- SPX Monitoring purposes: Long SPX on 1/3/22 at 4796.56.

- Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

- Long Term SPX monitor purposes: Neutral

The bottom window is the VIX which is moving sideways; near highs in the market, the VIX will start to rise, and so far, that has not happened here. The next window up is the VVIX/VIX ratio, which is still rising and a bullish short-term sign.

The top window is the VVIX which also can rise before a top is seen in the SPX, and so far, it's trending sideways. Tick close above +400 can also warn a top is near, so the Tick has been closing near the +100 range.

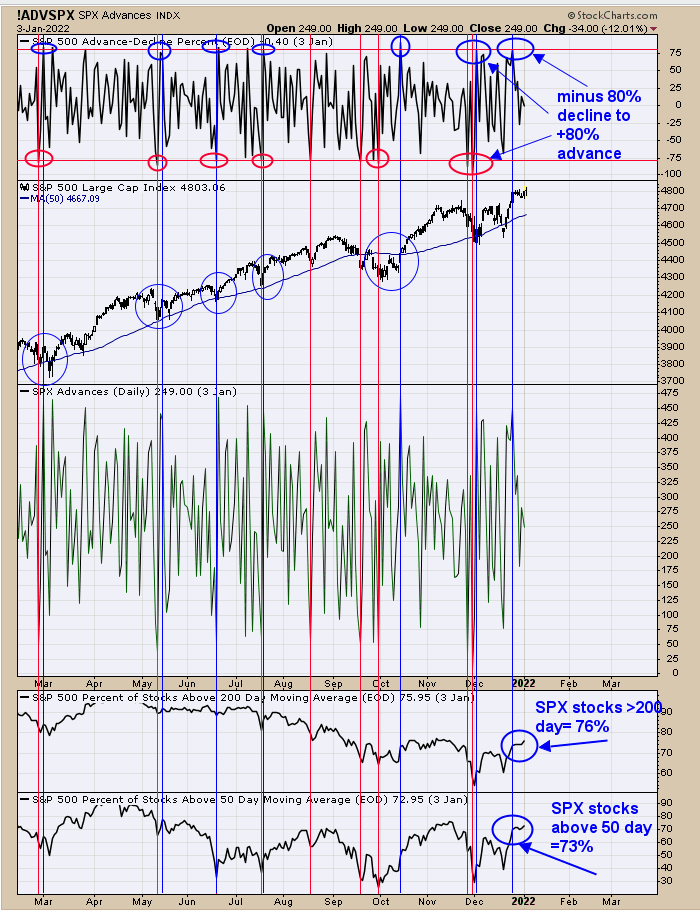

Yesterday we said, “The top window is the SPX 500 Advance-Decline. A selling climax is reached when this indicator reaches -80% (80% of the stocks in the SPX were down that day). Two “Selling Climaxes” were reached going into the early December low (circled in red). To confirm a reversal in the market, a reading of +80% (80% of the stocks in the SPX were up that day) is a sign of strength (SOS). An SOS was recorded on December 2 and 27.

The bottom window is SPX stocks above their 50-day average (which stands at 71%. Readings below 60% can be a significant market is getting into trouble. The next window up is SPX Stocks above the 200-day average (which stands at 74%). Readings below 60% is a sign that the market is in a weakening position. In general, the market looks OK so far.” We want to point out that the bottom window increased today to 73% (up 2% from yesterday), and the next window increased to 76% and up 2% from yesterday. Although the market hasn’t’ moved much, the internals does show modest improvement.

It appears gold is near an important event and the reason we are showing these charts as it unfolds in real-time. Above is the monthly Gold chart going back to 2009. The pattern forming appears to be a very large Head and Shoulders bottom, and the Neckline lies near 2000. One Should see a “Sign of Strength” through the 2000 neckline to confirm this large Head and Shoulders bottom. There is also a Head and Shoulders bottom pattern forming on the Right Shoulder with its Neckline near the 1850 range, which also should see a “Sign of Strength” to confirm that smaller Head and Shoulders pattern.

The bottom window is the monthly GLD with its Bollinger Bands, and notice that there are pinching, suggesting the year and a half of consolidation is near an end and an impulse wave is about to begin.

Monthly Slow Stochastic has turned up, suggesting the move up has started. Sometimes at the beginning of these big moves, a “Shakeout” is performed before the move actually begins, and that could happen here. “Shakeout” or no “Shakeout” the rally in gold appears to have started.”