Last week we pointed out recent inflows in a levered Bull Natural Gas linked product from VelocityShares, VelocityShares 3x Long Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:UGAZ) (Expense Ratio 1.65%, $975 million AUM), as the fund has reeled in nearly $200 million since the second to last week in October via creation activity.

Interestingly, UGAZ is the largest “Natural Gas” linked product in the U.S. landscape at the moment, bigger than even the $619 million “benchmark” name in the space United States Natural Gas (NYSE:UNG) (Expense Ratio 1.12%). UNG debuted way back in 2007 and has recently attracted about $75 million in new assets via creation appetite, but UGAZ, which debuted in 2012 has proven to be a favorite of traders and short term directional speculators whom may be playing Natural Gas prices through ETPs.

For example, UGAZ averages more than 15.6 million shares traded on an average daily basis as compared to UNG’s 6.7 million shares, and UGAZ’ sister ETN VelocityShares 3x Inverse Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:DGAZ) (Expense Ratio 1.65%) is rather popular as well averaging 3.8 million shares on an average daily basis and slotted as the third largest ETP in the Natural Gas category with about $107 million in AUM.

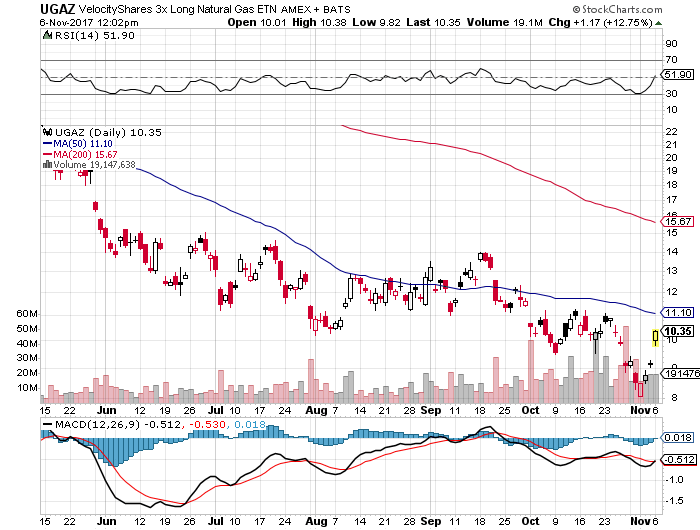

Judging from the huge move higher that we have seen in Natural Gas prices this morning, the recent inflows in the ETP space especially concerning UGAZ appear to be very well timed.

The VelocityShares 3x Long Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:UGAZ)) was trading at $10.31 per share on Monday morning, up $1.13 (+12.31%). Year-to-date, UGAZ has declined -77.68%, versus a 16.79% rise in the benchmark S&P 500 index during the same period.

UGAZ currently has an ETF Daily News SMART Grade of F (Strong Sell), and is ranked #13 of 24 ETFs in the Leveraged Commodities ETFs category.