Loews Corporation (NYSE:L) reported second-quarter 2017 operating earnings of 76 cents per share, which met the Zacks Consensus Estimate. Earnings surged 27% year over year.

The quarter witnessed a better performance by CNA Financial (NYSE:CNA) , Diamond Offshore (NYSE:DO) and Loews Hotels and improved results from the parent company’s investment portfolio. However, lower earnings at Boardwalk Pipeline (NYSE:BWP) and soft results from the parent company investment portfolio were partial dampeners.

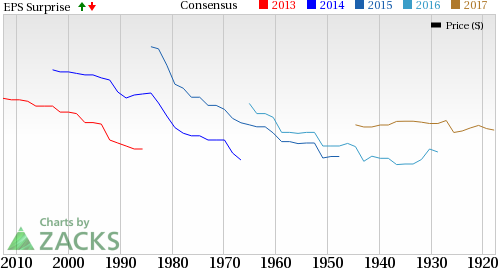

Loews Corporation Price, Consensus and EPS Surprise

Including asset impairment charges at Diamond Offshore Drilling Inc. (DO), the company reported net income of 69 cents, thereby rebounding from the year-ago quarter’s loss of 19 cents.

Revenues

Operating revenue of $3.3 billion increased 3% year over year. Rise in insurance premiums, contract drilling revenues and other revenues aided this improvement.

Behind the Headlines

Total expenses declined 16.7% year over year to $3 billion, mainly due to lower contract drilling expenses and other operating costs as well as a decrease in insurance claims & policyholders' benefits.

CNA Financial’s revenues increased 4.3% from the prior-year quarter to $2.4 billion. It reported net income attributable to Loews Corp. is $244 million, up 29% from the year-ago quarter. This improvement may be attributed to current accident year underwriting results from its core P&C business and higher realized investment gains. However, lower net investment income limited the upside.

Boardwalk Pipeline’s revenues inched up 3.2% year over year to $318 million. Net income attributable to Loews, plunged 65% year over year to $7 million, due to loss on the sale of a processing facility.

Loews Hotels’ revenues declined 4.2 % year over year to $181 million. Income attributable to Loews jumped to $10 million from $1 million in the year-ago quarter. Earnings improved on higher equity income from Universal Orlando joint-venture properties.

Diamond Offshore’s revenues improved 5.6% year over year to $399 million. Net income attributable to Loews was $7 million, comparing favorably with ($294 million) in the year-ago quarter. Higher fleet utilization and lower depreciation expense resulted mainly from the asset impairment charges taken in 2016.

Book value as of Jun 30, 2017 was $56.01 per share, up about 2.5% from $54.62 as of Dec 31, 2016.

Zacks Rank

Loews currently has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

More Stock News: 8 Companies Verge on Apple-Like Run Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Boardwalk Pipeline Partners L.P. (BWP): Free Stock Analysis Report

Loews Corporation (L): Free Stock Analysis Report

CNA Financial Corporation (CNA): Free Stock Analysis Report

Diamond Offshore Drilling, Inc. (DO): Free Stock Analysis Report

Original post