Lear Corporation (NYSE:LEA) has announced the closing of the earlier-announced offering of $750 million aggregate principal amount of 3.80% senior unsecured notes. For the Southfield, MI-based company, this move is expected to boost the financial flexibility and position it well to take advantage of conducive market conditions.

Lear Corporation is a leading global supplier of automotive seating systems, electrical distribution systems and electronics. The company utilized the net proceeds generated from the refinancing transactions for redeeming $500 million senior unsecured notes due 2023, lowering the borrowings under the term-loan facility by around $200 million, for paying fees and expenses in relation to the refinance transactions and for general corporate purposes. This has given a boost to the financial flexibility of the company.

The closing of the refinance transaction follows the completion of a new $2 billion credit agreement announced on Aug 8, 2017. The new credit arrangements include $1.75 billion revolving credit facility and a $250 million term-loan facility.

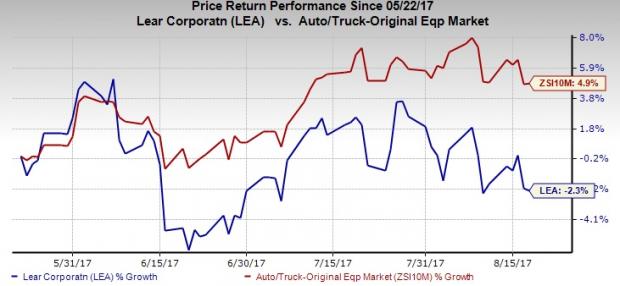

Lear Corporation’s shares have lost 2.3% in the last three months, underperforming the 4.9% increase of the industry it belongs to.

Lear Corporation currently carries a Zacks Rank #3 (Hold).

A few better-ranked automobile stocks are Ferrari N.V. (NYSE:RACE) , Fox Factory Holding Corp. (NASDAQ:FOXF) and Cummins Inc. (NYSE:CMI) . While Ferrari N.V. sports a Zacks Rank #1 (Strong Buy), both Fox Factory Holding and Cummins carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ferrari has an expected earnings growth rate of 14.1% in the long run.

Fox Factory has a long-term growth rate of 16%.

Cummins has an expected long-term earnings growth rate of 12%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Lear Corporation (LEA): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research