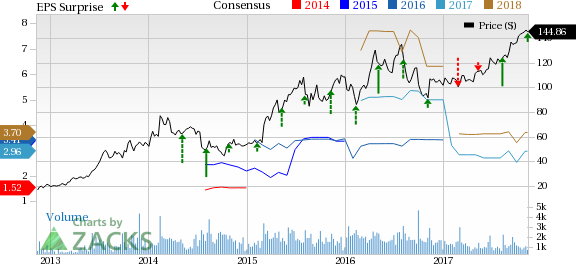

Ligand Pharmaceuticals Inc. (NASDAQ:LGND) reported third-quarter 2017 adjusted earnings of 69 cents per share, significantly up 56.8% from the year-ago figure of 44 cents. The bottom line also beat the Zacks Consensus Estimate of 60 cents.

Ligand’s shares have outperformed the industry year to date. The stock has soared 42.5% compared with the industry’s 2.7% increase.

Total revenues in the quarter surged 54.6% year over year to $33.4 million, mainly on the back of higher royalty revenues. The top line also surpassed the Zacks Consensus Estimate of $31 million.

Quarterly Highlights

Royalty revenues were $21.9 million in the reported quarter, up approximately 39.5% year over year. Higher royalties on sales of Novartis' (NYSE:NVS) Promacta, Amgen's (NASDAQ:AMGN) Kyprolis and Spectrum Pharmaceuticals' (NASDAQ:SPPI) Evomela drove this upside. Ligand licenses its platform technologies such as Captisol or OmniAb to partners for use in their proprietary programs.

Material sales also soared by 83.3% to $7.7 million owing to the favorable timing of Captisol purchases for clinical and commercial use.

License and milestone revenues were $3.8 million, registering a massive rise of 123.5% compared with $1.7 million in the year-ago period. This increase was courtesy of the favorable timing of milestones and license fees earned.

Research & development (R&D) expenses marginally decreased by 18.6% to $4.8 million. However, general & administrative expenses increased 6.1% year over year to $7 million.

Pipeline and Other Updates

In September, Ligand Pharmaceuticals announced positive top-line results from a phase II study, evaluating the efficacy and safety of its pipeline candidate LGD-6972, for treatment of patients with type 2 diabetes mellitus (T2DM), inadequately controlled on metformin monotherapy. The study achieved statistical significance in the primary endpoint of change from baseline in hemoglobin A1c after 12 weeks of treatment at all doses (5 mg, 10 mg and 15 mg) tested.

In July, the company announced that it has entered into a commercial license and supply agreement with Amgen, granting it rights to use Captisol in the formulation of its anti-CD33 x anti-CD3 (BiTE) bi-specific antibody, AMG 330. Under the terms of the deal, Ligand is entitled to potential milestone payments, royalties and revenues from the future sales of AMG 330.

2017 Outlook

Ligand raised its 2017 earnings and revenue outlook. The company now expects revenues in the range of $134-$136 million compared with the previous expectation of at least $134 million along with up to $9 million as contract payments.

Adjusted earnings are now expected in the range of $2.95-$3.00 per share compared with the past projection of $2.93.

Zacks Rank

Ligand carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Novartis AG (NVS): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Spectrum Pharmaceuticals, Inc. (SPPI): Free Stock Analysis Report

Original post

Zacks Investment Research