Nearly every corner of global markets has rebounded sharply since the coronavirus crash pulled the rug out of asset prices in March.

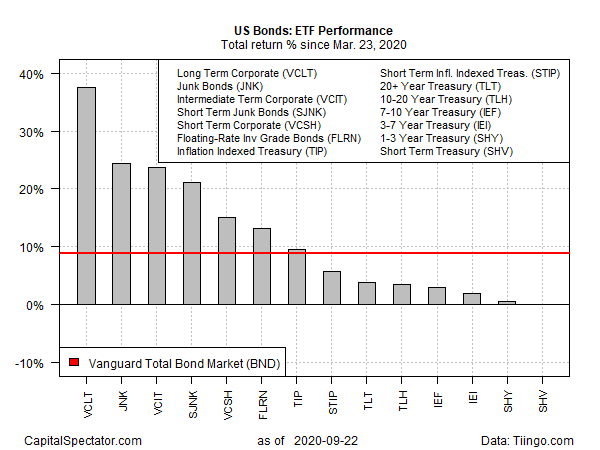

The US bond market is no exception, which has enjoyed a strong rally. Leading the way higher within the fixed-income realm by a wide margin: long-term corporate bonds, based on a set of exchange-traded funds.

Using the Mar. 23 bottom in US stocks (S&P 500) as a general trough date, Vanguard Long-Term Corporate Bond VCLT has dominated the bounce in fixed income. The ETF is up 37.5% since Mar. 23—far ahead of the rest of the field.

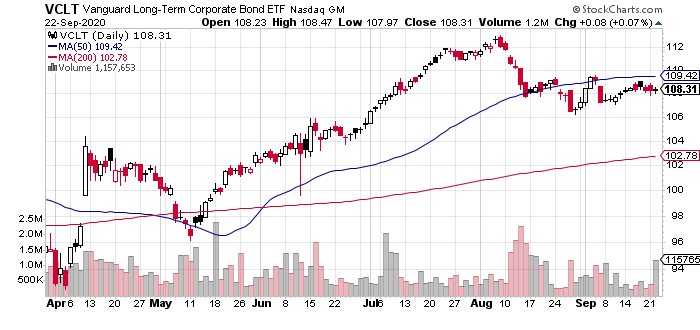

Although VCLT is holding on to its post-crash lead, the fund has been stuck in a trading range since mid-August.

In what is effectively a second-place tie for returns since Mar. 23: JNK and intermediate-term corporates VCIT, which are up roughly 24% since that date.

Various flavors of Treasuries are the weakest performers since the March bottom, although all slices of US fixed-income are currently posting gains from the coronavirus bottom in stocks.

The US investment-grade benchmark is up a solid 8.9%, based on the BND.

The question is whether the bond-market’s bounce has run out of road? Although no one thinks economic and financial conditions have returned to “normal,” the jury’s out on whether a new leg down in interest rates is likely at this point. The benchmark 10-year Treasury yield has been treading water in the 0.62%-0.75% range for much of the past month. Unless rates take another dive lower, the bond market will be hard-pressed to break out of its sideways run of late.

What could trigger a new dive in yields? Renewed fears about a rebound in coronavirus infections and deaths in the fall and winter are on the short list. If investors perceive fresh trouble with Covid-19, the risk-off trade could revive and light another fire for the bond bulls.

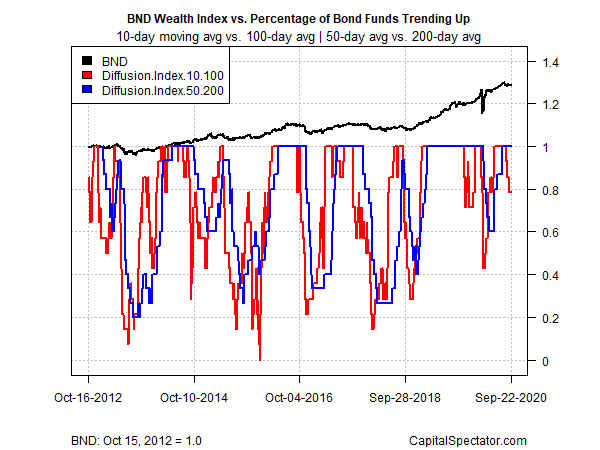

Meantime, bond market action remains a bit of a yawn, although profiling all the ETFs listed above through a momentum lens shows that the market recently reached a trending state of nirvana with all corners enjoying a strong upside bias. But in recent days, a short-term measure of bond-market behavior (based on 10- and 100-day moving averages) has pulled back from the highest-possible bullish reading as several funds stumbled. A medium-term measure of momentum (50- and 200-day moving averages), by contrast, still reflects an upside bias for all the funds listed above.