Long Bond Investing or Longboard Riding… Who is the bigger Daredevil?

While the Equity markets resemble a Yo-Yo for April, global bonds had one clear path. As investors monitor global economic data and inflation trends, some big shifts in Fixed Income bets are occurring. During the month of April, investors lost years of interest income as high quality longer duration securities fell in value. The bumps have startled, but not complete spooked, Equity investors. What is different this time from 1993-1994 is that the yield curve is steepening rather than elevating. Remember back when short-term yields in Europe and the U.S. doubled in 1994 and half of our friends in London lost their Finance jobs? Inflation seems distant right now so the short end could be okay for a while. But if you are sitting on 10yr+ maturity debt, tighten your helmet strap and bend your knees into that next curve.

Great thoughts from Eric Peters on the Global Bond Markets…

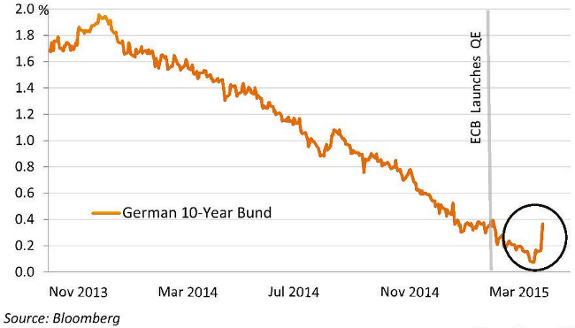

“The idea that you pay governments to hold their debt, it’s just crazy,” said Alan Howard, commanding the world’s largest macro fund. And in a flash, what had once been crazy to deny, became crazy to accept. You see, investors have grown to slavishly believe they should own whatever a central bank is buying. Or short whatever they’re printing. But with $3trln of European bonds trading at negative yields, that Emperor stood uncomfortably, waiting for the cry, “He’s wearing no clothes!” Now, Howard wasn’t the first to state the obvious. Gundlach and Gross had cried the alarm too. But for whatever reason, Howard was the one who turned the crowd’s tide. And will we ever know why it was he and not the others that moved markets? Or will we know whether it was he at all? Or simply coincidence? Of course not. Which is the most remarkable aspect of this crazy business; no one ever really knows why anything happens, even after it’s happened. 10-year bund yields surged 22bps on the week to 0.37%. Prices fell -2.04%, losing most of their gains since the Jan 22 ECB announcement that they’ll purchase E1.1trln worth. U.S. 10-year yields surged as well; ending the week +20bps at 2.11%. Which is remarkable given that U.S. Q1 GDP printed a pathetic +0.2%, the Fed statement was boringly dovish, and the Atlanta Fed GDPNow forecasted +0.80% Q2 GDP (while consensus predicts +3.25%). Of course, it’s entirely possible that having spent years believing we’re meant to buy bonds because central banks are buying, in a flash we’ve entered a new stage. Where we’re meant to sell bonds precisely because they’re buying. Because for a central bank to buy bonds, they must first print money. Which may be our Emperor. But it’s just crazy

The Bond yield everyone is watching (and others are leveraging short)…

@MxSba: CHART: This week’s bond sell-off has sent the 10-year Bund yield back where it was before the #ECB’s QE launch.

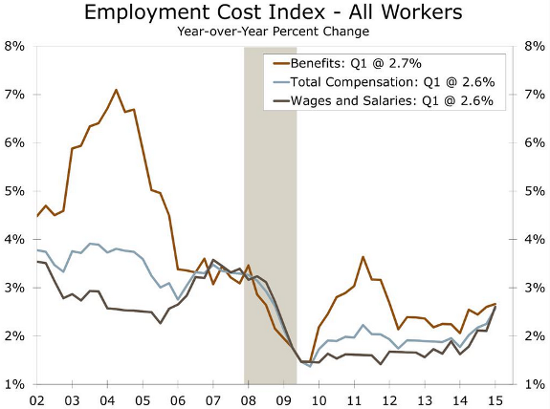

Why all the worries over long maturity Bonds? Wage Pressures are SLOWLY rising…

(@PlanMaestro)

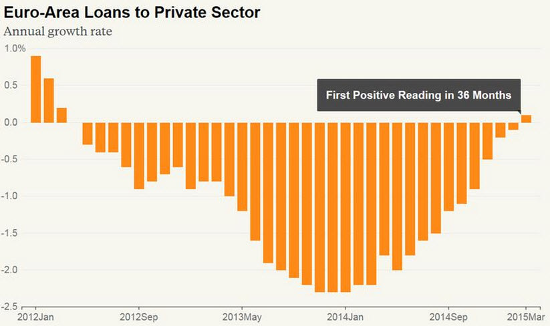

And in Europe, Zero Interest Rates are finding borrowers…

@TheStalwart: Meanwhile, I think this was a pretty significant story this week.

