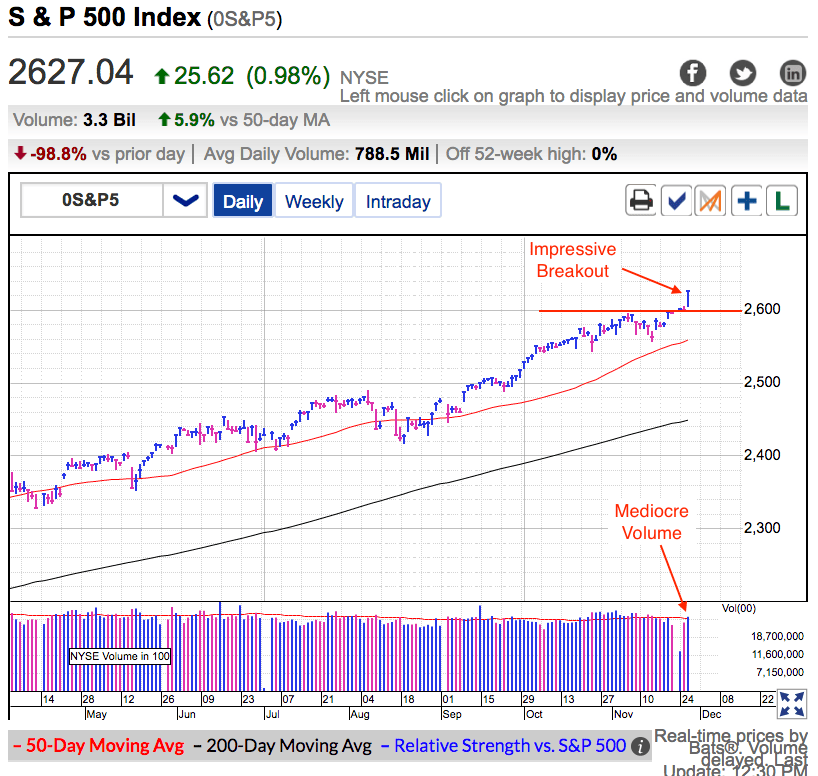

On Tuesday the S&P 500 surged to record highs in the biggest up-day in several months. As strong as the price gains were, volume was barely average. But light trade isn’t a huge surprise since we just returned from the Thanksgiving holiday.

A big chunk of Tuesday’s enthusiasm stemmed from a Senate committee clearing the way for a vote on a revised tax bill. Progress is encouraging and that put traders in a buying mood. These gains were especially significant since this was the first material breakout in months. Previous attempts were met with apathy and momentum fizzled within hours. This time buying lasted all day and even withstood another North Korean missile test.

Tuesday's gains keep this market creeping higher. As I’ve been saying for weeks, if this market was going to crumble, it would have happened by now. Confident owners are keeping supply extremely tight as they refuse to sell any negative headlines or bearish price-action. The resulting tight supply makes it easy for even modest demand to keep pushing prices higher.

Underweight money managers have been patiently waiting for a pullback that is refusing to materialize. With year-end just weeks away, many of these managers are being pressured to chase prices higher or else they risk looking foolish when they report to their investors. Their desperate buying will likely keep a bid under this market and keep pushing us higher in the final weeks of the year.

Even though the path of least resistance is clearly higher, this is still a risky place to be adding new positions. Risk is a function of height, making this the riskiest time in months to be adding new money. Confident owners are demanding premium prices and that leaves new buyers with little margin for error. Even though Tax Reform is making progress through Congress, politics is an ugly process and without a doubt there will be bumps and roadblocks along the way. These near-term gyrations will give recent buyers heartburn when prices dip under their buy-points.

2017 has most definitely been a buy-and-hold year. The largest dips barely registered more than a few percent. This lack of volatility has made it a very challenging year for traders. But that is just the way this goes. Traders do well in sideways and down years, investors do well in steady climbs higher. This is why everyone should diversify their market exposure across both short-term trading and long-term investments. One will do well when the other is struggling.

While this has been a great year for buy-and-hold, chances are volatility will return in 2018. Just when the crowd gets used to the market’s mood, it changes. Once tax reform passes, the market’s attention will shift to whatever comes next. Given all the good news that has been priced in over the last 12 months, it is inevitable we will come across something that doesn’t go as well as expected. Markets go up and markets go down, that’s what they do. The higher we go over the near-term, the closer we get to the top. Remember, markets top when the outlook is the most bullish. I’m not predicting anything imminent, but I’m certain 2018 won’t be as easy for investors as 2017.