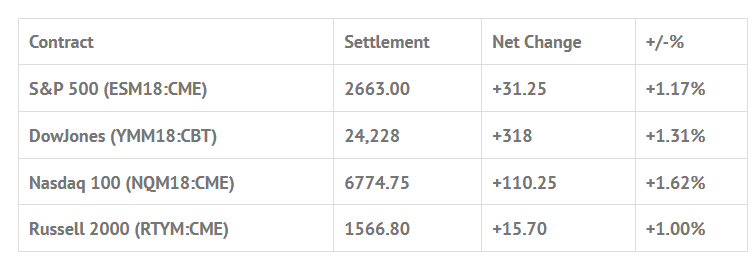

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 5 out of 11 markets closed higher: Shanghai Comp +1.48%, Hang Seng +0.23%, Nikkei -0.03%

- In Europe 12 out of 13 markets are trading higher: CAC +0.03%, DAX +0.48%, FTSE +0.86%

- Fair Value: S&P -2.39, NASDAQ +0.90, Dow -58.41

- Total Volume: 1.67 mil ESM & 913 SPM traded in the pit

Today’s Economic Calendar:

TD Ameritrade IMX 12:30 PM ET, Tom Barkin Speaks 2:00 PM ET, Consumer Credit 3:00 PM ET, Robert Kaplan Speaks 3:30 PM ET, and Charles Evans Speaks 3:30 PM ET.

S&P 500 Futures: Run The Sell Stops / Run The Buy Stops

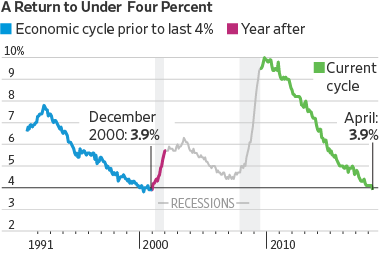

Once the S&P 500 futures pierced its 200 day moving average at 2611.00, the next thing on the platter was Friday’s jobs report, which showed 164,000 new jobs, and a 3.9% jobless rate. After a semi weak Globex session that pushed the futures down to 2614.75, the ES traded 2617.00 on the 8:30 open. The ES then traded down to 2612.25 before rallying all the way up to 2654.50 at 10:35 CT.

The PitBull asked me why the ES rallied so much, and I responded by saying, “it’s all about how the algos run the sell stops, and then run the buy stops.” The S&P has stumbled in recent days, putting major indexes on course for their third straight weekly loss after several disappointing earnings reports, but after an early selloff Friday morning, the futures came ‘flying’ back up.

After a two or three handle pullback, the ES made five new highs in a row. Just after 1:00, it traded up to 2664.00, and after another 2 handle pullback, the buys continued to push the futures to a daily high of 2669.50 at 1:40, up +37.50 handles, and up +78.50 handles from Thursdays 2591.00 low.

The final hour saw the MiM flip from a modest buy side to a modest sell side, as the actual MOC came in at $150 million to sell. There was some profit taking in the final hour, and ES dropped down to 2657.00, a +12.50 handle move, making a low just before the 3:00 close. At 3:00 the futures printed 2661.50, and then continued to rally up to 2664.00, before settling the day at 2663.75 on the 3:15 futures close, up +31.75 handles, or +1.21%.

The ES has now closed down three weeks in a row, but almost got out of the red during Friday’s rally up to the 2669.50 level. Had it closed above 2670.00, it would have closed up on the week. I said I thought higher prices on Friday, and that’s exactly what we got. Will it continue higher? Yes, but it will go back down again once everyone gets too long into the rally.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.