The first half of 2020 has seen billions of global citizens shelter-in-place as part of lockdowns against the spread of COVID-19. A result of these stay-at-home and work-from-home trends: consumers have increasingly been relying on services and industries that make this new way of life and work easier to maintain.

With fears of a second wave of the coronavirus pandemic permeating, shares of these companies may continue to do well in the coming months. There is also a broad range of exchange-traded funds (ETFs) that provide exposure to many of these stocks.

Today, we'll take a closer look at two ETFs, and a third that's on the way, that market participants may consider researching. An ETF typically tracks an index. As one cannot directly invest in an index, an exchange traded fund enables market participants to gain exposure to companies in the index.

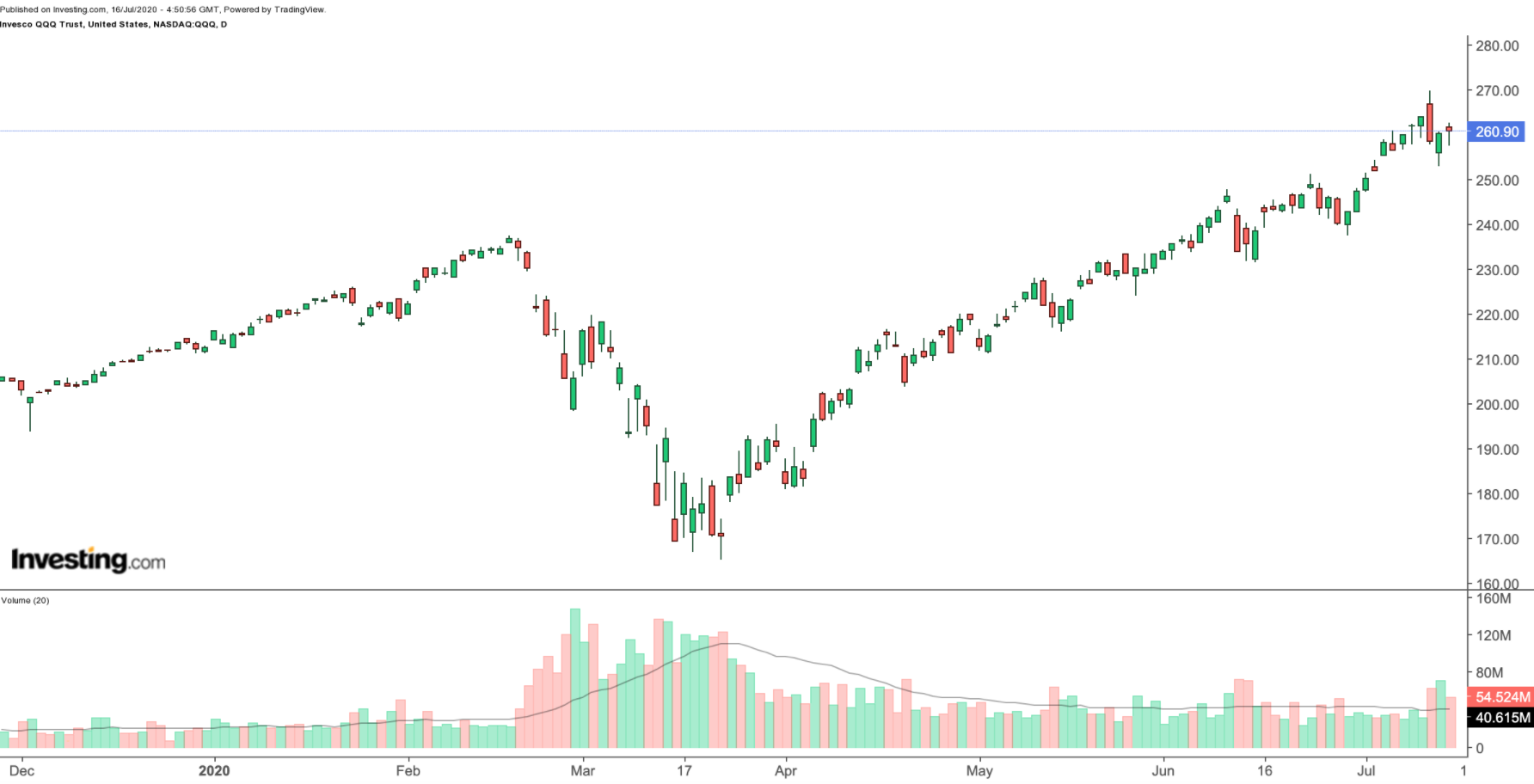

1. Invesco QQQ Trust

- Current Price: $260.90

- 52-week range: $164.93-$269.79

- Dividend Yield: 0.63%

- Expense Ratio: 0.20% per year, or $20 on a $10,000 investment.

The Invesco QQQ Trust (NASDAQ:QQQ) is currently the second most traded ETF in the US based on average daily trading volume. The fund tracks the NASDAQ 100 index, which comprises 100 of the largest US and non-US-based non-financial companies listed in the NASDAQ Stock Exchange based on market cap. It may also be referred to as “the triple Q’s or simply QQQ.”

The fund gives investors access to 100 companies via a single investment. It also provides exposure to some of the most significant trends in technology. QQQ may be an appropriate choice as a stay-at-home and work-from-home ETF because these businesses cover a broad range of industries, such as online shopping, video streaming, communications, cloud technology, biotechnology, healthcare, media, food, beverages, and restaurants.

The fund's top 3 holdings are Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Amazon (NASDAQ:AMZN). These three heavy weights make up close to a third of the fund.

Other notable companies in the Invesco QQQ ETF are Facebook (NASDAQ:FB), Alphabet (NASDAQ:GOOGL), Intel (NASDAQ:INTC), PepsiCo (NASDAQ:PEP), Cisco Systems (NASDAQ:CSCO), and Netflix (NASDAQ:NFLX).

