A beautiful new week is upon us. The weather is turning, the snow is behind us and it does seem that at least some of the geopolitical issues that have been rocking the markets lately now have a chance for an easy exit.

At the annual conference in Boao China the weather is 27° Celsius and hopes are high that President Xi Jinping's upcoming address there will be positive. Being drawn into a tit-for-tat trade war with President Trump is clearly not on the globalist statesman's agenda.

For the moment, the trade war has been targeting very small things like specific imports. If things do escalate to the larger munitions, we could easily be looking at a debt war, which could easily dwarf whatever is on the table at the moment.

We are currently at a pivotal moment for global trade. Though I don't know which direction we're about to go, you can bet that there will be plenty of trading opportunities.

Today's Highlights

Green Bounce

Saving DB from Cryan

Soros is now in Crypto

Please note: All data, figures and graphs are valid as of April 9th. All trading carries risk. Only risk capital you're prepared to lose.

Traditional Markets

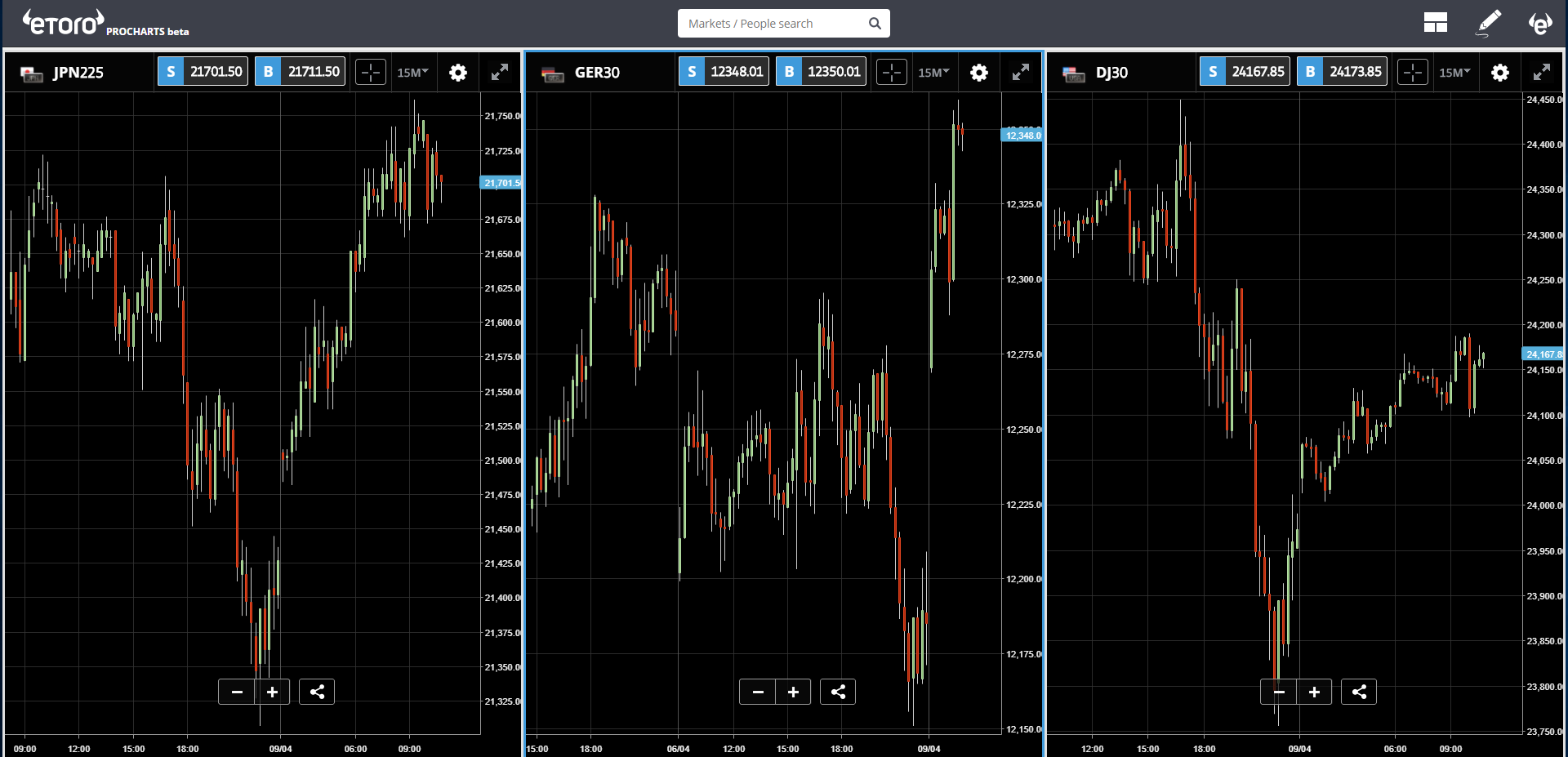

Global stocks took a dive on Friday afternoon after some ramped up protectionist rhetoric from President Trump and ended up closing the week negative. That sentiment has been reversed in Asia and Europe this morning and the losses have mostly been recouped.

We hope that whatever happens in Boao today ends up being productive and de-escalating, but aside from the trade war we also need to take a good look at the physical war happening in the world right now, Syria. Initially, Donald Trump seemed content to cede control to Putin but after the last chemical attack is taking a more proactive stance.

What's interesting is Trump's new National Security Advisor John Bolton, who though in his congressional testimonies said he would simply be carrying out the wishes of the president has a history of extreme rhetoric and has on several occasions advocated pre-emptive strikes on non-capitulating countries like North Korea and Iran.

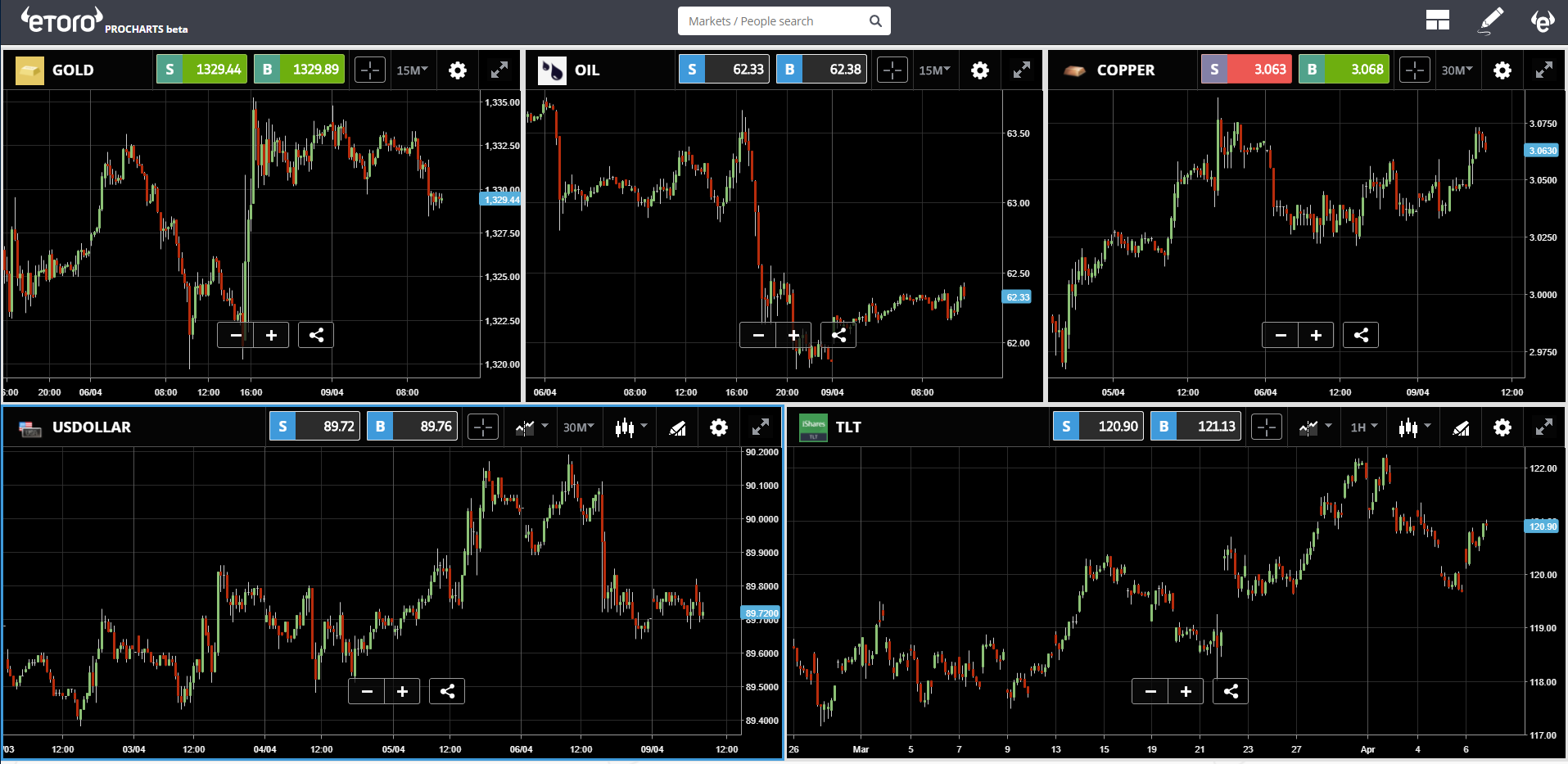

For now, markets are at 'risk on' mode, with stocks bouncing from their lows and commodities dipping down. At this point though, it's tough to tell where the day will end.

Watch also for critical support on Crude oil, which is coming up fast...

