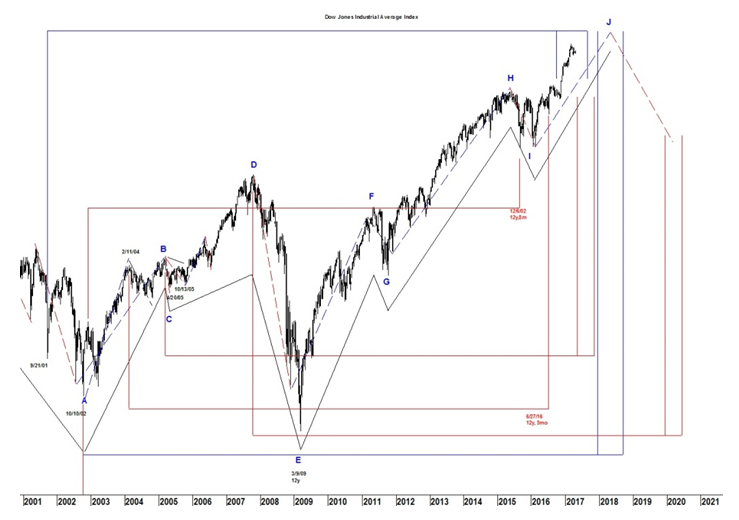

The March 20 Market Update showed our Long Term interval forecast – both 15 and 12-year intervals. As we are now seeing the biggest pullback in the Dow since last Autumn we have to assume that the 15-year interval is exerting its influence and the decline won’t end until the 12-year interval (May-November, 2017) takes over.

Lindsay wrote that a 12-year interval counts 12 years, 2 months – 12 years, 8months from an important high. However, these long term intervals (as might be expected) were the least exact of all Lindsay’s counts. For example, the 2/11/16 low was exactly 12 years, 0 months from the high on 2/11/04. If we account for a possible two month error in the counts, we are already in the 12-year interval time target.

Cycles

Last week’s Market Update noted a 19-day cycle low which points to the next low on April 24 which matches the Hybrid Lindsay forecast for a low on or near April 24-28. Not mentioned was the date of the next 21-day cycle high on April 28. Conclusion: the following rally will be short-lived.