Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -0.77%, Hang Seng +0.97%, Nikkei -0.22%

- In Europe 12 out of 13 markets closed lower: CAC -0.22%, DAX -0.28%, FTSE -0.01%

- Fair Value: S&P +1.92, NASDAQ +13.88, Dow -19.48

- Total Volume: 1.24 million ESM & 139 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Personal Income and Outlays 8:30 AM ET, Personal Income and Outlays 8:31 AM ET, and Dallas Fed Mfg Survey 10:30 AM ET.

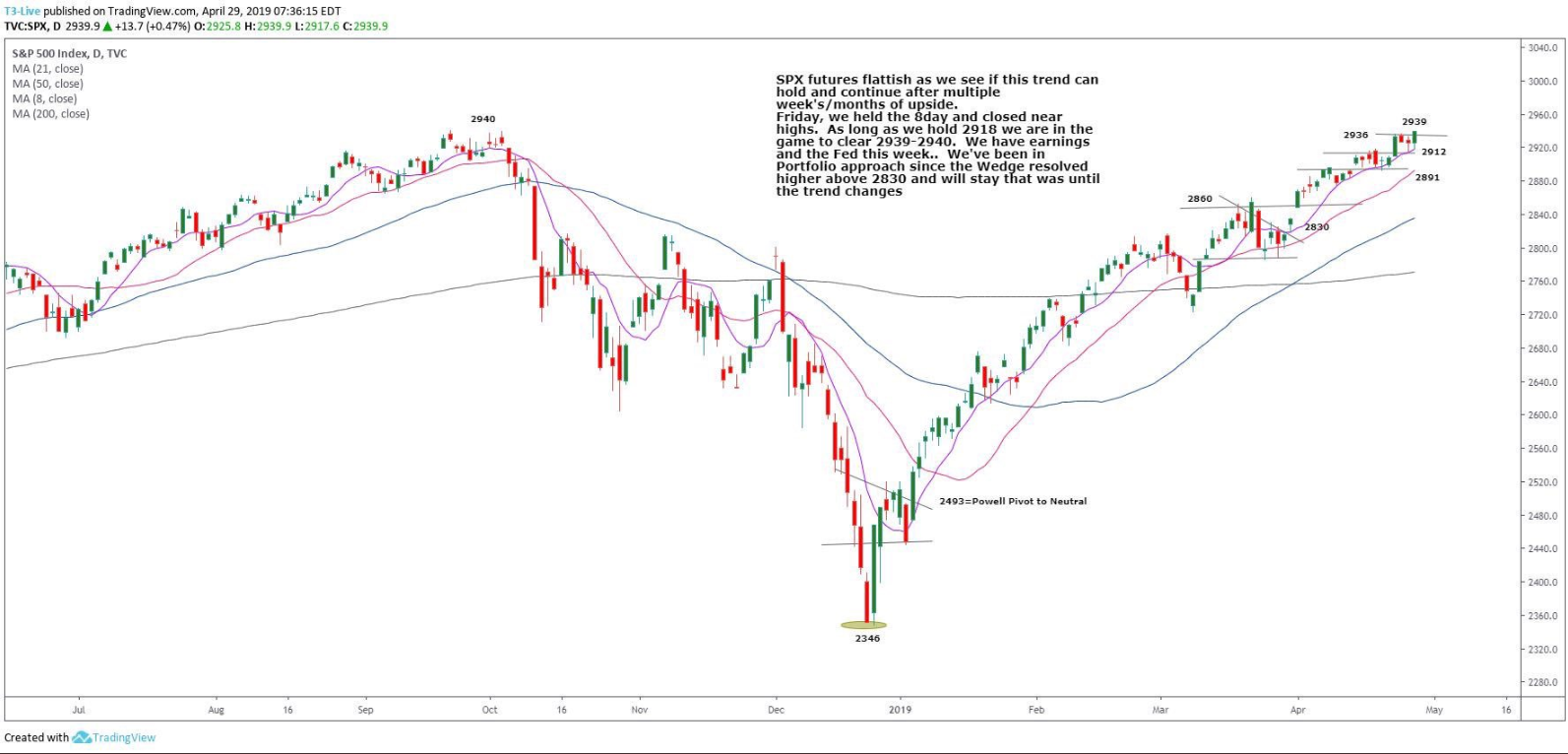

S&P 500 Futures: Overbought And Overextended But Still Going Higher

Chart courtesy of Scott Redler @RedDogT3 – $spx futures flattish as we head into a busy week with the Fed, earnings, and macro reports (use 2912 as key to hold).

During Thursday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2932.75, a low of 2917.25, and opened Friday’s regular trading hours at 2928.00.

After spiking on positive the GDP number, the ES began to fade back going into the 8:30 CT open, and by 9:00 had traded down to an RTH low at 2919.25. From there, the futures started to recover, and by 9:30 had traded back through the opening range and up to 2929.75.

After a little back and fill down to 2925.50, the ES continued to grind higher for the rest of the morning, eventually topping out at 2934.75.

The futures went on to trade sideways until 2:00, when it finally broke through the ceiling and started making new highs. The ES stayed strong going into the close. When the 2:45 cash imbalance reveal came out showing $372M to sell MOC, the futures were trading at 2938.75. On the 3:00 cash close, the ES printed 2941.75, and ended the week at 2942.00 on the 3:15 futures close, up +15.75 handles.

In the end, the overall tone of the ES was strong. In terms of the days overall trade, total volume was higher, with 1.2 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.