**These are my thoughts on the SPY (NYSE:SPY) ETF in my Daily Trade Ideas**

No amount of money, no amount of security is ever going to give you the sense that this is the right time. -Debbie Millman

Markets took the week to move back up off lows and are now setup to break higher anytime with the Nasdaq leading which is always great.

Many stocks took a little break and have small lows in place with buy levels ready to go.

The very short rest period stocks have taken are a testament to the strength of this bull market.

AMZN (NASDAQ:AMZN) is breaking out strongly, MSFT (NASDAQ:MSFT) is on the slow go and PCLN (NASDAQ:PCLN) won’t stop and other leading stocks are acting very special as well.

I’m in heavy buying mode, but waiting for the right buy levels.

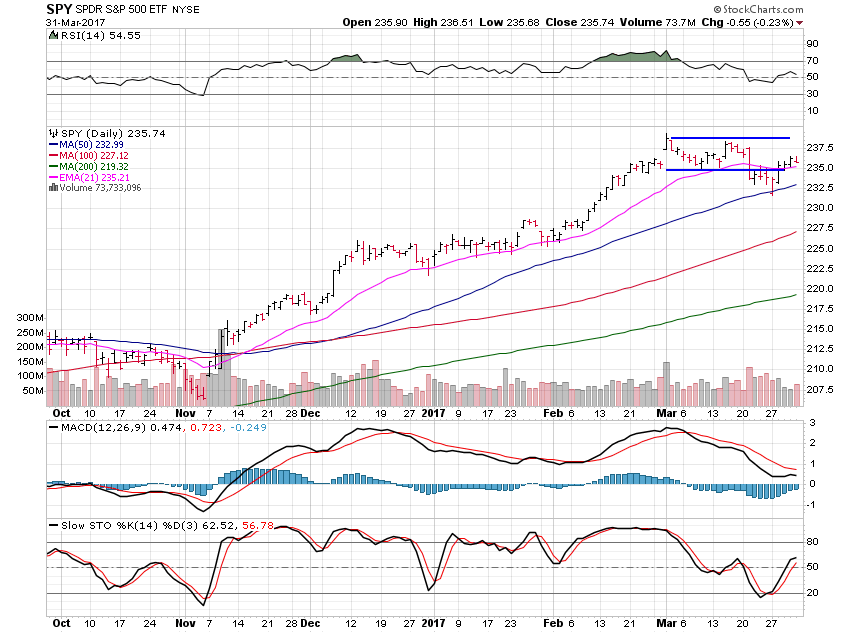

SPY is working back to highs and doing so nice and slow.

A great test of the 50 day is good to see and I should have been into it at that level but I wasn’t.

We should see SPY move up to the 240 area in the week ahead before it give new highs another go after a few days of rest.

Grab all of this weekend's buy levels by subscribing and enjoy your weekend.