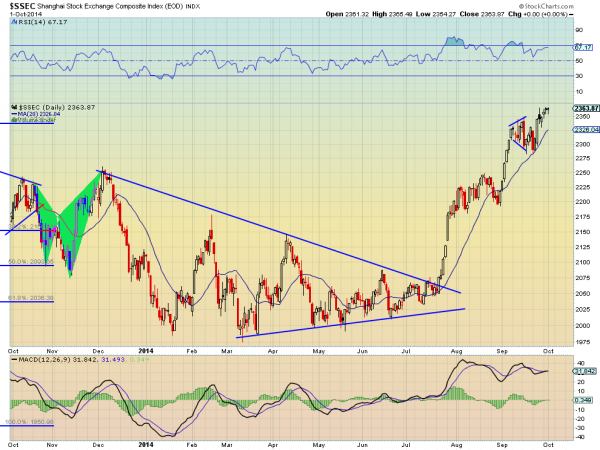

The Shanghai Composite is on holiday for National Day and it deserves it. It has been on fire. Since it broke out of triangle consolidation pattern in late July it is up over 15%. And you saw it coming from the technical view on the chart below. So why are you not winning?

The problem has many answers but the simplest is that you cannot actually buy the Shanghai Composite. You can buy the iShares FTSE/Xinhua China 25 Index (ARCA:FXI) that has some of the biggest (read government sponsored) stocks and that should do you pretty well. But if you bought it on July 23rd, the day the Shanghai Composite broke out, you are not only not up 15%. In fact as of October 1 you have lost money, almost 5%. How can that be? Again there are many factors but it is because the FXI is priced in US Dollars, where the Shanghai Composite is priced in Yuan. So the FXI has been crushed with the strength in the US Dollar over September. You can try to hedge out this risk in the Foreign exchange market but as a retail trader that is unlikely to help you. SO what do you do? Watch.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.