Energy infrastructure provider Magellan Midstream Partners, L.P. (NYSE:MMP) recently announced that it is initiating a pipeline construction to carry crude oil and condensate in the Delaware Basin.

Project Details

The 60-mile pipeline will start from Wink, TX and carry oil to Crane, TX. The project is expected to cost around $150 million. Per the partnership, the initial capacity of the new 24-inch wide pipeline will be around 250,000 barrels per day (B/D). The company will expand the oil carrying capacity to more than 600,000 B/D, provided the demand for crude oil and condensate shots up. The pipeline is scheduled to be operational by mid-2019.

The partnership intends to conduct an open season to look for interested takers among the transporters for this new pipeline. Magellan Midstream assures that results of this open season trial will no way affect the pipeline building work.

Project Purpose

The project will work as a source to Magellan Midstream’s Longhorn pipeline that connects Houston with Texas City refining complex and marine export facilities. This latest addition to the pipeline system of Magellan Midstream will also help the oil-producers in the Delaware Basin reach the Port of Corpus Christi.

Apart from the Delaware Basin pipeline, the partnership will build a new terminal at Wink with the purpose to facilitate clients.

Magellan Midstream’s Benefit

The new pipeline will add positive attributes to the partnership’s solid fee-based pipeline and terminal services. We remind investors that the partnership reported revenues of $619.4 million, outpacing the Zacks Consensus Estimate of $561 million in the second quarter of 2017, thus projecting strength in its fee-based services.

In other news, Magellan Midstream has agreed in constructing a 135-mile, 16-inch wide pipeline from Houston to Hearne, TX with Valero Energy Corporation (NYSE:VLO) , a San Antonio, TX-based downstream oil company. The construction of the pipeline — expected to cost $380 million — will be completed by mid-2019.

About the Partnership

Tulsa, OK-based Magellan Midstream is a master limited partnership (MLP) that owns and operates a diversified portfolio of energy infrastructure assets. The partnership primarily transports, stores and distributes refined petroleum products and ammonia to some extent. Magellan Midstream functions in three segments namely Refined Products, Crude Oil and Marine Storage.

Magellan Midstream boasts an excellent earnings history when it comes to beating estimates. Investors should note that the partnership hasn’t missed earnings estimates since end-2015.

However, Magellan Midstream’s non-fee based assets continue to buckle under pressure due to weak crude prices. This may put onus on the earnings and revenues for the firm.

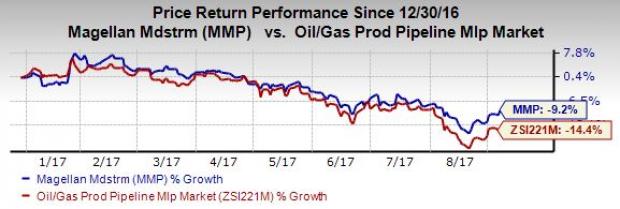

Price Performance

Magellan Midstream has outperformed the broader industry year to date. The stock has lost 9.2% of its value compared with the 14.4% fall of its industry during the period.

Zacks Rank and Stocks to Consider

Magellan Midstream currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the oil and energy sector are Lonestar Resources US Inc. (NASDAQ:LONE) and Range Resources Corporation (NYSE:RRC) , each stock sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lonestar Resources’ sales for 2017 are expected to surge 60.2% year over year. The company delivered a positive earnings surprise of 62.5% in the second quarter of 2017.

Range Resources’ sales for the third quarter of 2017 are expected to increase 27% year over year. The company delivered an average positive earnings surprise of 51.8% in the last four quarters.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Magellan Midstream Partners L.P. (MMP): Free Stock Analysis Report

Valero Energy Corporation (VLO): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Lonestar Resources US Inc. (LONE): Free Stock Analysis Report

Original post