Why the U.S. dollar still reigns supreme

Where did the ES futures volume go?

At the time this newsletter was being written, volume in the December e-mini S&P was creeping up on the one million mark in contracts traded. This is dramatically lower than the 1.5 to 2.0 million we were starting to get used over the last three or four weeks of trading.

Our theory is that many of the highly leveraged market participants have moved to the sidelines after a rough period of trading. Don't forget, bear markets lure traders to the futures markets like flies on "fertilizer." This is because most speculators believe there is quicker, and bigger, profits to be made during sell-offs than can be made during a bull market phase. Their assumption is true, but it also comes with elevated risks.

The big sell-offs in August and September brought traders to the markets, but the October rally has likely chased them back into hiding (particularly the massive short squeeze seen on Thursday and Friday of last week).

What does this mean going forward? Two things stick out in our minds; first, the e-mini S&P 500 bears will think twice about selling into a market that has burned them (twice). Second, if these traders stay sidelined and volume remains light, the path of least resistance will continue to be higher in the stock market (light volume tends to see melt-up type of trade).

We are roughly a week away from the Fed meeting, Treasury futures traders will start positioning soon

The "market" collectively has decided that the Fed will NOT raise rates next week, but we are surprised at the lack of focus on the upcoming FOMC meeting. After all, we've been drowning in commentary and opinions weeks ahead of previous meetings this year. Thankfully, earnings season seems to be taking some of the attention away from the event. Regardless of the cause, we are certain the chatter will turn into a roar in the coming days.

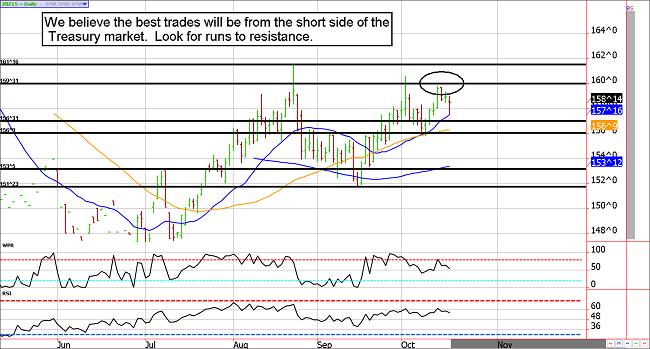

Generally speaking, talk of the Fed meeting should keep a bid under pricing in Treasuries for now. However, we believe that sooner rather than later, the current bond and note rally will fail. If the bears are lucky, there will be an opportunity on, or around, the Fed meeting to get into bearish positions near the recent highs; 162 in the ZB and 130 in the ZN.

Treasury Futures Market Analysis

**Bond Futures Market Consensus:** The highs are likely in, or at least near, for now. Look for places near resistance to get bearish.

**Technical Support:** ZB : 156'31, 156'0, 153'05, and 151'23 ZN: 128'18, 127'27, 127'12, 126'16, 125'30, and 125'17

**Technical Resistance:** ZB : 159'20, and 161'16 ZN: 129'20 and 130'06, and 131'15

By some measures, the ES is getting toppy, but in our opinion the rally has another leg higher.

Bearish technicians are pointing out overbought oscillators and a nearly full retracement of the August collapse as evidence that this market has come "too far, too fast."

We beg to differ. The bears didn't seem to complain when the ES dropped from about 2100 to 1820 in a handful off days in a move that truly was "too far, too fast." Additionally, the December e-mini has another 20 handles to go before hitting the down-trend line that dates back to the July peak.

We remain optimistic into year's end due to seasonal tendencies, and help from the greenback. Nevertheless, there could be some corrective action from the 2040/2050 area. The bears might look for those levels to establish positions.

Stock Index Futures Market Ideas

**e-mini S&P Futures Market Consensus:** The short squeeze should see 2040 to 2050 before all is said and done.

**Technical Support:** 1982, 1958, 1905, and 1861

**Technical Resistance:** 2031 (minor), and 2039, 2048

e-mini S&P Futures Day Trading Ideas

**These are counter-trend entry ideas, the more distant the level the more reliable but the less likely to get filled**

ES Day Trade Sell Levels: 2032, 2041, and 2048

ES Day Trade Buy Levels: 2011, 2005, 1989, and 1981

In other commodity futures and options markets....

October 16 - Buy December corn in a small fashion (mini contracts or full size, depending on risk tolerance and funding).

Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data.

Seasonality is already factored into current prices, any references to such does not indicate future market action.

**There is substantial risk of loss in trading futures and options.**

These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.