LyondellBasell (NYSE:LYB) said that Shandong Shougang Luqing Co., Ltd, has chosen its industry-leading Hostalen Advanced Cascade Process (ACP) polyethylene technology for a 350 KTA high density polyethylene (HDPE) unit to be constructed in the latter’s petrochemical complex, at Bohai Industry Park, Shouguang, Shandong Province, China.

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

LyondellBasell Industries NV (LYB): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Original post

Zacks Investment Research

This technology is known for increasing the flexibility and versatility in multimodal HDPE resins production compared to other HDPE technologies. These multi-modal HDPE resins have higher toughness balance and impact resistance. Also, they boast high stress cracking resistance and other processing advantages that make them valuable in film, blow molding and pipe applications.

Apart from the Hostalen ACP process, LyondellBasell’s portfolio of licensed polyolefin technologies and associated technical services includes Spheripol, Spherizone, Metocene PP, Lupotech and Spherilene.

LyondellBasell has underperformed the industry over the last six months. The company's shares have lost 3.8% during the period against the industry’s 3.1% gain.

LyondellBasell’s adjusted earnings came in at $2.82 per share for second-quarter 2017, beating the Zacks Consensus Estimate of $2.71. Revenues rose roughly 14.7% year over year to $8,403 million in the quarter but missed the Zacks Consensus Estimate of $8,670.5 million.

With no major maintenance schedule, the company expects robust performance from its global assets moving forward.

LyondellBasell is undertaking expansion projects to leverage the U.S. natural gas liquids (NGLs) advantage. LyondellBasell's ethylene expansion initiatives are likely to boost the capacity and add to its earnings. It also remains committed to boosting shareholder returns by leveraging healthy cash flows.

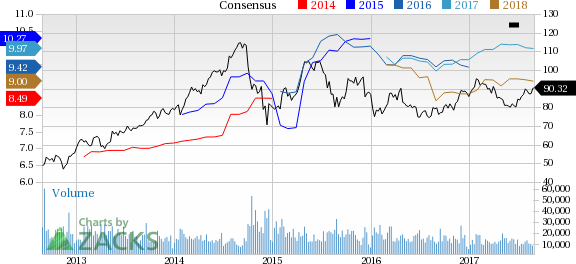

LyondellBasell Industries NV Price and Consensus

LyondellBasell Industries NV Price and Consensus

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

LyondellBasell Industries NV (LYB): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Original post

Zacks Investment Research