Lending by euro-area banks to companies and households rose for the first time in three years in a sign that record monetary stimulus is finally reaching the economy. Bank lending increased 0.1 percent in March from a year earlier, the ECB said in a statement on Wednesday. Loans had posted annual declines in every month since May 2012. Lending climbed 0.2 percent from February

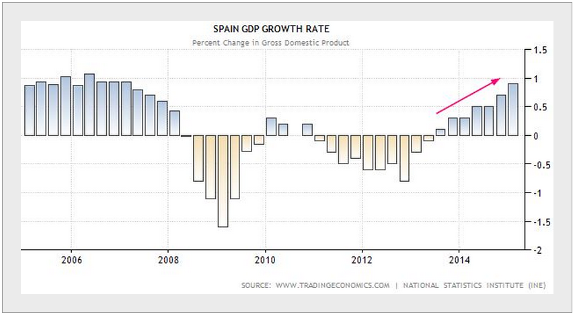

Even Spain is seeing ramping growth…

In looking at the damage to the big U.S. Bond ETF, a couple of important support levels approaching from below…

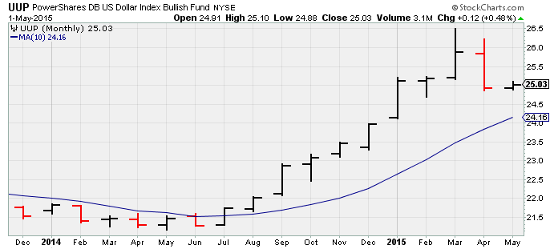

As for the US dollar, the 9 month winning streak has been broken (then stomped and burned)…

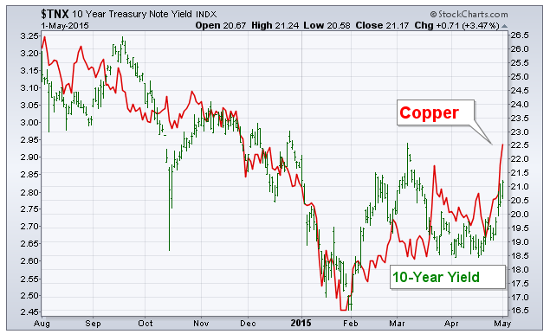

As Bonds and the US$ have fallen, Copper and the Industrial metals have found life…

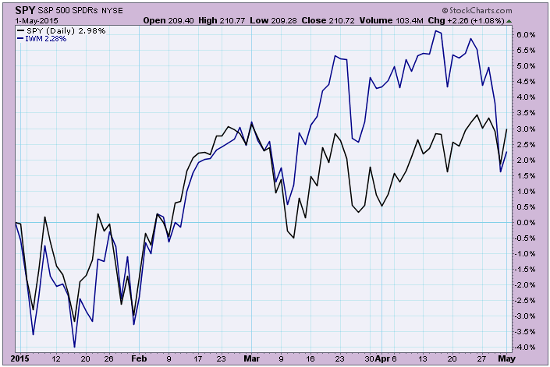

Also getting pounded by the weak US$ has been Small Cap U.S. stocks…

Investors elected to run to Multi-Nationals and Exporters during the end of April possibly betting that the Dollar’s move will continue.

