London Forex Report: USD Bid Ahead Of FOMC Minutes

London Forex Report: Equities in major European markets and in the US ended slightly higher yesterday, rebounding from their intraday low after enduring a poor start. Asian majors extended their drop but notable exceptions include CSI 300, KOSPI and KLCI with reports of official intervention to stem the decline in China equities. Overall sentiments remain very subdued by and large, and as oil prices extended its steady fall ahead of a report anticipating a rise in inventories. Data flow was scarce yesterday, the less than expected 0.2% YOY increase in CPI in the Eurozone reaffirmed the case of still very benign price pressure, and that chances of inflation moving back closer to the ECB’s “close to but below 2% target” remains far-fetched. Ahead of tonight’s FOMC minutes, the USD remained in demand, closing firmer as safe haven flows continue to reign amid lackluster sentiment in equities and commodities with rising geopolitical tensions. The USD Index jumped 0.55% to 99.40, pulling back from intraday highs of 99.63.

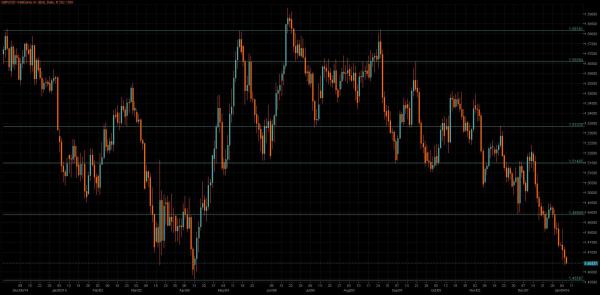

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR traded a one-month low against USD yesterday at 1.0709. The EUR/USD dropped on Tuesday as Eurozone inflation rate was 0.2%, which rose at a slower than expected rate in December and traders believed that further monetary easing would therefore be on the ECB’s agenda.

Technical: While offers at and just above 1.08 contain upside attempts, expect rotation south to test bids at 1.07, failure at 1.07 opens 1.0660 as next downside objective.

Interbank Flows: Bids 1.07 stops below. Offers 1.08 Stops above.

Retail Sentiment: Bullish

Trading Take-away: Sidelines

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Despite a report showing UK construction sector expanded at a faster-than-expected pace during the month of December, sterling struggled to outperform under a strong greenback. Cable hit a day-low of 1.4636 before slowly recovering to current levels at 1.4670s. Today’s UK Services PMI and a string of US economic indicators will be closely watched by the markets so as to determine whether GBP/USD can break the key resistance level at 1.47 or retest 2015 lows.

Technical: While 1.4730 caps intraday upside, expect a drift lower to retest bids at 1.4565 the 2015 lows. Above 1.4750 opens 1.4850.

Interbank Flows: Bids 1.46 stops below. Offers 1.47 stops above

Retail Sentiment: Bullish

Trading Take-away: Short from 1.48 for 1.45

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The risk off market sentiment drove USD/JPY down yesterday. Traders continue to seek risk adverse positions due to anxiety about slowing global growth, crumbling Chinese stock market and the tense relation between Iran and Saudi Arabia, compounded overnight by a missile test by North Korea.

Technical: While 119.50 caps intraday upside attempts, expect a sustained break of 118.50 to test bids at and just below the 118 figure. Only a breach of 119.70 eases immediate downside pressure.

Interbank Flows: Bids 118 stops below. Offers 119.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Kuroda has been on the wires the past 24 hours, reinforcing the theme that they are prepared to add stimulus if needed, although seemingly putting the onus to further fuel growth to companies by raising wages, citing current policy is enough to reach their inflation goal. And with this backdrop of Japan content to stand pat for now, external developments have been the most significant factor in EUR/JPY’s weakness to begin the year. The cross breaks yesterdays lows overnight as after another weak CNY fix and rising geopolitical tensions in the region.

Technical: While 128.20 caps intraday upside reactions, expect a grind lower to retest 2015 lows at 126.50s as the next downside objective. Only a breach of 129.50 eases immediate downside pressure.

Interbank Flows: Bids 126.50 stops below. Offers 129.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD remained under pressure overnight as the global selloff in equities this week sparked a run to safety. AUD/USD closed at 0.7157, dropped from 0.7300 starting on Monday when Chinese shares tumbled seven percent. The theme of selling risk on rallies remains whilst stocks continue their downward pressure. AUD/USD will likely find resistance back to 0.7160/70 now.

Technical: While .7160 caps intraday upside, expect a test of .7080 ahead of pivotal.7000. A breach of .72 opens a move back to test offers at the range highs of.7340

Interbank Flows: Bids .7050 stops below. Offers .7150 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: CAD hit its weakest point against USD since mid-2003, as oil prices fell and traders remain concerned about the pace of growth in China. The loonie lost 16 percent of its value in 2015 as the Bank of Canada cut rates twice to offset the negative impact of low prices for oil.

Technical: Bulls have the ball while 1.37 supports, expect a grind higher to test stops above 1.41 while 1.3940 caps intraday downside. A close below 1.37 would ease the near term bullish bias. The next key technical levels to the upside are 1.4189 (23 July 2003 high) and 1.4509 (76.4% Fibo retracement of 1.6193 to 0.9058)

Interbank Flows: Bids 1.3950 stops below. Offers 1.41 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines