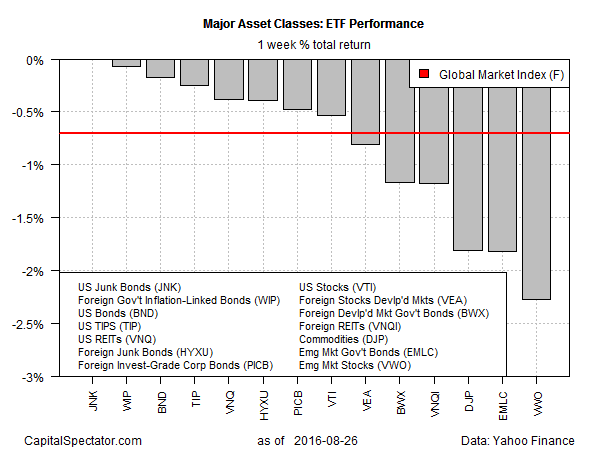

Investment gains were missing in action last week for all the major asset classes, based on a set of broadly defined proxy ETFs. The best performer only managed to hold steady for the five trading days through Aug. 28, with the rest of the field posting varying degrees of loss.

SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK) remained unchanged last week, posting a zero total return–the best performance for the last full week of August. Flatlining looks pretty good vs. the worst performer for the previous week: emerging-market stocks tumbled 2.3% via Vanguard FTSE Emerging Markets (NYSE:VWO). The slide in VWO—the first weekly decline for the fund since early July—was due in part to higher probability estimates for a US rate hike in the near term after moderately hawkish comments from Fed officials last week. Emerging-market assets are widely viewed as vulnerable in periods of rising US rates, which tends to lift the US dollar and create headwinds for so-called developing countries.

The negative tone in last week’s trading took a toll on an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F slipped 0.7%, the first weekly loss for the benchmark in three weeks.

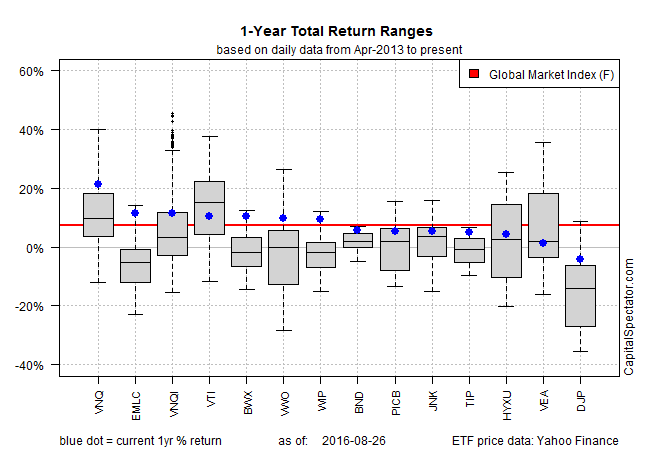

For the trailing one-year results, US real estate investment trusts (REITs) continue to hold the top position. Although Vanguard REIT (NYSE:VNQ) fell last week, the ETF is still in the lead for the major asset classes over the past 12 months with a strong 23.8% total return through Friday.

Meantime, broadly defined commodities remain dead last in the one-year return column. The iPath Bloomberg Commodity (NYSE:DJP) is off 4.3% for the 252 trading days through Aug. 28.

GMI.F, by contrast, continues to hold on to a respectable gain for one-year results. As of last Friday, the benchmark’s total return is a solid 7.4% for the past 12 months.