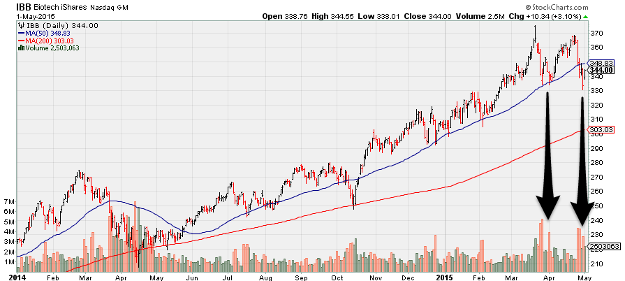

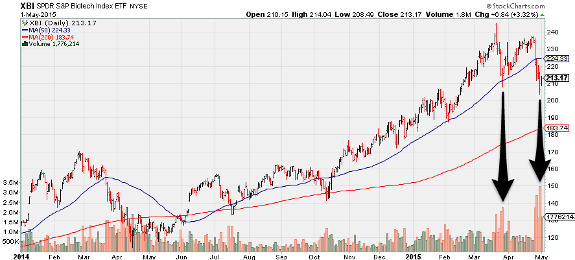

Getting more Sector specific, investors have decided to have a second helping of aggressive Biotech selling for 2015…

The selling shows up even more aggressive in the Small/Mid Cap Biotech index…

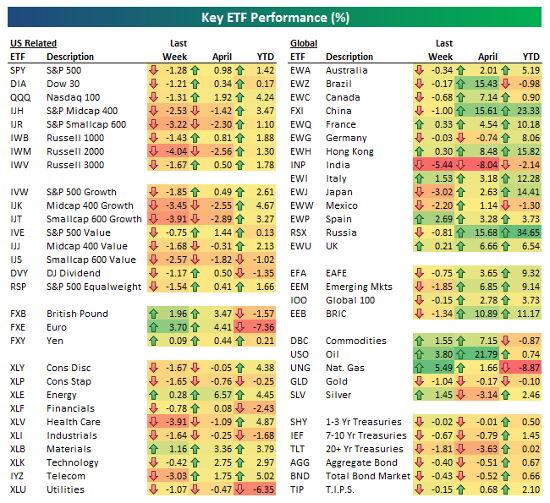

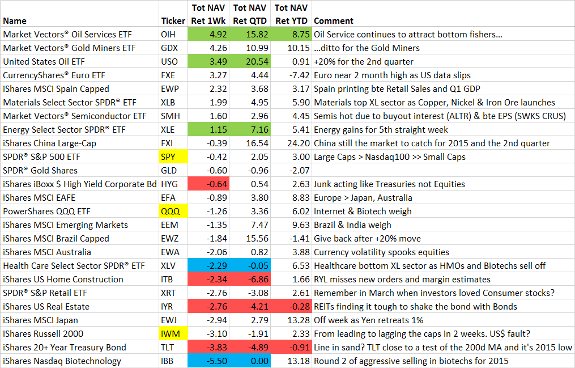

But as April ended with a loud thud for many asset classes, the Emerging Markets put up solid gains…

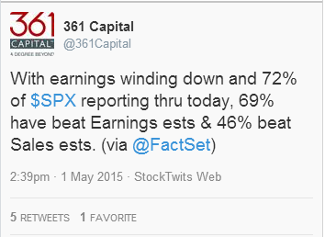

The end of April also brought with it the end of the March earnings reporting season. And it was a good one…

Looking at the heat map for 1 day earnings performance shows many more big winners…

+10% Winners: Netflix (NASDAQ:NFLX), Allegheny Technologies Incorporated (NYSE:ATI), Amazon.com Inc (NASDAQ:AMZN), Hasbro (NASDAQ:HAS), Microsoft Corporation (NASDAQ:MSFT), Genworth Financial (NYSE:GNW), Red Hat (NYSE:RHT). -10% Losers: Wynn Resorts Limited (NASDAQ:WYNN).

(Click the below link to enlarge. A great map. Thanks Finviz.)

A quote from the boss on the single big post earnings loser…

“If you were to ask me… what will the second quarter look like in Las Vegas? Weak. Do you hear me? Weak. So I’m trying to lower expectations here. This notion of a big recovery is a complete dream. I don’t think Las Vegas is experiencing a great recovery. I think it’s still very patchy and I think that that’s probably our non-casino revenue in the first quarter was flat. I’d be thrilled if it was flat in the second quarter.”

