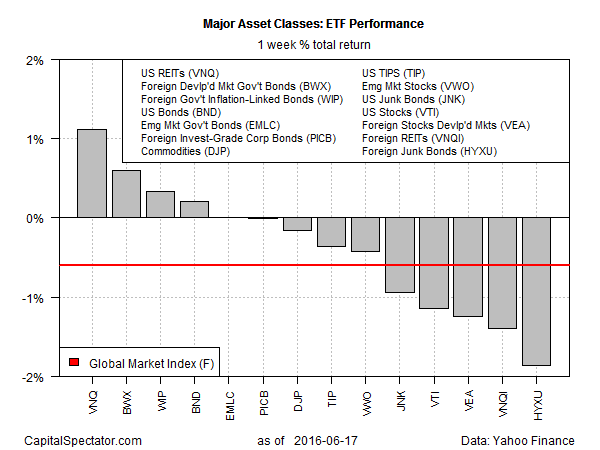

US real estate investment trusts claimed the lead last week for total returns among a set of proxy ETFs for the major asset classes. The Vanguard REIT (NYSE:VNQ) increased 1.1% for the five trading days through June 17, marking the ETF’s fourth straight weekly gain.

Last week’s biggest loser: foreign high-yield bonds in US dollar terms. iShares International High Yield Bond (NYSE:HYXU) eased 1.9%, its second consecutive weekly drop.

Meanwhile, an ETF-based version of the Global Markets Index (GMI.F) — an investable, unmanaged benchmark that holds all the major asset classes in market-value weights — fell again last week, shedding 0.6%.

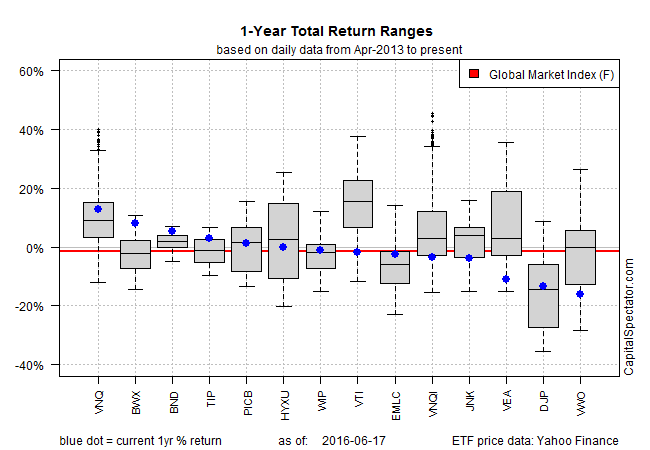

For the trailing one-year period, US REITs are also in the lead. The Vanguard REIT (VNQ) climbed 14.3% for the 12 months through June 17, easily eclipsing the 8.4% total return for the number-two performer: SPDR Barclays International Treasury Bond (NYSE:BWX).

On the opposite end of the one-year performance spectrum: emerging-market equities, which continue to deliver the biggest loss among the major asset classes. The Vanguard FTSE Emerging Markets ETF (NYSE:VWO) has a negative total return of 15.4% for the trailing one-year period.

Finally, GMI.F continues to post a slight loss for the year, dipping 1.6% for the 12 months through June 17.