely consistent with the preceding, the Dow is rolling over, including its own non-confirmations among my preferred and historically reliable momentum indicators (above).

Regarding the world's most popular gauge of global sentiment toward the health of the economy, the Dow, its sell point must be taken VERY seriously, since, as I have previously discussed, the best way to probe a major long-term top is to short an intermediate-term peak.

The global picture suggests a low-risk entry probe into the fear strategies discussed in these pages.

A long term combination of diagonal Dow put spreads and puts are appropriate for most who wish to seek high reward/risk strategies at this logical entry point, since the present peak, which includes a bullishly divergent VIX and very cheap premiums that are further lowered by the long-term spread component contemplated by the here-preferred strategic approach.

Most of all, with my favoured silver momentum indicators readying to cross into bullish territory (which, given ANY positive action, is where they could find themselves this week), the most critically strategic and leveraged risk-adjusted opportunities are found in 2 to 3-year silver warrants that are exercisable into vaulted silver; for well-healed accounts, this actually exists.

Further, notwithstanding today's disgust with the PMs, silver's technical picture, including its Wave-count, suggests an acceleration of off lows as entirely possible....at anytime (VXSLV, SLV charts above).

Warrants exercisable into vaulted silver merits immediate attention, which is demanded both by silver's deeply undervalued fundamentals, as well as its bottoming technicals. The latter includes the cheap and divergent premiums (VXSLV) discussed above.

Therefore, fundamental and technical indicators, including the global picture painted above are entirely supportive of immediate attention and action into high reward/risk silver strategies at this time.