Steve Wynn, CEO of Wynn Resorts

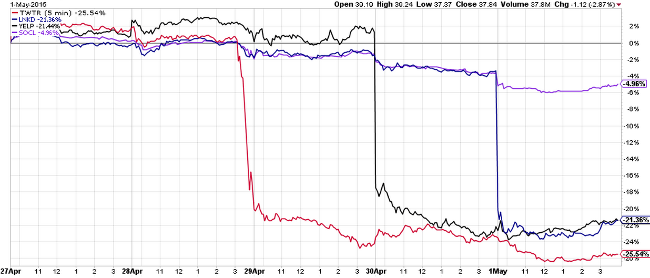

A big win for Indexing last week since Twitter (NYSE:TWTR), LinkedIn (NYSE:LNKD) and Yelp (NYSE:YELP) are not in any major Index, yet started the week at a combined $70b in market cap…

@MktOutperform: Tough week for social media, 20+% declines in $TWTR, $LNKD and $YELP. (NASDAQ:SOCL)

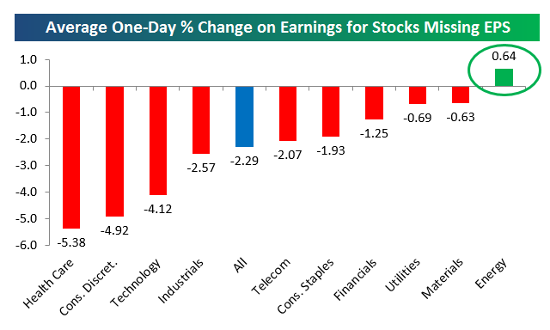

One of the best ways to fill up your research work list is to find stocks that rise on earnings misses…

If a stock doesn’t fall after its poor results, then guidance must be pretty close to the bottom. So if there are few sellers left, you could get rewarded when the company’s expectations begin to rise. We know that Energy company earnings estimates were brutalized for the last 6 months. If oil & gas prices continue to recover, will the next moves be higher? On the flip side, go look through your holdings for companies that crushed earnings and the stocks fell after reporting. Then do some homework on whether or not all the good news and expectations are already in the name.

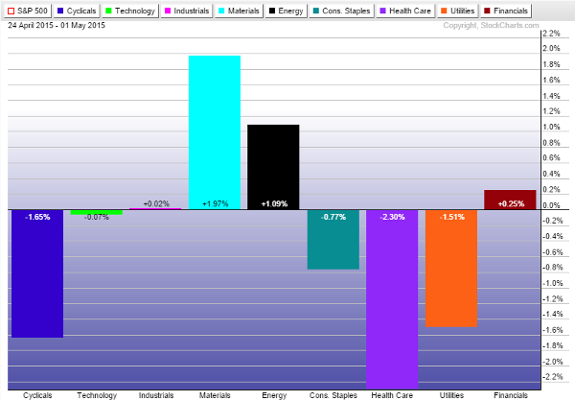

For the week, Materials and Energy win, due to better than expected earnings and rising commodity prices (and falling USD)…

More broadly, the Energy/Commodity sectors led globally while Fixed Income, Biotech and Health Care rode the long board…

Barron’s also gave you a big homework assignment on China. Spend time with your analysts here…

FOREIGN INVESTORS CANNOT AFFORD to ignore China, not when the U.S. bull market is maturing and the stench of disinflation wafts from Europe and Japan. Asian growth is slowing, but, at an average pace of 6.2%, DBS economists reckon it’s still enough to spawn an economy the size of Germany’s every 3½ years. China, which has cut rates twice since November, still has many tools to stimulate growth: The short-term interest rate is more than 3.3%, versus zero or negative for its trading partners.

Valuations also don’t yet inspire vertigo. Shanghai stocks fetch 22 times trailing earnings, versus 49 times in 2007. And Hong Kong’s Hang Seng Index fetches 12 times earnings, versus 20 times in 2007. China’s onshore stock market is at about 75% of its gross domestic product, still below 90% in South Korea and 150% in the U.S. The Chinese are upbeat thanks to ample liquidity. Just as U.S. traders believe in not fighting the Fed, the Chinese swear by “don’t battle Beijing.”

