LKQ Corporation (NASDAQ:LKQ) will announce its second-quarter fiscal 2017 results, before the market opens on Jul 27.

Last quarter, LKQ Corp. surpassed estimates by 6.52%. The company has managed to beat earnings in two of the trailing four quarters, miss in one and come in line in one, thus delivering an average positive surprise of 2.15% over this period.

Let’s see how things are shaping up for this announcement.

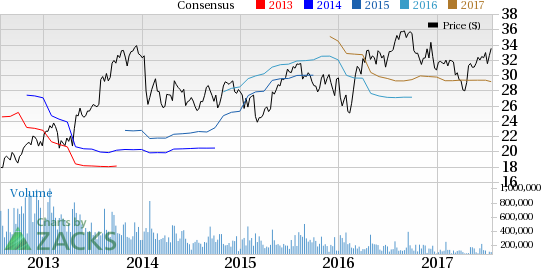

LKQ Corporation Price and EPS Surprise

Factors to Consider

In 2017, LKQ Corp. expects organic sales growth in the range of 4–6%. Adjusted income from continuing operations is expected within $565-$595 million from the prior expectation of $560−$590 million. The company also raised its expectations of adjusted earnings to $1.82–$1.92 per share from $1.80–$1.90, expected earlier. Also, its focus toward lowering its operational costs will also boost the sales figure.

Additionally, it focuses on expanding its operations in Europe. To achieve this aim, the company has been opening new ECP branches for counter sales and distribution centers in the continent. In second-quarter 2017, the company opened 12 new operations in Eastern Europe. Plus, a new distribution center is currently under construction at Tamworth, U.K., which is expected to be completed in 2018.

However, fluctuations in foreign currency translations and pressure on gross margins due to recent acquisitions, are some of the headwinds that the company is facing.

Earnings Whispers

Our proven model does not conclusively show that LKQ Corp. is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP: Earnings ESP for LKQ Corp. is currently 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 52 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: LKQ Corp. currently carries a Zacks Rank #3 (Hold).

We caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Price Performance

LKQ Corp.’s stock has rallied 12.5% in the last three months, outperforming the 1.8% decline of the industry it belongs to.

Stocks to Consider

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Cummins Inc. (NYSE:CMI) has an Earnings ESP of +3.1% and a Zacks Rank #2 (Buy). The company is expected to report its second-quarter 2017 results on Aug 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tenneco Inc. (NYSE:TEN) has an Earnings ESP of +1.67% and a Zacks Rank #3. The company’s second-quarter 2017 financial results are expected to release on Jul 28.

Horizon Global Corporation (NYSE:HZN) has an Earnings ESP of +2.99% and a Zacks Rank #3. The company’s second-quarter 2017 financial results are expected to release on Aug 1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Tenneco Inc. (TEN): Free Stock Analysis Report

Horizon Global Corporation (HZN): Free Stock Analysis Report

LKQ Corporation (LKQ): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research