London Forex Report: Following hawkish comments from a string of Federal Reserve Bank presidents, another top Fed official joined the bandwagon in making the case for a rate hike sooner rather than later. St Louis Fed chair James Bullard said that policy makers should consider hiking in April amid positive outlook on inflation and the job market. Recovery in economic indicators suggests that policy tightening would avoid “overshooting on inflation”. USD strengthened as equities and oil prices weakened. The USD Index rose steadily before easing slightly after US mid-day, but held firm to close 0.42% higher at 96.04.

EUR/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/USD dropped to print a daily low during the American session at 1.1157, the lowest level since last Wednesday when the FOMC announced its decision on monetary policy. The German Bundesbank head said on Wednesday that European Central Bank policy makers were right to step up euro-area stimulus this month, though he thought the full package of rate cuts, bond purchases and free loans went too far.

Technical: EUR has breached symmetry support in the 1.12 which now becomes initial intraday resistance, while this level contains upside reactions anticipate a move back to 1.1050 in broader range trade.

Interbank Flows: Bids 1.1150 stops below. Offers 1.14 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Hawkish comments from Fed’s Bullard pushed GBP below 1.4100 handle, a level which was seen ahead of last Wednesday’s FOMC rate decision. Sterling has suffered a double blow of increased Brexit fears and Fed rate hike talk since Monday. Political developments over the weekend in the UK and terror attacks in Brussels heightened Brexit fears and weighed on the currency.

Technical: The breach of 1.4130 support has exposed 1.4050 pivotal support. A failure to hold 1.4050 opens a retest of year to date lows at 1.38 ahead of 1.37 weekly swing objective

Interbank Flows: Bids 1.4050 stops below. Offers 1.4200 stops above.

Retail Sentiment: Bearish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: USD rose against the JPY yesterday, as Federal Reserve officials suggested a US rate hike in the near future and the likelihood of more interest rates later in this year. The BoJ released “Summary of Opinions at the Monetary Policy Meeting” on 14-15 March. The policy makers engaged in the heated debates on the advantages and disadvantages of the negative interest rates, with one even suggesting it was preferable to roll it back

Technical: Price currently testing near term resistance sited at 112.88 with a close over 113 required to neutralise the immediate downside threat, in the broader range of 111/114

Interbank Flows: Bids 111 offers below. Offers 113 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: The JPY was sold off against the majors overnight. The Japanese government downgraded its assessment of the domestic economy and with private consumption in particular. However, it was more upbeat on business investment. This downbeat assessment could weigh on the Nikkei and then on the pair, which could cap upside.

Technical: Bids sub 125 supported the current advance to target a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggests false upside break and opens retest of 123.

Interbank Flows: Bids 125 stops below. Offers 127.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