Back to thinking about the U.S. equity markets, JP Morgan (NYSE:JPM) summarizes the pitch well…

The U.S. landscape is still largely the same, characterized by: 1) weak Q1 growth (as evidenced by the very soft GDP number this week) but w/conditions suggestive of a rebound in Q2 and beyond (albeit one that at least right now doesn’t look as powerful as occurred in year’s past); 2) a Fed that will retain ZIRP for a few more months w/tightening occurring in Sept; 3) a CQ1 earnings season that wound up being better-than-feared but w/full-year ’15 estimates that haven’t shifted much (still ~$118 for the SPX); 4) relatively static multiples given unchanged estimates (still 17.75-18x on this year’s numbers and 15.5-16x using 2016); 5) fewer geopolitical headwinds (Russia/Ukraine has stayed calm for a few weeks, Tehran and the P5+1 countries are still on track for a nuclear accord notwithstanding the ship seizure this week, Greece appears on its way towards resolution and regardless investors just don’t consider a “Grexit” to be the type of systemic risk it once was, etc.).

(JP Morgan)

And Goldman Sachs (NYSE:GS) believes that U.S. Growth will rebound from its recent misses…

Beyond the fundamentals, we see three statistical reasons to “keep the faith” in a growth rebound:

- First, the Q1 GDP weakness is at odds with other data as summarized by our current activity indicator (CAI), which showed 2.8% growth on a quarter-on-quarter annualized basis. The 2.6-point gap between the two measures is the biggest in the 1997-2015 history of the CAI. Historically, large gaps of 1.5 points or more have on average been unwound entirely by a subsequent acceleration in GDP growth as opposed to a slowdown in the CAI.

- Second, adverse weather was likely an important drag on growth last quarter. We estimate that cold temperatures and ample snowfall shaved 1¼ percentage points from Q1 growth. If our estimate is correct, and if the impact unwinds in Q2, the weather swing in itself should result in a GDP acceleration of about 2½ percentage points.

- Third, Q1 has long been a funny quarter. Since 2010, GDP growth has averaged just 0.3% in Q1, compared with 2.9% in the remaining three quarters of the year. Some of this is due to the adverse weather in 2014 and 2015, but there is also evidence going back to the early 1990s that residual seasonality in several components of GDP has tended to weigh on Q1

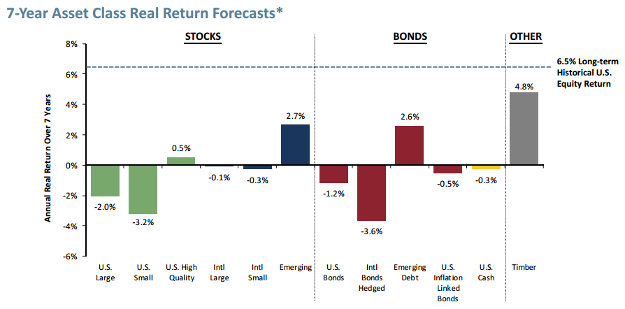

GMO released their quarterly update with specific thoughts on global Fixed Income…

At current yields, the utility of long-term government bonds in most investment portfolios is questionable at best. To our minds, any investors who are not required to own long-term government bonds in their portfolios should warmly consider getting rid of them, and those tempted to speculate on the future pricing of bonds may want to consider the benefits of betting that European and perhaps Japanese bond yields will be higher in the future. The obvious question this recommendation leads to is what to do with the money that isn’t being put in long duration bonds. We don’t believe that investors should use it as an excuse to buy more equities, but do believe that investors should consider both shortening up the duration of their bond portfolios – the low yields on cash today are a decent trade-off against the possibility of significant losses on bonds in the future – and expanding holdings of alternative investments, such as conservative hedge funds, as well. This makes sense for U.S.-based investors, but is even more essential for investors in Europe and Japan.

Dan Loeb at Third Point also shared his market thoughts in his investor update…

The letter said the firm was “constructive” on the U.S. because of improving economic data and the likelihood of continued low interest rates. “These factors should create an environment where growth improves and monetary policy stays flexible, which is generally good for equities (higher multiples notwithstanding),” the letter said. “We may follow last year’s playbook and ignore the old adage to ‘sell in May and go away.’

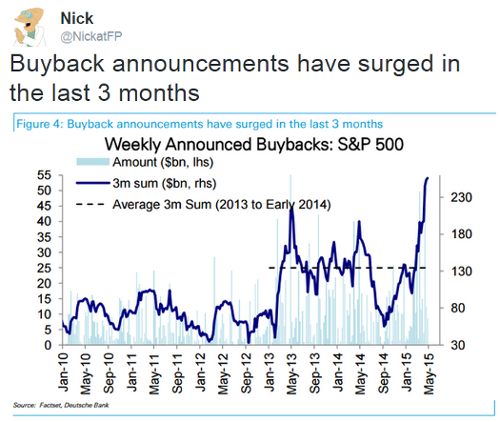

An acceleration of Stock Repos are bound to provide a strong tailwind to equities now that earnings are passed…

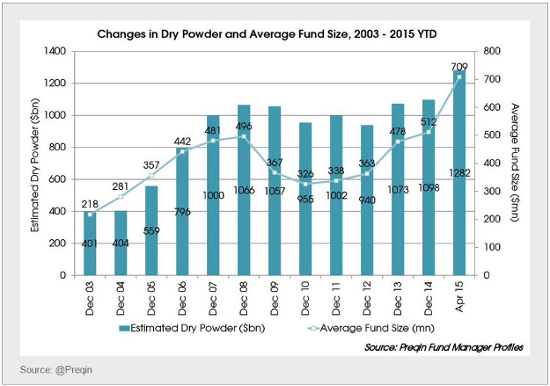

As is dry powder at Private Equity Funds hunting for acquisitions…

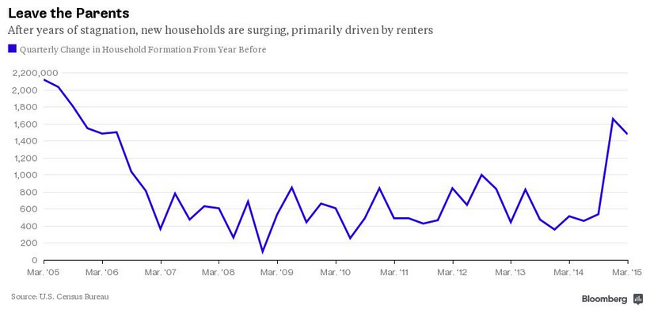

The Quarterly Household Formation chart was updated last week. Still strong after the 4Q14/1Q15 spike, which could benefit Apartments & Houses…

After shacking up with family or friends for the past few years, millennials finally seem to be striking out on their own. The number of households grew by 1.48 million in the first quarter from a year earlier, following a 1.66 million increase in the final three months of 2014, according to data released Tuesday by the Census Bureau. While the numbers can be volatile, it marks the fastest back-to-back gains in household formation since the second half of 2005

What can one say about the Apple (NASDAQ:AAPL) numbers but ‘Wow’…

Look at how big China is now. And think of how many of your friends/family are left to upgrade their Apple 4′s and 5′s.

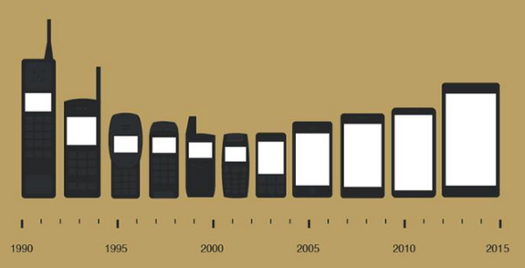

Speaking of phones…

@ITredux: Mobile phone evolution…

Finally, you owe it to yourself to read the Amazon (NASDAQ:AMZN) letter to shareholders each year. You will get something out of it…

To our shareowners:

A dreamy business offering has at least four characteristics. Customers love it, it can grow to very large size, it has strong returns on capital, and it’s durable in time – with the potential to endure for decades. When you find one of these, don’t just swipe right, get married.

Well, I’m pleased to report that Amazon hasn’t been monogamous in this regard. After two decades of risk taking and teamwork, and with generous helpings of good fortune all along the way, we are now happily wed to what I believe are three such life partners: Marketplace, Prime, and AWS. Each of these offerings was a bold bet at first, and sensible people worried (often!) that they could not work. But at this point, it’s become pretty clear how special they are and how lucky we are to have them. It’s also clear that there are no sinecures in business. We know it’s our job to always nourish and fortify them.

We’ll approach the job with our usual tools: customer obsession rather than competitor focus, heartfelt passion for invention, commitment to operational excellence, and a willingness to think long-term. With good execution and a bit of continuing good luck, Marketplace, Prime, and AWS can be serving customers and earning financial returns for many years to come

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.