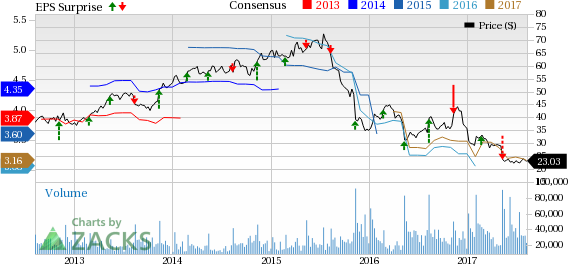

After witnessing negative earnings surprise in the first quarter of fiscal 2017, Macy’s, Inc. (NYSE:M) posted earnings beat of 6.7% in the second quarter. Total sales also came ahead of the estimate after missing the same in the preceding two quarters. However, we observed that the company’s top and bottom lines continued to decline year over year. The stock is down roughly 1.7% during pre-market trading hours.

In fact in the past six months, Macy’s shares have nosedived roughly 29.3% compared with the industry’s decline of 15%. Analysts pointed that the overall industry is grappling with waning mall traffic and increased online competition.

Let’s Delve Deep

Macy’s posted adjusted earnings of 48 cents a share that beat the Zacks Consensus Estimate of 45 cents but declined substantially from 54 cents reported in the year-ago period. This Cincinnati, OH-based company generated net sales of $5,552 million that came ahead of the Zacks Consensus Estimate of $5,501 million but decreased 5.4% year over year. Comparable sales (comps) on an owned plus licensed basis dipped 2.5%, while on an owned basis comps fell 2.8%.

.jpg)

In an attempt to augment sales, profitability and cash flows, the company has been taking steps such as cost cutting, integration of operations as well as developing its eCommerce business and Macy’s Backstage off-price business, along with the expansion of Bluemercury and online order fulfillment centers. Moreover, as a part of store rationalization program, the company plans to shut down underperforming stores. These are seen as a part of the company’s endeavors to better withstand competitive pressure from both brick-and-mortar discount stores and online retailers, such as Amazon.com, Inc. (NASDAQ:AMZN).

Coming back to results, gross profit in the quarter declined 6.6% year over year to $2,239 million, whereas gross margin contracted 60 basis points to 40.3%. Operating income plunged 18% to $305 million, while adjusted operating margin shriveled 90 basis points to 5.5%.

Store Update

During the quarter under review, the company opened 16 new freestanding Bluemercury beauty specialty outlets and 12 new Macy’s Backstage off-price stores within existing Macy’s stores. The company shuttered two Macy’s stores in Temple, TX, and Dublin, OH. The company also plans to close the Macy’s store at Magic Valley Mall in Twin Falls, ID, in early 2018.

Other Financial Aspects

Macy’s, which carries a Zacks Rank #3 (Hold), ended the quarter with cash and cash equivalents of $783 million, long-term debt of $6,301 million, and shareholders’ equity of $4,388 million, excluding non-controlling interest of $5 million. During the first half of 2017, the company bought back about $247 million face value of senior notes and debentures at a total cost of approximately $257 million.

Guidance

Management reiterated its fiscal 2017 guidance. Macy’s continues to project comps on an owned plus licensed basis to decrease in the band of 2–3%. On an owned basis, comps are expected to decline between 2.2% and 3.3%. Management envisions total sales to decline in the range of 3.2–4.3% in the fiscal year. The company maintained its adjusted earnings guidance of $2.90 to $3.15 per share for fiscal 2017.

Interested in Retail? Check these 3 Trending Picks

J.C. Penney Company, Inc. (NYSE:JCP) with a long-term EPS growth rate of 16% has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Build-A-Bear Workshop Inc. (NYSE:BBW) , also carrying a Zacks Rank #2 (Buy), has long-term EPS growth rate of 22.5%,

Five Below Inc. (NASDAQ:FIVE) , with a long-term EPS growth rate of 28.5%, flaunts a Zacks Rank #2.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Build-A-Bear Workshop, Inc. (BBW): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

J.C. Penney Company, Inc. Holding Company (JCP): Free Stock Analysis Report

Original post

Zacks Investment Research