Here is a brief review of period-over-period change in short interest in the December 17-31 period in nine S&P 500 sectors.

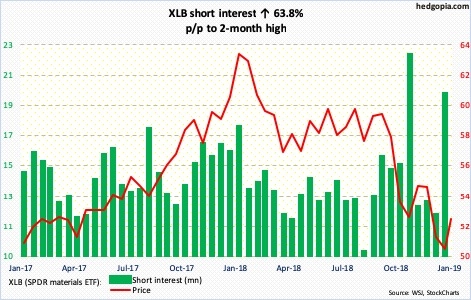

XLB (NYSE:XLB) (SPDR materials ETF)

Shorts got aggressive during the reporting period. XLB (52.48) dropped to 47.05 intraday on December 26, before rising. This represents breakout retest of 47-48 from two years ago. Two months ago, short interest similarly spiked, but only to immediately drop back down. It is possible the same thing happens this time around – or may have already taken place. The ETF rallied 11.5 percent from that low, and currently sits right under the 50-day moving average.

XLE (NYSE:XLE) (SPDR energy ETF)

XLE (62.38) fell as low as 53.36 on December 26. It has since rallied nicely. During the October-December drawdown, the ETF suffered a lot of technical damage, pushing several indicators into oversold territory. On the daily, they have now been unwound. Decent resistance lies at 64-plus. The 50-day is at 63.52.

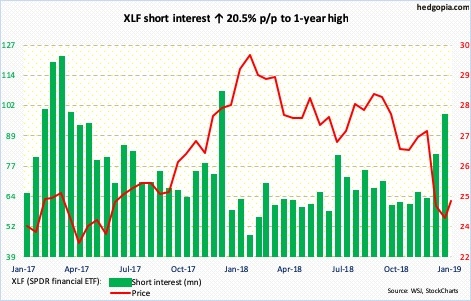

XFL (NYSE:XLF) (SPDR financial ETF)

Ahead of 4Q18 results from major US banks and brokers in the next couple of weeks, XLF (24.44) short interest shot up 55.9 percent in December. Last month, the ETF lost major support at 25. The 50-day rests at 25.37. Bulls’ best hope near term is to recapture that support-turned-resistance and possibly force a squeeze.

XLI (NYSE:XLI) (SPDR industrial ETF)

Last month, XLI (67.94) sliced through 67-68, before dropping to 59.92 on Boxing Day. That breakdown is currently being tested. The weekly has room to continue higher, but the daily is getting extended. With the 50-day (68.50) right above, a decent bull-bear duel is imminent in the next few sessions.

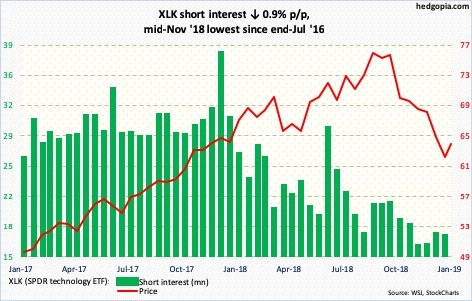

XLK (NYSE:XLK) (SPDR technology ETF)

Having been burned particularly in the first half last year, shorts continue to stay on the sidelines. From the intraday low of 57.57 on Christmas Eve, XLK (63.66) has rallied to currently test 63-64. A breakout – should one occur – is unlikely to help the bulls much as short interest remains subdued.

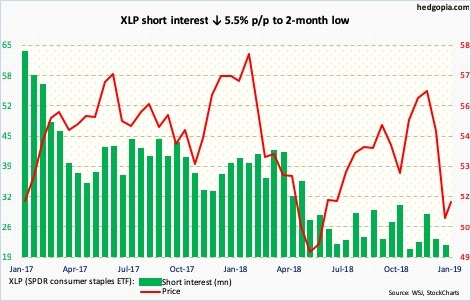

XLP (NYSE:XLP) (SPDR consumer staples ETF)

Shorts had a very good December, as XLP (51.48) dropped 9.7 percent in the month. Throughout this, they pretty much kept a low profile. This was maybe because bulls did step up to save 50, which is where the neck of a head-and-shoulders formation rests. Nearest resistance lies at 52.

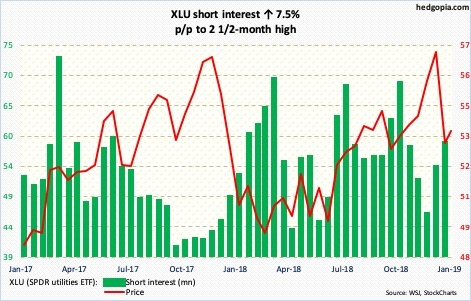

XLU (NYSE:XLU) (SPDR utilities ETF)

Short interest jumped 26.2 percent in December. This can come in handy, if bulls had their way. After briefly losing the 200-day, they have recaptured the average. On the daily, XLU (53.43) just had a potentially bullish MACD crossover. In an ideal situation, the 50-day lies at 54.38, followed by horizontal resistance at 54.50-55.

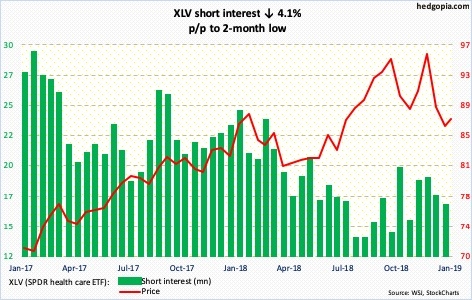

XLV (NYSE:XLV) (SPDR healthcare ETF)

XLV (87.51) finds itself at an interesting juncture. Having dropped to 80.61 intraday on December 26, it tested the 200-day (87.71) Wednesday. A breakout opens the door to a test of 89, which was lost during last month’s selling. The 50-day is at 89.26. Shorts likely appear at that level.

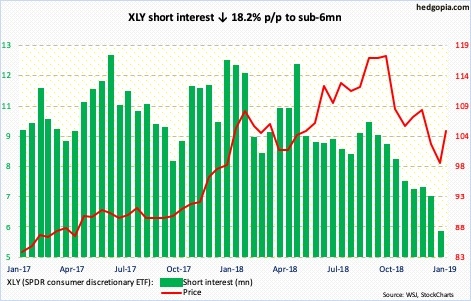

XLY (NYSE:XLY) (SPDR consumer discretionary ETF)

Short interest continues to drop, now 5.8 million. Kudos to bulls for recapturing 101-102. In the past three sessions, trading revolved around the 50-day (103.73). The 200-day lies at 108.09. In the event XLY (104.48) gets there, sellers are likely to appear. The daily would have been pushed into deep overbought territory by then.