The Dividend Aristocrats are widely considered to be the best-of-the-best when it comes to dividend growth stocks. Indeed, the Dividend Aristocrats are an exclusive group of 57 stocks in the S&P 500 Index with at least 25 years of annual dividend increases. The Dividend Aristocrats have long-lasting brand power, competitive advantages, and shareholder-friendly management teams that are committed to growing profits and dividends over the long-term.

But on occasion, even the Dividend Aristocrats experience downturns. Leggett & Platt (NYSE:LEG) is a Dividend Aristocrat, having raised its dividend for 48 years in a row. But the stock has declined 12% in the past three months and has underperformed the broader S&P 500 Index by a wide margin to start 2019.

However, Leggett & Platt has a plan to overcome the recent challenges and continue to grow for the long-term. The stock has an attractive valuation and a high dividend yield above 4%. Therefore, Leggett & Platt is one of the best dividend stocks for long-term dividend growth investors.

Business Overview & Recent Events

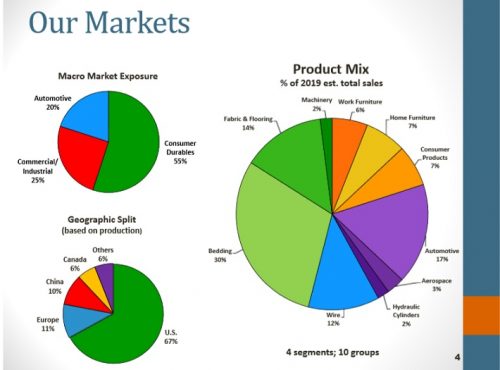

Leggett & Platt Incorporated is a diversified manufacturing company. It designs and manufactures a wide range of products, including bedding components, bedding industry machinery, steel wire, adjustable beds, carpet cushioning, and vehicle seat support systems. The company has a large and diverse product portfolio.

Source: Investor Presentation

Leggett & Platt reported its first-quarter earnings results on April 30. The company reported revenues of $1.16 billion for the first quarter, which represents a 12.6% growth rate compared to the prior year’s quarter. Revenues nevertheless missed the consensus analyst estimate. The company’s revenue growth was based on a 13% sales gain thanks to the impact of acquisitions, while organic revenues declined by 1% year over year. Sales volumes were down 3% when acquisitions are backed out, but improved pricing offset those volume declines partially. Leggett & Platt generated earnings-per-share of $0.49 during the first quarter, which represents a decline versus earnings-per-share of $0.57 during the previous year’s first quarter. Leggett & Platt’s earnings-per-share for the first quarter also missed the analyst consensus estimate by $0.03, or roughly 5%.

Leggett & Platt’s guidance ranges for sales as well as for earnings-per-share were maintained at the previous level. The company forecasts revenues of $4.95 billion to $5.10 billion during fiscal 2019, which represents a revenue growth rate of 16% to 19% compared to the revenues that the company generated during fiscal 2018. Revenue growth will be positively impacted by the acquisition of Elite Comfort Solutions that closed earlier this year, and that has already positively impacted Q1’s reported revenues. This takeover should generate additional revenues of about $675 million during fiscal 2019, which means that organic revenues will likely grow by 0%-3% during the current year. Leggett & Platt guides for earnings-per-share in a range of $2.45 to $2.65 for fiscal 2019.

Leggett & Platt has maintained a long history of steady growth, thanks in large part to the company’s durable competitive advantages. Coming into 2019, Leggett & Platt held an expansive intellectual property portfolio, consisting of 1,500 issued patents and nearly 1,000 registered trademarks. These competitive advantages separate Leggett & Platt’s various brands from the competition and allow the company to be a category leader across its product portfolio.

Valuation & Expected Returns

Using the midpoint of management guidance, Leggett & Platt is expected to generate earnings-per-share of $2.55 for 2019. Based on this, the stock trades for a price-to-earnings ratio of 14.8. Over the past 10 years, the stock had an average P/E ratio of 18.8; a reasonable target P/E ratio could be 18, based on the company’s strong profitability and steady EPS growth. As a result, a higher valuation is warranted, due to the company’s steady growth over many years, and long dividend history. If the P/E ratio expands from the current level of 14.8 to 18, the expansion of the valuation would add approximately 4% to annual shareholder returns.

In addition, Leggett & Platt’s dividend will add to shareholder returns. Leggett & Platt recently increased its dividend by 5%, to a new quarterly rate of $0.40 per share. The new annual payout of $1.60 per share represents a hefty 4.2% dividend yield. This makes Leggett & Platt a high-yield stock, as the S&P 500 Index on average yields just 2% right now.

Leggett & Platt should have little trouble continuing to raise its dividend each year going forward, as it has done for nearly five decades. Based on the expected EPS of $2.55, the forward annual dividend payout of $1.60 per share represents an expected payout ratio of 63% for 2019. This is a manageable payout for Leggett & Platt. In other words, the company is projected to distribute less than two-thirds of its EPS this year, which leaves enough cash flow left over to pay down debt and invest in growth. As a result, Leggett & Platt’s dividend appears secure.

Combining valuation changes with 6.0% annual earnings growth and the 4.2% dividend yield results in total expected returns of more than 14% per year over the next five years. This is a high expected rate of return that indicates Leggett & Platt is an undervalued dividend growth stock.

Final Thoughts

Leggett & Platt has had a difficult year. Rising cost inflation has put pressure on the company’s margins, while the threat of geopolitical conflict and escalating trade tensions threatens its growth in the international markets. However, Leggett & Platt has experienced even worse periods before, such as the Great Recession. Even in very difficult economic climates, Leggett & Platt has generated enough cash flow to continue raising its dividend each year.

Leggett & Platt is a beaten-down Dividend Aristocrat, but the company has a positive long-term growth outlook. Acquisitions, international growth, and share repurchases should allow Leggett & Platt to reach its revenue growth targets in the years ahead. In the meantime, an attractive valuation and compelling 4.2% dividend yield make Leggett & Platt a top dividend stock to buy today.