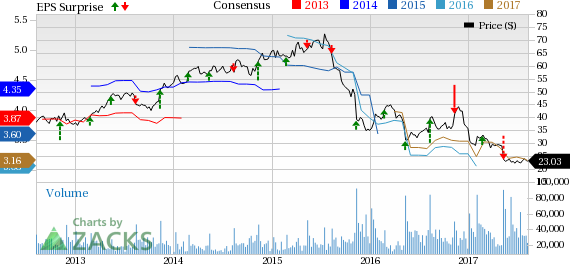

Macy's, Inc. (NYSE:M) , one of the leading department store retailers, came out with second-quarter fiscal 2017 results, wherein adjusted earnings of 48 cents per share surpassed the Zacks Consensus Estimate of 45 cents but declined 11.4% from 54 cents per share delivered in the year-ago quarter.

Management reiterated fiscal 2017 guidance. For fiscal 2017, management continues to anticipate earnings in the band of $2.90- $3.15 per share.

Estimate Revision: The Zacks Consensus Estimate for fiscal 2017 has been stable over the past 30 days. If we look at the Macy's performance in the trailing four quarters (excluding the quarter under review), the company has missed the Zacks Consensus Estimate by an average of 12.9%.

Revenues: Macy's generated net sales of $5,552 million that declined 5.4% year over year but outpaced the Zacks Consensus Estimate of $5,501 million. Comparable sales on an owned plus licensed basis declined 2.5% while on an owned basis, comparable sales fell 2.8%.

Macy’s continues to project comps on an owned plus licensed basis to decrease in the band of 2–3% during fiscal 2017. On an owned basis, comps are expected to decline between 2.2% and 3.3%. Management envisions total sales to decline in the band of 3.2–4.3% in fiscal 2017.

Zacks Rank: Currently, Macy's carries a Zacks Rank #3 (Hold) which is subject to change following the earnings announcement. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Macy’s shares are down nearly 2% during pre-market trading hours following the earnings release.

Check back later for our full write up on Macy's earnings report!

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Macy's Inc (M): Free Stock Analysis Report

Original post

Zacks Investment Research