Saving Cryan DB

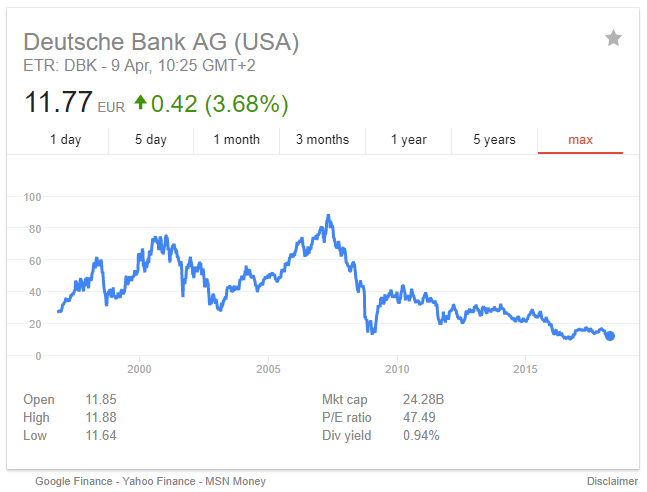

European markets are buzzing this morning with talk of a shakeup over at Deutsche Bank (DE:DBKGn).

John Cryan has been trying hard to save Germany's injured mega-bank but it seems that the board has grown impatient. Replacing Cryan will be Christian Sewing (pronounced: Saving) who's been with DB since he was a teen.

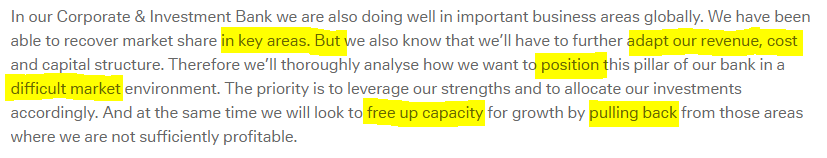

This morning, Sewing has sent a heavy-handed Email to all 98,000 employees that included the following paragraph...

In loose terms, it looks like Sewing is about to hand out some pension packets.

Investors seem to be enjoying the prospect of new management and DB stock is doing great in the pre-market. After all, why not? These shares were trading at $88 in 2007 and are now near all time lows at $11.

Crypto Green Bounce

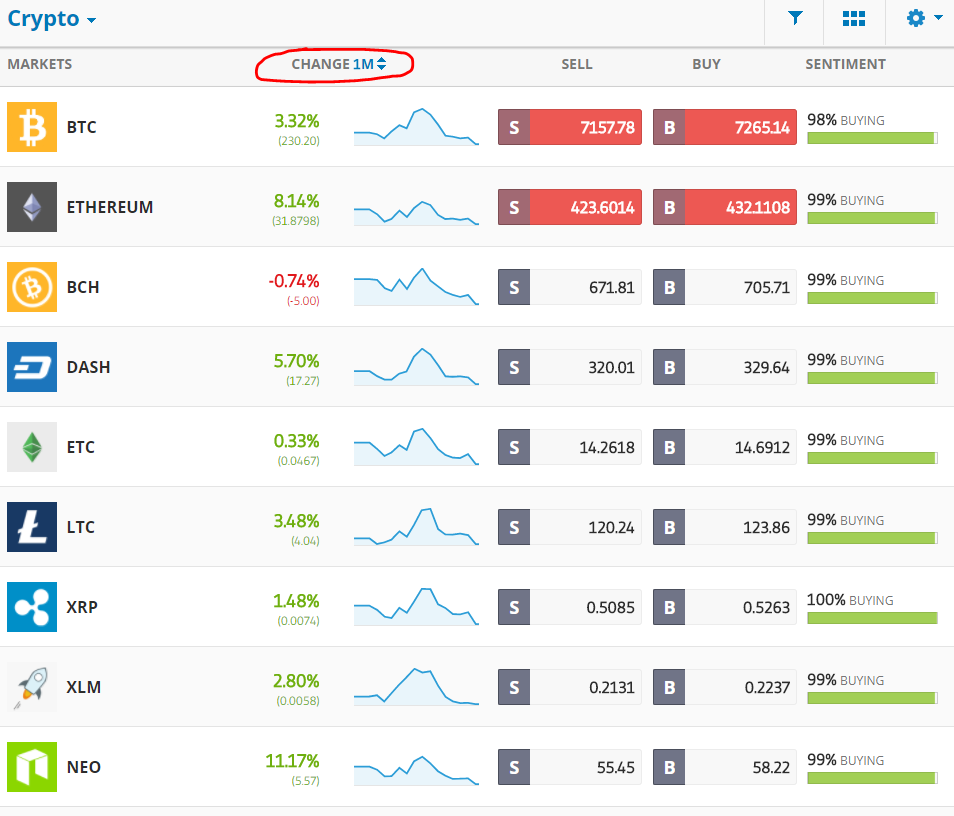

We're also seeing some sustained gains in crypto-land after a bearish period. Sentiment is still neutral but even though the greens are nowhere near November's "orders of magnitude" price shifts, we can see that over the last month most of the top cryptos are in green.

The excitement is drawing in some big names lately. We know that a Goldman Sachs (NYSE:GS) company bought out a huge crypto exchange a few weeks ago, now it looks like George Soros and even the Rockefellers are getting in on the action.

Though direction is still a question, it's clear now that liquidity will soon not be a problem in this industry.

Let's have an amazing day ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.