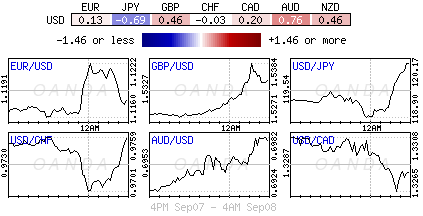

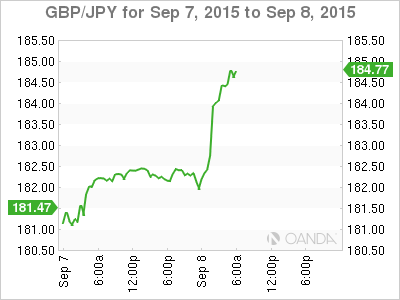

M&A news has led to short sterling positions being squeezed. The pound has rallied for a second consecutive day, pulling away from last Friday’s four-month low outright (£1.5163), supported by improved risk sentiment in global markets and on the news that a Japanese insurer was buying a British company (Sumitomo Mitsui Insurance (NYSE:SMFG) said it had agreed to buy British insurer Amlin (LONDON:AML) in a cash deal – £3.46b). GBP/JPY is up +1.25% in the overnight session to £184.82.

Last week, a slew of disappointing UK data added to doubts over whether the Bank of England (BoE) would be able to raise interest rates any time soon especially given the worries over market volatility and global growth. Governor Carney has stated that a slowdown in China’s economy did not, for now, change the bank’s position on when and how it might raise rates (MPC rate announcement Thursday September 10). Money markets are currently pricing in a BoE rate hike in early Q2 2016. Expect the pound to remain vulnerable as investors seek some positive clues from the Governor on timing.

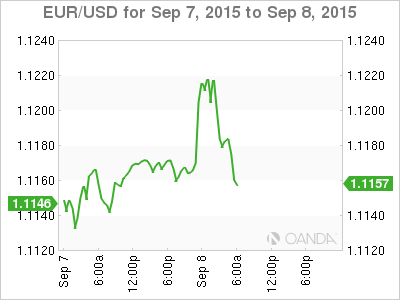

Investors continue to digest last Friday’s US payroll report in terms of Fed rate liftoff. Overall, the report was disappointing (+173k and +5.1%), but monthly backward revisions have kept a September Fed rate hike a distinct possibility. The million-dollar question is how much weight Ms. Yellen and company place on financial market stability and overseas growth.

The US dollar gained almost +10% in Q1 as investors prepared for a Fed “lift-off” of interest rates. But the reserve currency of choice has struggled since April on market fears over Greece and then China. Global growth concerns have reduced investor’s expectations that the Fed will begin their normalization policy as early as next week (September 16-17).

Global growth fears has the euro remaining better bid starting the week (€1.170). Overnight data revealed that China’s imports tumbled again last month, the tenth consecutive drop, adding to concerns about the health of the world’s second-biggest economy and the implications for other emerging markets and the rest of the globe.

China trade surplus has again topped consensus ($60.5b), but the internal components remain on the weak side. The exports decline of -5.5% was worse than the expected -5%, while the imports component decline was more than double than anticipated. The trade data certainly provides a negative signal, not just for China, but also for the broader global trade picture – another excuse for the Fed to stand pat.

Despite global growth issues, euro equities have opened in the black on renewed optimism of state support in China. The DAX is also being supported by record trade surplus from Germany (+€22.8b) and on Q2 euro preliminary GDP beating expectations (+0.4% vs. +0.3%e m/m or +1.5% vs. +1.2%e y/y). Small risk has bond yields temporarily backing up.

Central bank monetary policy and rate differentials continue to dominate market currency positioning. The yen outright is opening under pressure this morning in this shortened trading week, trading back above the psychological $120 handle ($120.15), as growing downside risks to Japan’s growth and inflation outlook gathers some momentum. Perhaps the market is looking for additional easing measure from the central bank? The Bank of Japan (BoJ) meets next week on September 15 just ahead of the FOMC announcement.

Commodity and interest rate sensitive currencies, like the CAD ($1.3270) and NOK ($8.2765), remain hyper sensitive to crude prices (WTI $45.15). The IEA Chief economist has indicated that oil prices are to remain low for now, barring any new geopolitical events. The Bank of Canada (BoC) rate decision tomorrow, Wednesday September 8, is not expected to dominate currency positioning. Money markets are pricing in no rate change, but Governor Poloz could sound a tad more dovish.

From a fundamental perspective it’s a light week stateside. Tomorrow will see the JOLTS report where job openings, like most other employment readings, have been soft. Thursday’s highlight will be import and export prices, which, due to oil and commodity prices, are expected to show deepening rates of contraction.