With the Q2 earnings season in its last leg, the widely diversified Consumer Discretionary sector has grabbed much of the attention.

Per the Earnings Preview, 69.4% of the Consumer Discretionary companies in the S&P 500 index have reported their results, as of Aug 4. The growth rate for earnings and revenues is 9.0% and 10.5%, respectively. In fact, the beat ratio of 68.0% and 56.0% for the bottom and top line, respectively, is also noteworthy.

Leisure Stocks in Focus

Coming to the leisure companies from the Consumer Discretionary sector, we note that their performance has been healthy so far this earnings season as they usually see an uptick during the spring and summer seasons.

Notably, among the leisure stocks that have already reported results, Hilton Worldwide Holdings, Inc. (NYSE:HLT) , Royal Caribbean Cruises Ltd. (NYSE:RCL) and Wyndham Worldwide Corporation (NYSE:WYN) have delivered an impressive performance with the bottom and top lines surpassing the Zacks Consensus Estimate.

Meanwhile, AMC Entertainment Holdings, Inc. (NYSE:AMC) and Pool Corporation’s (NASDAQ:POOL) reported mixed results. While their respective earnings missed the consensus mark, revenues topped the same.

Now, let’s take a look at what might be in store for the four leisure stocks from the sector that are set to report their second-quarter 2017 results on Aug 8. Will these companies manage to put up a decent performance?

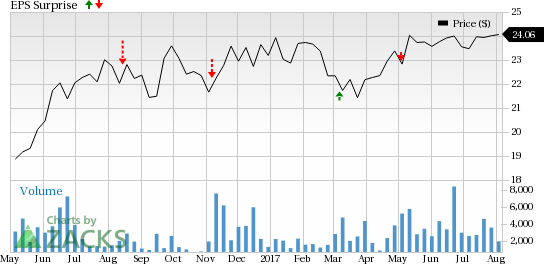

Cruise line operator, Norwegian Cruise Line Holdings Ltd. (NASDAQ:NCLH) , delivered a positive earnings surprise of 8.11% in the last quarter. Moreover, earnings and revenues improved substantially on a year-over-year basis.

According to our proven model an earnings beat is likely for Norwegian Cruise Line in the quarter. This is because the company has the right combination of the two key ingredients – a positive Earnings ESP and a Zacks Rank #3 (Hold) or better – to increase its odds of an earnings surprise.

For the second quarter, the company has an Earnings ESP of +1.03% and a Zacks Rank #2 (Buy). Also, the Zacks Consensus Estimate for the quarter’s earnings is pegged at 97 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Notably, increased travel demand and the company’s expansion efforts to capture it raise optimism in the stock. In fact, Norwegian Cruise Line’s focus on strengthening its balance sheet by deleveraging is also appreciative (read more: Is a Beat Likely for Norwegian Cruise in Q2 Earnings?).

Norwegian Cruise Line Holdings Ltd. Price and EPS Surprise

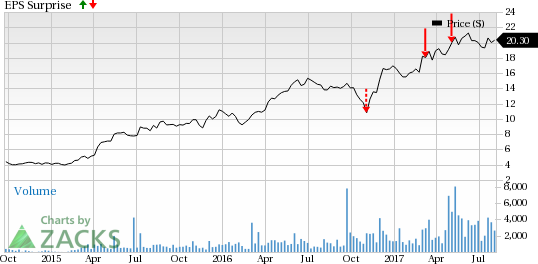

Red Rock Resorts, Inc. (NASDAQ:RRR) saw a negative earnings surprise of 18.92% in the last quarter. In fact, the company also missed on earnings in three of the trailing four quarters, with an average miss of 18.18%.

Moreover, the company has an Earnings ESP of 0.00%, which makes surprise prediction difficult even though the company has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for the quarter’s earnings is pegged at 29 cents.

Red Rock Resorts, Inc. Price and EPS Surprise

Eldorado Resorts, Inc. (NASDAQ:ERI) , which is based in Reno, NV, witnessed an earnings miss of 80.00% in the last reported quarter. In fact, it missed on earnings in each of the trailing three quarters.

Nevertheless, we expect the company to surpass expectations in the to-be-reported quarter owing to the combination of its Zacks Rank #3 and Earnings ESP of +12.00%. The Zacks Consensus Estimate for the quarter’s bottom line is pegged at 25 cents.

Eldorado Resorts, Inc. Price and EPS Surprise

Finally, let’s see what’s in store for Florida-based theme park and entertainment company SeaWorld Entertainment, Inc. (NYSE:SEAS) . Last quarter, the company’s loss was wider than the Zacks Consensus Estimate of loss, which led to a negative earnings surprise of 24.53%. In fact,

SeaWorld has witnessed negative earnings surprises in each of the last four quarters, with an average miss of 17.07%.

For the quarter, the company has an Earnings ESP of -5.88%, which makes surprise prediction difficult even though it has a Zacks Rank #3. Furthermore, the Zacks Consensus Estimate for the quarter’s bottom line is pegged at 34 cents.

It is to be noted that SeaWorld’s total revenue per capita has been under pressure mostly due to lower attendance, especially from Latin American and the UK visitors. Nevertheless, it remains to be seen if promotional offerings and a robust lineup of new products are successful in arresting the decline in traffic trends in the to-be-reported quarter (read more: What's in Store for SeaWorld This Earnings Season?).

SeaWorld Entertainment, Inc. Price and EPS Surprise

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Red Rock Resorts, Inc. (RRR): Free Stock Analysis Report

Eldorado Resorts, Inc. (ERI): Free Stock Analysis Report

Wyndham Worldwide Corp (WYN): Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT): Free Stock Analysis Report

Pool Corporation (POOL): Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH): Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC): Free Stock Analysis Report

SeaWorld Entertainment, Inc. (SEAS): Free Stock Analysis Report

Original post