Year-to-date, the fund is up over 20%, which technically means it's in a bull market. In the coming days, many NASDAQ 100 companies will be reporting quarterly earnings.

Given the recent increases in prices of individual shares, there may be some short-term profit-taking around the corner. A decline toward the $250 level or below is likely. This could provide potential QQQ investors with a better entry point.

2. Direxion Work From Home ETF

- Current Price: $51.24

- 52-week range: $49.20-$54.00

- Expense Ratio: 0.45% per year, or $45 on a $10,000 investment.

The Direxion Work From Home ETF (NYSE:WFH) is one of the newest additions to the universe of exchange traded funds. It started trading on June 25, at an opening price of $50.08. On July 13, it hit an all-time high of $54.

The primary difference between WFH and the QQQ is its narrower focus. The Direxion fund is a specific work-from-home ETF. It tracks the Solactive Remote Work Index, which comprises businesses offering technological infrastructure and services in four industries: cloud technologies, cybersecurity, remote communications, online project and document management.

The Solactive Remote Work Index consists of 40 companies, ten from each industry group.

The top five holdings of the Direxion Work From Home ETF are Twilio (NYSE:TWLO), Inseego (NASDAQ:INSG), Crowdstrike (NASDAQ:CRWD), Avaya (NYSE:AVYA), and Okta (NASDAQ:OKTA). They make up approximately 18% of the total value of the fund.

Bottom Line

The COVID-19 pandemic has triggered structural shifts in the way people, worldwide, are now living their lives. 2020 is quickly becoming the year of 'home sweet home' for many.

Thematic investing may enable market participants to diversify their portfolios while capturing trends such as stay-at-home and work-from-home. And these two ETFs may act as a basis for further research. As always, investors should consider individual investment goals along with risks/return profiles and charges/expenses of each fund.

Finally, in recent weeks, BlackRock (NYSE:BLK), the world's largest asset manager, filed with the US Securities and Exchange Commission (SEC) to create a new exchange traded fund with exposure to stay-at-home stocks. According to the filing, it will be called the iShares Virtual Work and Life Multisector ETF. We plan to cover this ETF once it starts trading.