London Forex Report: Mixed PMI data weighs on dollar.

ISM, PMI and Nikkei surveys showed global manufacturing remained weak and uneven, reaffirming patchy and far from solid growth in manufacturing activities as global demand stays soft. Consumer indicators from the US were also soft, with growth in personal income remaining unchanged while personal spending stagnated in December. Core PCE also remained low at 1.4% YoY, far below the Fed 2% target that would raise the bar for the Fed further tightening move. Fed Vice Chairman Fischer commented that recent financial market turmoil and uncertainty over China leaves the Fed’s next move in limbo, as it was difficult to gauge such impact on the US economy. BOJ’s surprise move in nudging its rates on reserves to -0.1% last Friday to revive growth and prices was another good testimony that the world remains entrenched in an easing cycle. USD Index slipped 0.6% to 99.00, pressured by sell-off from soft US data.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Euro lost upward momentum after the beginning of American session. EUR/USD dropped from the day high of 1.0912 to 1.0875. The pair then gained support and rose further, boosted by the decline of the greenback across the board.

“Our monetary policy is working; and the ECB is willing to contribute its share to ensuring that the recovery remains firmly on track,"

stated ECB President Mario Draghi.

Technical: Trading mid to upper range, a sustained breach of 1.08 bids opens 1.07 range lows. A breach of 1.0990 trend resistance opens a broader 1.1240 symmetry corrective objective.

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 Stops above.

Retail Sentiment: Bearish

Trading Take-away: Play the range, buy dips to 1.07 sell rallies to 1.10

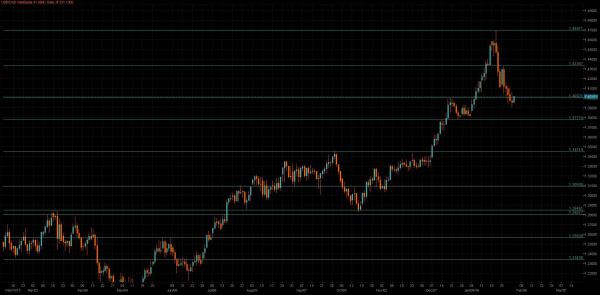

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP surged on brighter UK manufacturing data, climbed to as high as 1.4444 intraday, the highest since 14 January. The UK PMI data posted a reading of 52.9, beating the forecast 51.6 which proved that Britain’s manufacturing sector has had a slight improvement. While Brexit issues remain on the table, the upside of sterling should be capped. However, markets will have their focus on BoE meeting due this Thursday.

Technical: Over 1.4450 eases immediate downside pressure and sets up a broader correction. Broader corrective bias remains in tact while 1.4280 supports intraday downside reactions failure at 1.4250 suggests false upside break and resets bearish tone.

Interbank Flows: Bids 1.4250 below. Offers 1.4450 stops above

Retail Sentiment: Bearish

Trading Take-away: Buy pullbacks against 1.4250 for 1.4530

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Dollar grinded lower against JPY after hitting the 6-week high last Friday. USD/JPY touched an intraday low at 120.66 and then recovered to 120.97, just below the 121.00 handle. US ISM Manufacturing data came in at 48.2, worse than the forecast 48.4 which has contributed to the dollar’s weakness. The ATM spot-week volatility retreated from 16 to 9.5 after the BoJ meeting, showing that markets remain uncertain on near-term JPY direction.

Technical: 121.66 is initial resistance, an upside breach here opens a move to test 123.64 next, bulls have the ball while 120 supports intraday downside reactions. A failure at 119.60 opens 118.60 on the downside

Interbank Flows: Bids 119.50 stops below. Offers 122 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY remained pressured by recent BoJ policy easing and prospects of more expansionary measures. January’s Nikkei manufacturing PMI stood at 52.3 (9th consecutive month of expansion), from 52.4 in December. Meanwhile, vehicle sales rose tad 0.2% y/y in January, from a healthy 3.1% in December.

Technical: While 130.40 supports intraday downside reactions expects a retest of 132.30 offers and stops above, a close above 132 opens a test of 134 next.

Interbank Flows: Bids 130.50 stops below. Offers 132.50 stops above

Retail Sentiment: Bearish

Trading Take-away: Buy pullbacks against 130.30 for 134

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Reserve Bank of Australia (RBA) left the cash rate unchanged at 2%, consistent with the RBA’s previous assessment of gradual improvement in the domestic economy. The accompanying statement highlighted the risk of potentially weaker global and domestic demand. FX commentary was little changed, and continued to reflect consistency with commodity prices.

Technical: While .7000 caps intraday downside expect a test .7200. Only a closing breach of .7150 eases immediate downside pressure.

Interbank Flows: Bids .7000 stops below. Offers .7150 stops above

Retail Sentiment: Neutral to bearish

Trading Take-away: Sidelines

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: US released Personal Spending MoM and ISM Manufacturing data overnight and all came in below expectations. Further signs that the US economy is not going as well as the Fed had anticipated and as a result have markets doubting a possible rate hike in March, dragging the USD. Opening this morning, USD/CAD traded slightly stronger above 1.3950 on the back of sluggish crude prices as weak Manufacturing PMI from China added worries about demand for oil.

Technical: While 1.4160 caps upside reactions expect a broader corrective phase to test AB=CD corrective swing target at 1.3750 support. Only above 1.4330 eases immediate downside pressure and opens a retest of 2016 highs.

Interbank Flows: Bids 1.3950 stops below. Offers 1.4150 stops above

Retail Sentiment: Neutral

Trading Take-away: Sidelines