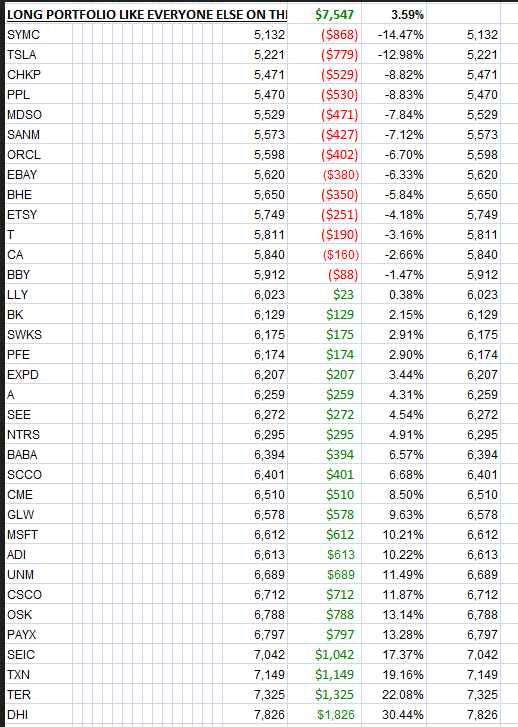

A couple of months ago, I decided to do a little experiment. Frustrated with eight years swimming against the stream, I asked myself – – what if I went ahead and bought equal amounts of every single stock in my Bull Pen watch list (that is, stocks with good-looking bullish patterns)? So I set up a spreadsheet with the prices on September 15th and have been tracking it ever since. Here’s what it looks like (the grand totals are at the top):

As you can see, even in just a couple of months, there are some pretty impressive gains (such as over 30% from homebuilder DR Horton (NYSE:DHI)). However, there is some weakness too, and once you add it all up, it comes to a gain of only about 3.5% over a two month period.

This isn’t exactly electrifying. The plain old boring SPDR S&P 500 (NYSE:SPY) yielded exactly the same return over that timespan. I guess I can at least conclude that although I’m not playing along with the bull party, I’m not exactly missing one whole hell of a lot either. If you think the market is cheap (ha!), just buy SPY and be done with it. It certainly isn’t a stock-picker’s market, judging from the fact that the average gain is, almost to the hundredth of a decimal point, the same as SPY.