Energy infrastructure provider, Magellan Midstream Partners, L.P. (NYSE:MMP) recently reported a gasoline leak of 10,988 barrels or more than 461,000 gallons at its Galena Park terminal near Houston, TX caused by Harvey. The leakage from two gasoline storage tanks above ground is the biggest reported spill in the region caused by the storm.

While Magellan Midstream believes the devastating flood caused the spill, it is still looking for the exact reason. The amount of the spill rapidly increased from the partnership's first estimate of 1,000 barrels by 10 times. The spilled fuel reached the waterway near the ship channel, which is a heavily industrialized area with dozens of petrochemical facilities. Some of the gasoline escaped into an adjacent ditch.

Due to Harvey, the total amount of fuel leaked in the area– including the one from Magellan Midstream’s terminal – is estimated at 600,000 gallons. Companies that reported such Harvey-stoked leaks in the Houston area include ExxonMobil Corporation (NYSE:XOM) , Valero Energy Corporation (NYSE:VLO) , Kinder Morgan, Inc. (NYSE:KMI) and others.

Risk Factor

Gasoline is known to be more volatile than oil. Hence, following a spill, it dissolves much faster. It penetrates the soil and contaminates groundwater supplies quickly, which can take a toll on the environment of the nearby area and pose health threats.

Steps Taken by Magellan

Magellan Midstream contained some of the spilled gasoline that leaked on Aug 31 by spraying foam. This was done to prevent the gasoline mixture from discharging harmful vapors. The partnership is excavating and restoring the affected soil. The whole operation is being monitored by the environmental agencies as further investigation is on.

The partnership reported that most of its infrastructure was back to normal after the storm. Its refined products pipeline system that originates in East Houston and connects Dallas and West Texas areas has already come online. It has started the truck loading services in the area on a limited basis.

About the Partnership

Tulsa, OK-based Magellan Midstream is a master limited partnership (MLP) that owns and operates a diversified portfolio of energy infrastructure assets. The partnership primarily transports, stores, and distributes refined petroleum products and, to a lesser extent, ammonia. Magellan Midstream conducts its operations in three segments: Refined Products, Crude Oil, and Marine Storage.

Magellan Midstream’s portfolio of energy infrastructure assets helps it to generate stable tariff-based revenues. However, the refined product demand of the partnership is inherently volatile and is subject to complex market forces.

Zacks Rank

The partnership has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

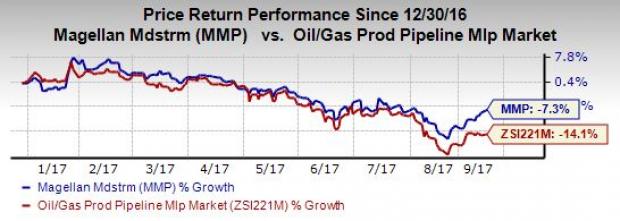

Price Performance

Magellan Midstream has lost 7.3% of its value year to date compared with 14.1% fall of its industry.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Magellan Midstream Partners L.P. (MMP): Free Stock Analysis Report

Valero Energy Corporation (VLO): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Kinder Morgan, Inc. (KMI): Free Stock Analysis Report

Original post

Zacks Investment Research