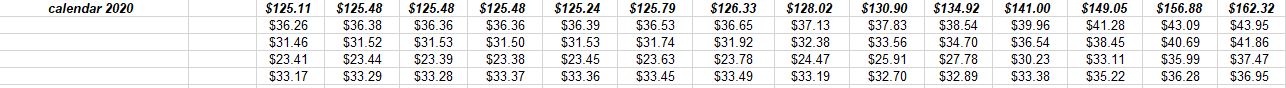

Ed Yardeni made a nice call on expected calendar 2020 S&P 500 EPS, estimating $120-$125, and sure enough the IBES by Refinitiv data has settled in right around $125 for the full 12-months of 2020.

The most recent data is bottom-up estimates from IBES by Refinitiv, with the first column being the week of June 26th, and the last column being the week of March 31 ’20.

Looking at Q1 ’20 S&P 500 revenue by sector:

Here’s a ranking of S&P 500 sectors from strongest to weakest y/y revenue growth (with 499 of 500 S&P 500 components having reported Q1 ’20 results, assume these numbers won’t change much):

- Health Care: +10.3%

- Cons Spls: +5.7%

- Real Estate: +5.5%

- Comm Services: +5.1%

- Technology: +3.8%

- Basic Materials: -0.6%

- Cons Disc: -1.5%

- Industrials: -6.2%

- Utilities: -6.2%

- Energy: -11%

- Financials: -19.8%

- S&P 500: -1.3%

Expected Q2 ’20 revenue growth:

- Health Care: +1.1%

- Utilities: +0.8%

- Technology: -1.1%

- Cons Spls: -2.2%

- Comm Services: -7.1%

- Financials: -7.3%

- Real Estate: -7.7%

- Basic Mat: -15.6%

- Cons Disc: -19.1%

- Industrials: -27.5%

- Energy: -43.6%

- S&P 500: -11.9%

Source: IBES by Refinitiv “This Week in Earnings” June 26, 2020

The 4 sectors that jump out right away (probably because they are the largest sectors within the S&P 500) are Technology, Health Care,Communication Services, and Financials. Consumer Discretionary and the Financial sector are both the same size at 10% each of the S&P 500 market cap, having both gotten drubbed from the Covid-19 pandemic.

Health Care sector revenue expectations are very subdued for Q2 ’20 – note the sharp drop from Q1 2’0 actual’s results. Part of that could be hospitals and the shutting of elective surgeries during Covid-19 sheltering. Merck’s Q1 ’20 results and Q2 ’20 guidance were greatly impacted bu hospitals seeing lower demand for Merck (NYSE:MRK) drugs and other products thanks to capacity constraints, even though Keytruda had a strong quarter in Q1 ’20. A reasonable expectation (and it’s just an opinion) is that Health Care as a sector will probably see at least mid-single-digit revenue growth before the quarter is over.

The Financial sector is “expected” to show a material improvement in revenue during Q2 ’20, but the CCAR and bank stress tests have limited dividend and share repurchases for Q3 ’20, so that has greatly impacted the stock prices of the Financial sector, at least temporarily. It surprised me that Q1 ’20 revenue for the Financial sector was down nearly 20%, part of that might be the tough compare from Q1 ’19 which was a great quarter for the capital markets and the US economy after Jay Powell reversed his tightening stance around monetary policy in December, 2018.

Technology sector revenue is within a tighter band for Q1 and Q2 ’20 revenue as Tech was thought to be a Covid-19 beneficiary. Readers will get an early look at what might happen within semiconductor co’s with Micron’s results after the bell on Monday, June 29th, 2020. Micron (NASDAQ:MU) is a DRAM and NAND producer so it’s the DNA of hardware technology (my term) but the company has a broad reach across sectors. Micron’s expected fiscal Q3 ’20 EPS and revenue estimates of $0.77 and $5.3 billion in revenue have risen nicely since their March ’20 report, which at the time for Q3 ’20 was expecting $0.55 on $4.7 billion in revenue.

Communication Services sector revenue is expected to see a 1,200 bp decline in Q2 ’20 not surprising given the ad revenue pressure from Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL), which is 44% of the Communication Services Select Sector SPDR (NYSE:XLC). The announcement just on Friday of Verizon (NYSE:VZ) and a couple of other advertisers pulling ad revenue from Facebook, won’t help that giant’s Q3 and Q4 ’20 revenue. There is always a “me too aspect” to advertisers fleeing controversial athletes or venues, as we saw with Tiger Woods, Lance Armstrong, and now Facebook and possibly Google. The departure is always with great fanfare, and any resumption will likely be very quietly.

Summary / conclusion: After CCAR, the Financial sector could get interesting as there could be decent revenue growth within the sector, which could mean better margins and more capital, but the Financials have been constrained for at least 3-6 more months given the great wisdom of the regulators and the stress tests, and thus—at least the banks and brokers anyway—could be awash with capital and nowhere to go with it. Technology and Health Care are likely to be fine in terms of Q2 ’20 results and guidance, and that is 42% of the S&P 500 by market cap as it stands today.

Take all opinions offered here with a grain of salt and substantial skepticism. Using sell-side consensus estimates is one of the best leading indicators there is (in my opinion), in trying get an edge on stock price direction and fundamental valuation, but in this one-off Covid-19 environment, even analysts could struggle with modeling financials and formulating estimates, given the uncertainty of the economic implications of the virus.

That being said, it is expected that Q2 ’20 will be the bottom for y/y declines in S&P 500 revenue and EPS growth, and that gradual improvement will occur, both late this year and early next year.