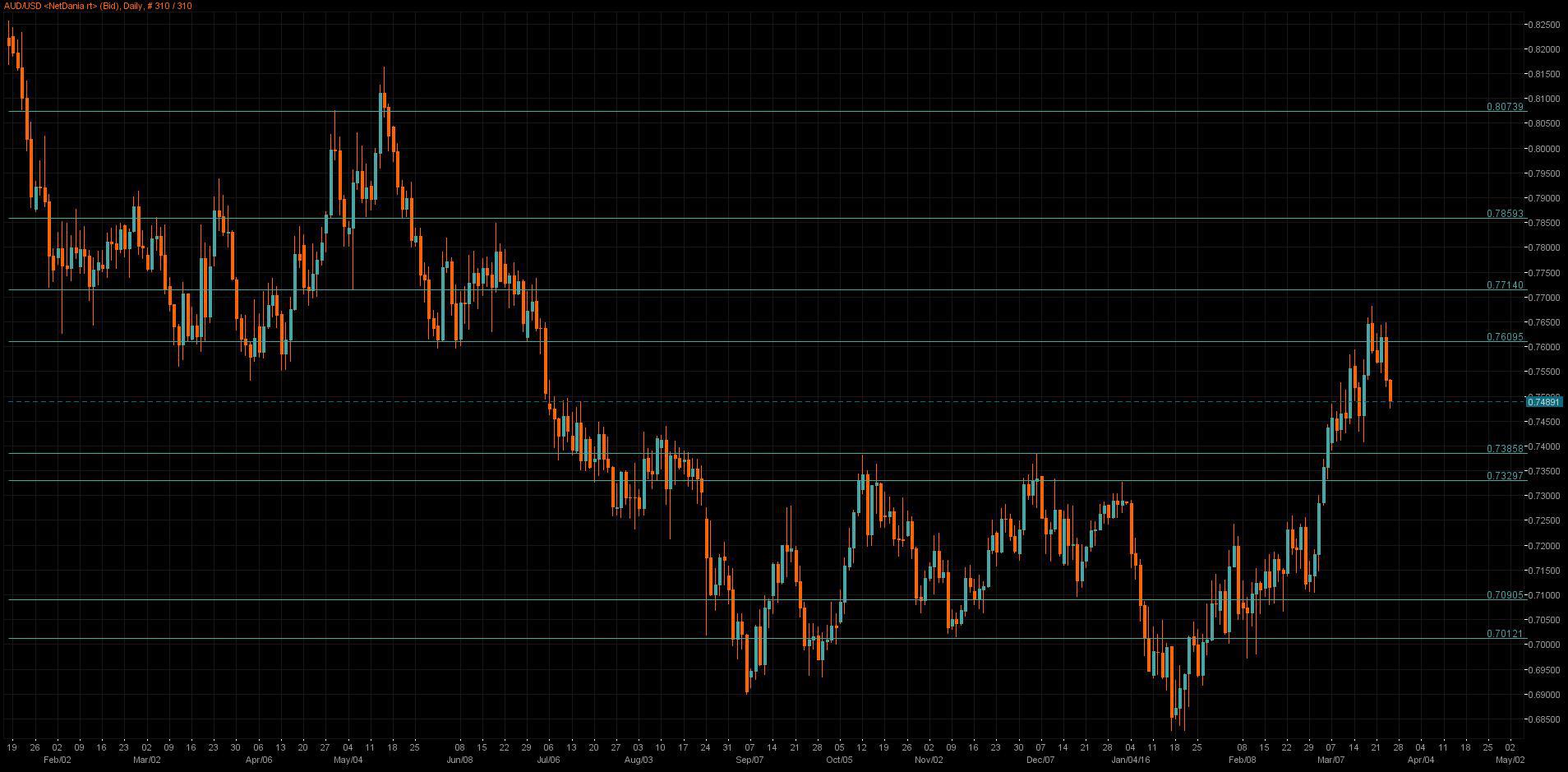

AUD/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD currency dropped yesterday with markets in an uncertain market mood. With equity markets suffering declines and the retreat of crude oil prices, the Aussie sold off in times of heightened risk aversion. The broad US dollar move drove by the overall positive tone of the Fed speakers also weighed on the Aussie.

Technical: Only a failure at.7400 support threatens medium term bullish bias. Expect consolidation above this level ahead of the holiday weekend with intraday resistance sited at .7550.

Interbank Flows: Bids .7450 stops below. Offers .7700 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: Canadian dollar weakened to a one-week low against USD as crude oil prices fell and the USD was boosted by comments from Federal Reserve officials in support of rate hikes. Oil prices lost 4% as US crude stockpiles rose more than expected, strengthening concerns about a stubborn global glut

Technical: AB=CD downside objective at 1.2966 achieved, while 1.3110 contains downside reactions expect a test of symmetry swing objective at 1.33 as next meaningful resistance, a close over 1.34 negates near term bearish bias.

Interbank Flows: Bids 1.3100 stops below. Offers 1.3300 stops above

Retail Sentiment: Bearish

Trading Take-away: Long