While everyone else is focusing on whether or not the Fed will hike rates next week… I’m much more concerned about what the Fed does when it realizes that rate cuts won’t save the markets.

Remember, the last two times the Fed started cutting rates during an economic downturn were 2000 and 2007.

We all remember what happened to stocks during those periods.

Here’s a brief reminder.

Put simply, during an economic downturn, rate cuts aren’t enough to save the markets… which is probably why the Fed is already laying the ground work for truly EXTREME monetary policy.

In the last three months we’ve seen Fed officials suggest that the Fed should:

1) Make QE a REGULAR monetary policy (as opposed to one used exclusively during emergencies).

2) Introduce negative interest rates.

3) Directly intervene in the bond markets to stop yields from reaching certain levels… on a daily basis if needed.

4) Directly infuse capital straight into the financial system (helicopter money).

The fact the Fed is already suggesting these policies now, BEFORE a crisis hits, tells us just how serious this situation is.

What is it that has the Fed so terrified that it’s openly talking about introducing extreme polices before a crisis hits?

The Everything Bubble has burst…

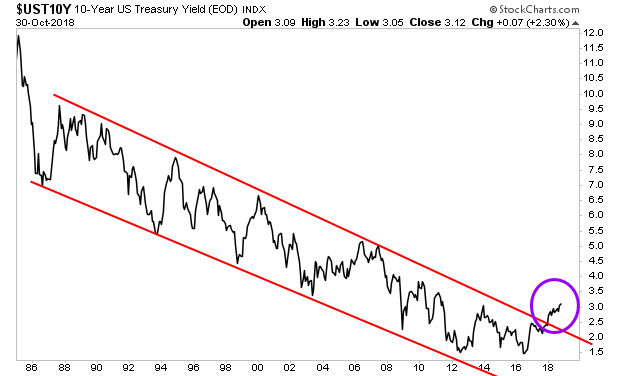

Purple Circle Shows the Treasury Bubble Bursting

And stocks know it….

Red Lines Show Bull Markets Ending and Crises Beginning

The last two times stocks broke down like this were October of 2000 and December of 2007… just before the markets entered the Tech Crash… and the Great Financial Crisis of 2008.

Will the Fed succeed in stopping the system from experiencing another crisis?

I don’t know… but I DO KNOW that they will be introducing EXTREME monetary policies to try and stop another financial crisis from happening.

Those investors who take the right steps to prepare for those policies, will make literal fortunes.