London Forex Report: Lifting of Iranian sanctions further heightened the already acute oversupply concerns, prompting global crude oil prices to plummet below $28/ barrel, a fresh 12-year low. This further reinforced expectations that downside risks to global growth and inflation forecasts will prompt policy makers to keep policy rates at very accommodative levels. US data turned downbeat Friday pointing to weakening retail spending and manufacturing activities that signaled a softer 4Q. Retail sales took a turn and fell 0.1% MOM in December while industrial production extended its decline amid weaknesses in manufacturing and utilities. On the contrary, consumer sentiments were surprisingly low in January as households were hopeful that low inflation will boost personal finances ahead. USD strengthened to overturn early losses despite weaker US data. The Dollar Index bounced off its intraday low near 98.44 to close at 98.95, narrowing losses to 0.13% for the day.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Renewed market risk-off sentiment from falling oil prices and disappointing US economic data, saw EUR/USD rise to 1.0984, its highest since 29 December 2015, and closed at 1.0914, falling below 1.09 overnight. Market focus this week will be on the ECB rate decision meeting this Thursday.

Technical: While offers at 1.0950 contain upside reactions expect rotation to retest bids at 1.08, a breach of 1.0990 trend resistance opens a broader 1.1240 symmetry corrective objective.

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 Stops above.

Retail Sentiment: Neutral

Trading Take-away: Sidelines

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP extended its decline below 1.43 against the USD and fell for the eighth consecutive week against the euro as investors became increasingly concerned about the impact of Brexit could have on the UK economic outlook. Also weighing on the sterling is the delay in BoE rate hike, as the latest meeting minutes showed policymakers expect the plunge in oil prices might possibly weigh on the already-subdued UK inflation rate.

Technical: While 1.4370 caps upside reactions expect a grind lower to retest yesterday’s last weeks lows en route to test bids at 1.42. Only over 1.45 eases immediate downside pressure.

Interbank Flows: Bids 1.42 stops below. Offers 1.45 stops above

Retail Sentiment: Bullish

Trading Take-away: Sell pullbacks to 1.4370 leaning against 1.45 to target 1.35

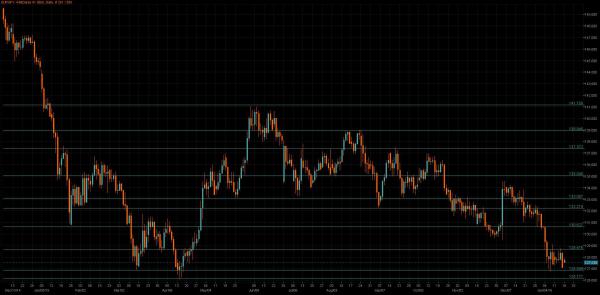

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Japanese yen was outperforming with 0.8% gain in an environment of elevated risk aversion and narrowing US-Japan 2Y yield spread. Triggered by falling oil prices and poor US economic data, US stocks were down 2% across the board, with Dow Jones and S&P 500 hitting the lowest levels since August last year. USD/JPY has recovered from the bottom of its one week range and is flirting again just above 117 levels. Risk sentiment is likely to be the main driver for the currency pair this week.

Technical: While 11750 caps intraday upside attempts, expect a grind lower en route to retest stops below 116.35. Only above 119 eases immediate downside pressure.

Interbank Flows: Bids 116 stops below. Offers 118 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Limited data and events in Japan should leave the JPY remaining prone to overall fluctuations in global risk sentiments, with eyes on developments in CNY and crude oil markets. A recovery in risk sentiment should help reverse some of the flight-to-safety appreciation of the JPY, and speculation about the upcoming BoJ meeting on 29 January may also provide some support.

Technical: While 128.10 caps intraday upside reactions, expect a grind lower to retest lows at 126.70s; a failure here opens a test of bids at 126. Only over 129 eases immediate downside pressure.

Interbank Flows: Bids 126.50 stops below. Offers 128.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Sidelines

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD/USD traded much softer below 0.69 amid a combination of risk aversion arising from weakening oil prices and disappointing US economic data. Under the lack of domestic data this week, traders will shift their focus to a series of Chinese tier-1 data which includes GDP, industrial production and fixed asset investment figures. If data is disappointing, risk sentiment is likely to further deteriorate

Technical: While .6950 caps intraday upside expect a grind lower to retest .6830s lows. Only a breach of .7050 eases immediate downside pressure.

Interbank Flows: Bids .6800 stops below. Offers .6950 stops above

Retail Sentiment: Bullish

Trading Take-away: Sell pullbacks to .6950 against .7050 to target .6750 initially

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: USD/CAD continued to break higher last Friday, rallying from 1.44 to 1.45 and closing the day at 1.4538, gaping up overnight to print above 1.46. With crude oil prices falling below $328, the loonie remained on the defensive alongside with other commodity currencies. Markets will watch closely the BoC rate decision this Wednesday night, where a rate cut is broadly expected by the markets amid record-low oil prices and gloomy business outlook

Technical: Bulls have the ball while 1.4385 supports, expect a grind higher to test stops above 1.4550. Only below 1.42 eases immediate bullish pressure

Interbank Flows: Bids 1.4350 stops below. Offers 1.4550 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines